Chain Blame: How Wall Street Caused the Mortgage and Credit Crisis

- By

- With:

- Publisher

- 4 Ratings

3.5

- Duration

- 11H 44min

- Language

- English

- Format

- Category

Economy & Business

THE TRUTH BEHIND AMERICA'S HOUSING ANG MORTGAGE CRISIS In the summer of 2007, the subprime empire that Wall Street had built all came crashing down. On average, fifty lenders a month were going bust-and the people responsible for the crisis included not just unregulated loan brokers and con artists, but also investment bankers and home loan institutions traditionally perceived as completely trustworthy. Chain of Blame chronicles this incredible disaster, with a specific focus on the players who participated in such a fundamentally flawed fiasco. Acclaimed financial reporters Muolo and Padilla go behind the headlines to expose the truth about how this crisis occurred, what individuals and institutions-from lenders and brokers to some of the biggest investment banks in the world-were doing during this critical time, who is ultimately responsible for what happened, and perhaps more importantly, why everyone was so taken by surprise. The authors reveal how human behavior and greed drove the demand, supply, and the investor appetite for these types of loans-and how Wall Street was all too willing to satisfy the desires of those who should have known better.

© 2009 Ascent Audio (Audiobook): 9781596593350

Release date

Audiobook: 22 January 2009

Chain Blame: How Wall Street Caused the Mortgage and Credit Crisis

- By

- With:

- Publisher

- 4 Ratings

3.5

- Duration

- 11H 44min

- Language

- English

- Format

- Category

Economy & Business

THE TRUTH BEHIND AMERICA'S HOUSING ANG MORTGAGE CRISIS In the summer of 2007, the subprime empire that Wall Street had built all came crashing down. On average, fifty lenders a month were going bust-and the people responsible for the crisis included not just unregulated loan brokers and con artists, but also investment bankers and home loan institutions traditionally perceived as completely trustworthy. Chain of Blame chronicles this incredible disaster, with a specific focus on the players who participated in such a fundamentally flawed fiasco. Acclaimed financial reporters Muolo and Padilla go behind the headlines to expose the truth about how this crisis occurred, what individuals and institutions-from lenders and brokers to some of the biggest investment banks in the world-were doing during this critical time, who is ultimately responsible for what happened, and perhaps more importantly, why everyone was so taken by surprise. The authors reveal how human behavior and greed drove the demand, supply, and the investor appetite for these types of loans-and how Wall Street was all too willing to satisfy the desires of those who should have known better.

© 2009 Ascent Audio (Audiobook): 9781596593350

Release date

Audiobook: 22 January 2009

Others also enjoyed ...

- Flash Crash: A Trading Savant, a Global Manhunt and the Most Mysterious Market Crash in HistoryLiam Vaughan

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsRobert J. Shiller

- Homewreckers: How a Gang of Wall Street Kingpins, Hedge Fund Magnates, Crooked Banks, and Vulture Capitalists Suckered Millions Out of Their Homes and Demolished the American DreamAaron Glantz

- Economist on Wall Street: Notes on the Sanctity of Gold, the Value of Money, the Security of Investments, and Other DelusionsPeter L. Bernstein

- Barbarians at the Gate: The Fall of RJR NabiscoJohn Helyar

- The Scandal of Money: Why Wall Street Recovers but the Economy Never DoesGeorge Gilder

- The Sellout: How Three Decades of Wall Street Greed and Government Mismanagement Destroyed the Global Financial SystemCharles Gasparino

- The Einstein Money: The Life and Timeless Financial Wisdom of Benjamin GrahamJoe Carlen

- The House of Morgan: An American Banking Dynasty and the Rise of Modern FinanceRon Chernow

- A Hedge Fund Tale of Reach and Grasp: … Or What's a Heaven For: ...Or What's a Heaven ForBarton Biggs

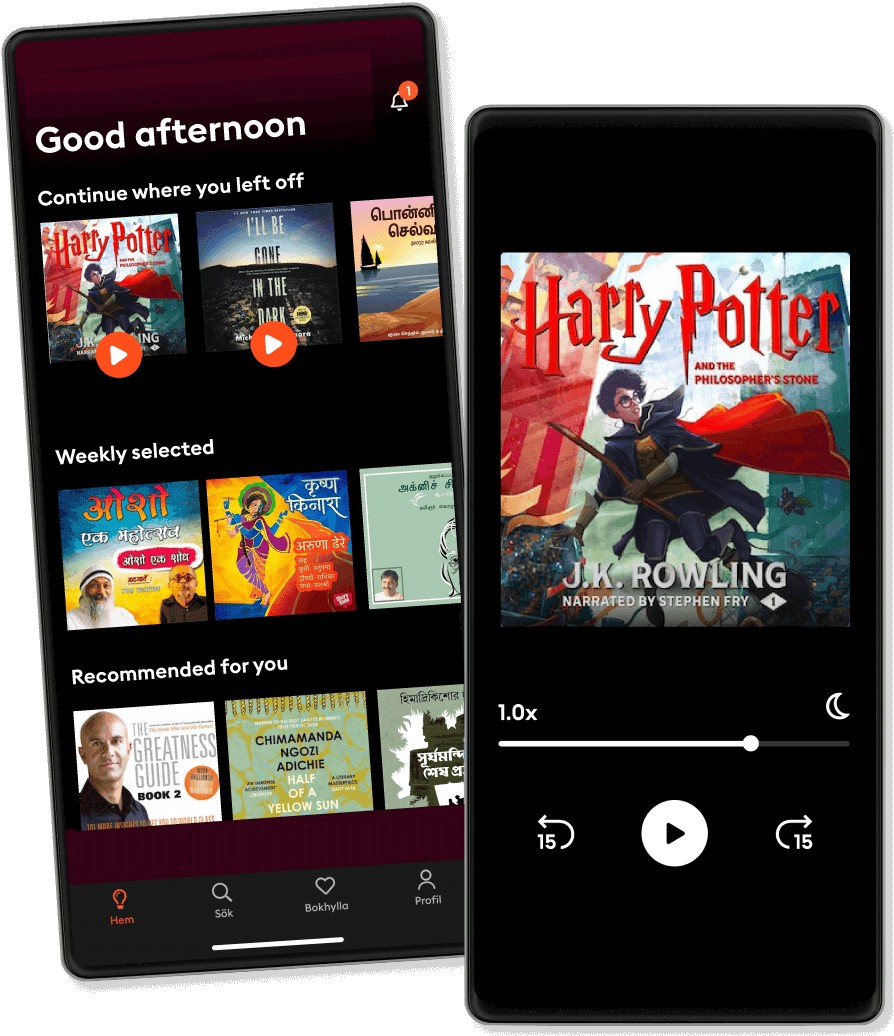

Listen and read

Step into an infinite world of stories

- Listen and read as much as you want

- Over 400 000+ titles

- Bestsellers in 10+ Indian languages

- Exclusive titles + Storytel Originals

- Easy to cancel anytime

Ratings and reviews

Reviews at a glance

3.5

Overall rating based on 4 ratings

Download the app to join the conversation and add reviews.

English

India