Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

2020 Year end tax planning and tax saving strategies for 2021 & beyond

- Oleh

- Episode

- 21

- Published

- 8 Des 2020

- Penerbit

- 0 Peringkat

- 0

- Episode

- 21 of 71

- Durasi

- 55menit

- Bahasa

- Inggris

- Format

- Kategori

- Ekonomi & Bisnis

•Year end tax planning and tax saving strategies for 2021 & beyond •Saving for education – credits, deductions and Qualified Tuition Plan •State tax implications of working remotely •PPP Loan Forgiveness •CARES Act – Economic Impact Payments what to expect when you file your 2020 tax returns. •International Taxation •Foreign Capital Gains •Foreign earned income exclusion •Foreign tax credit •FATCA (Form 8938)FBAR (Form Fincen 114) disclaimer: •Information shared in this webinar are for educational purposes. Individual situations may vary and needs to be considered on a case to case basis. Users discretion advised to consult their tax advisers

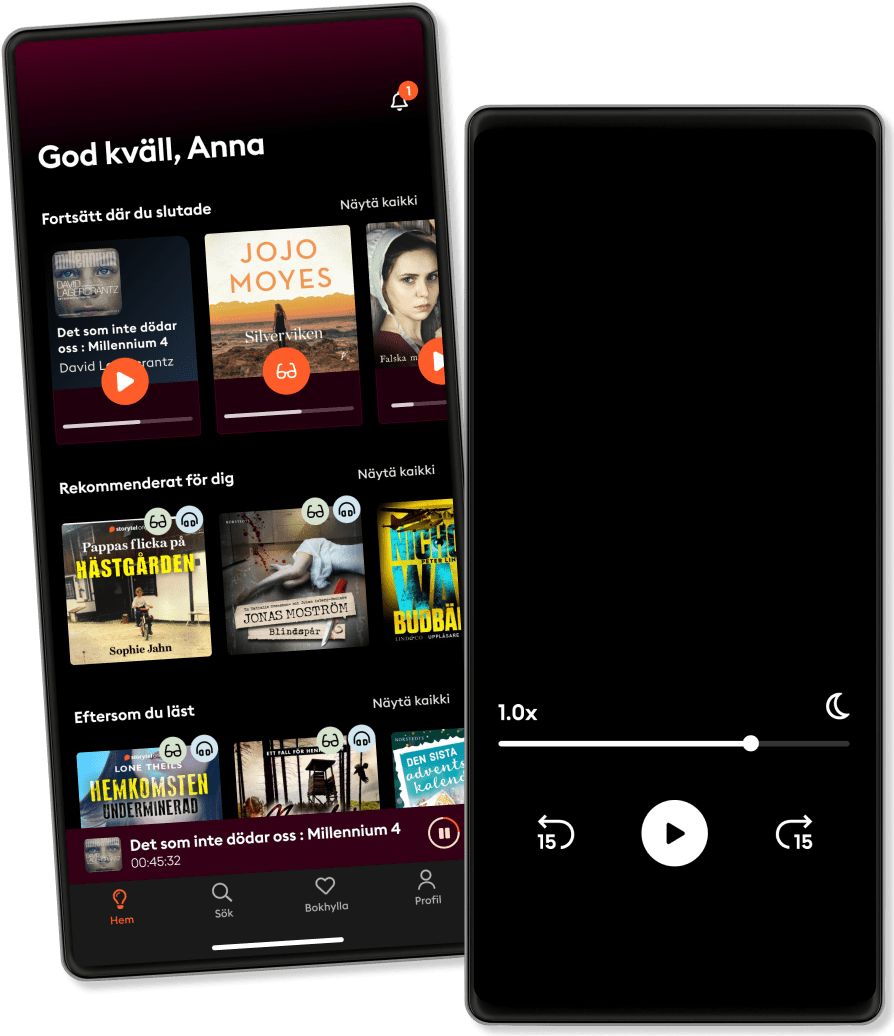

Dengarkan dan baca

Masuki dunia cerita tanpa batas

- Baca dan dengarkan sebanyak yang Anda mau

- Lebih dari 1 juta judul

- Judul eksklusif + Storytel Original

- Uji coba gratis 14 hari, lalu €9,99/bulan

- Mudah untuk membatalkan kapan saja

Podcast lain yang mungkin Anda sukai ...

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- Sabse Pehle Family, Sabse Pehle InsuranceBIG FM

- OLX Autos presents Kya baat kar rahe ho!BIG FM

- Meri Pyaari Saheliyan with HansiThe Quint

- Main Bhi Finance MInister with RJ RaniBIG FM

- Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- Sabse Pehle Family, Sabse Pehle InsuranceBIG FM

- OLX Autos presents Kya baat kar rahe ho!BIG FM

- Meri Pyaari Saheliyan with HansiThe Quint

- Main Bhi Finance MInister with RJ RaniBIG FM

Bahasa dan Wilayah

Bahasa Indonesia

Indonesia