- 0 Umsagnir

- 0

- Episode

- 892 of 1079

- Lengd

- 31Mín.

- Tungumál

- enska

- Gerð

- Flokkur

- Viðskiptabækur

On Wednesday, the Federal Reserve cut interest rates by 25 basis points as expected. But it also raised its inflation outlook for 2025, and sees just two more cuts next year. The markets reacted violently to it, with the major measures posting their worst day in a long time. What's more, there was nowhere to hide. Bonds and gold also sold off, alongside equities. So what's going on now? And what does this mean for portfolio construction? On this episode, we speak with Jim Caron, chief investment officer of the Portfolio Solutions Group at Morgan Stanley Investment Management. We talked about why the market reacted as sharply as it did, and how to think about next year, given highly concentrated markets, uncertain macro, and the difficulty in finding diversifying instruments. Read More: Powell Says Future Cuts Would Require Fresh Inflation Progress Become a Bloomberg.com subscriber using our special intro offer at bloomberg.com/podcastoffer. You’ll get episodes of this podcast ad-free and exclusive access to our daily Odd Lots newsletter. Already a subscriber? Connect your account on the Bloomberg channel page in Apple Podcasts to listen ad-free.

See omnystudio.com/listener for privacy information.

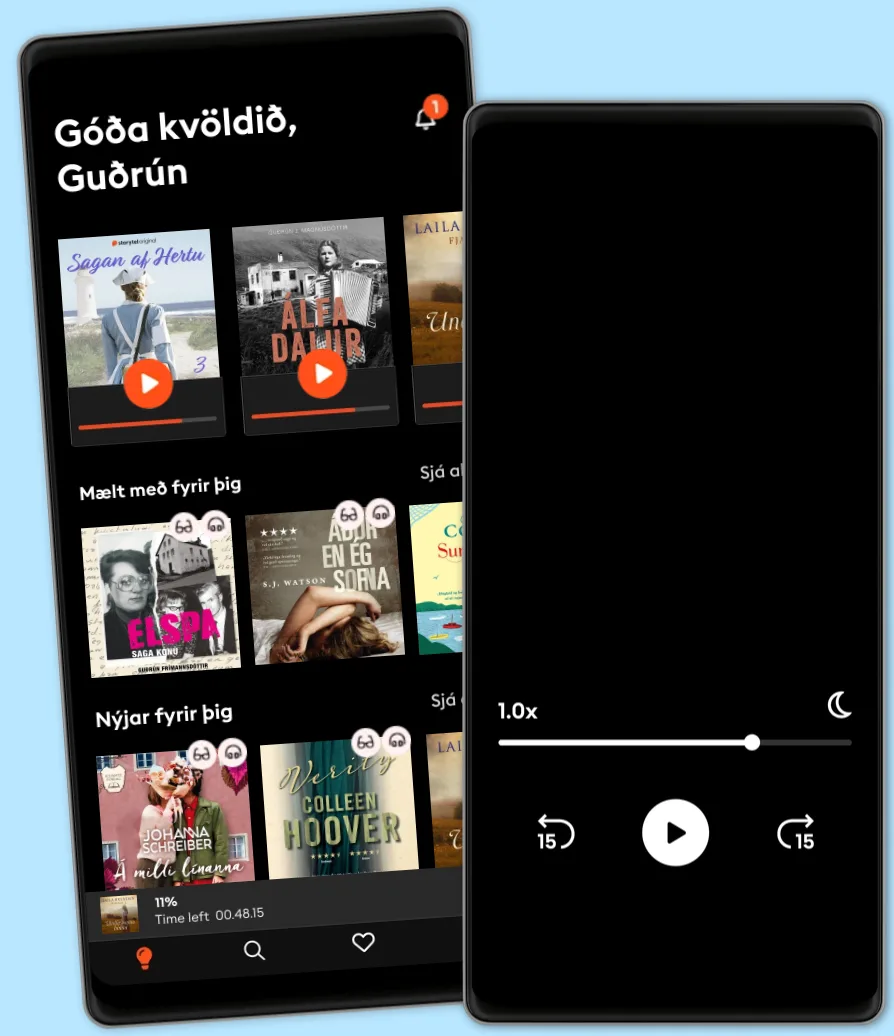

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Other podcasts you might like ...

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- BrainStuffiHeartPodcasts

- The Diary Of A CEO with Steven BartlettDOAC

- The School of GreatnessLewis Howes

- Motley Fool MoneyThe Motley Fool

- Decoder with Nilay PatelThe Verge

- Village Global PodcastVillage Global

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- BrainStuffiHeartPodcasts

- The Diary Of A CEO with Steven BartlettDOAC

- The School of GreatnessLewis Howes

- Motley Fool MoneyThe Motley Fool

- Decoder with Nilay PatelThe Verge

- Village Global PodcastVillage Global

Íslenska

Ísland