Amundi Tips AT1s in ‘Goldilocks’ View; Shipping Focus

- Höfundur

- Episode

- 63

- Published

- 4 apr. 2024

- Útgefandi

- 0 Umsagnir

- 0

- Episode

- 63 of 145

- Lengd

- 44Mín.

- Tungumál

- enska

- Gerð

- Flokkur

- Viðskiptabækur

Europe’s largest asset manager, Amundi, expects Additional Tier 1 bank bonds to extend gains in what it sees as a broadly positive market for corporate debt. “We’re obviously in this kind of Goldilocks scenario, I think, where the central bank put remains on the table,” Steven Fawn, head of global credit at Amundi Asset Management, tells Bloomberg News’ James Crombie and Bloomberg Intelligence’s Stephane Kovatchev. “Sub-debt is one part of the market which we like,” Fawn says in the latest Credit Edge podcast, referring to subordinated bonds, including bank AT1s. In addition, the portfolio manager discusses Amundi’s macroeconomic outlook, fund flows and positioning by industry sector and ratings tier. Also in this episode, BI’s Kovatchev analyzes the impact of the Baltimore bridge collapse on the global supply chain.

See omnystudio.com/listener for privacy information.

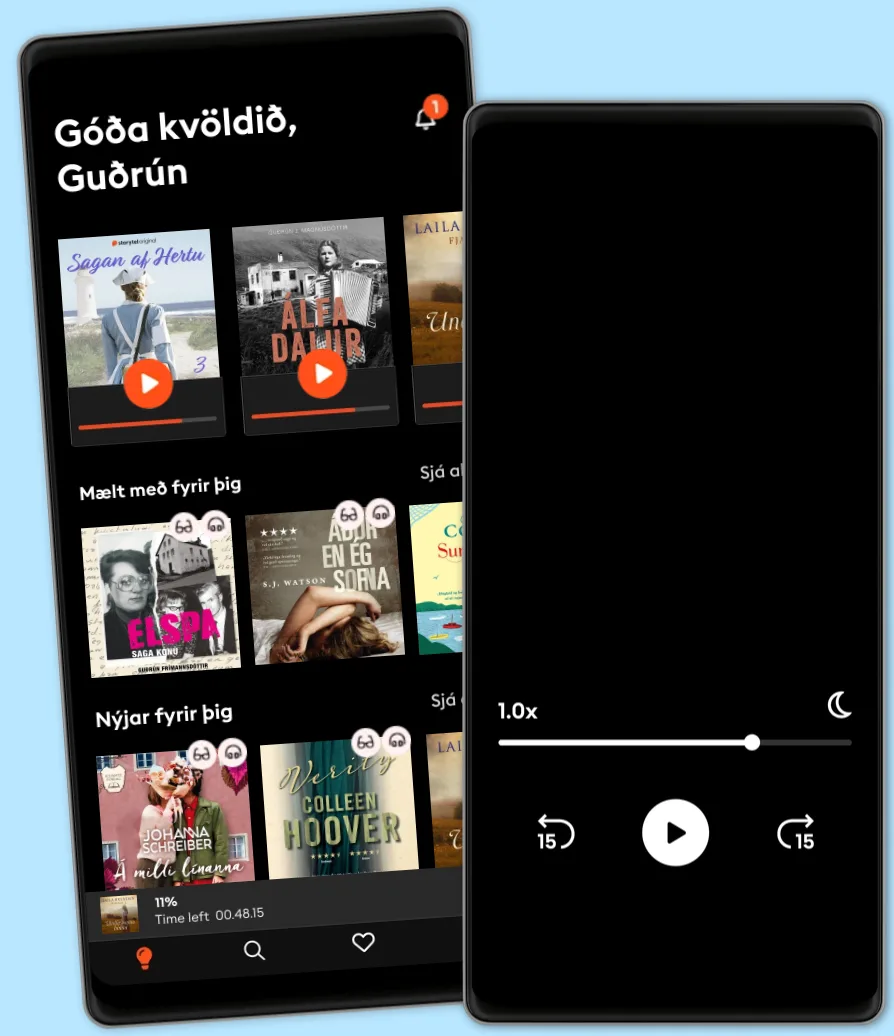

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Other podcasts you might like ...

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- BrainStuffiHeartPodcasts

- Money Clinic with Claer BarrettFinancial Times

- The Diary Of A CEO with Steven BartlettDOAC

- The School of GreatnessLewis Howes

- The Mindset MentorRob Dial

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- BrainStuffiHeartPodcasts

- Money Clinic with Claer BarrettFinancial Times

- The Diary Of A CEO with Steven BartlettDOAC

- The School of GreatnessLewis Howes

- The Mindset MentorRob Dial

Íslenska

Ísland