PineBridge Fears Credit Calamity as Demand Balloons

- Höfundur

- Episode

- 100

- Published

- 12 dec. 2024

- Útgefandi

- 0 Umsagnir

- 0

- Episode

- 100 of 141

- Lengd

- 51Mín.

- Tungumál

- enska

- Gerð

- Flokkur

- Viðskiptabækur

Swelling demand for limited supply of corporate bonds and loans could spell trouble for credit markets, according to PineBridge Investments. “The thing that gives me a lot of pause right now — and some concern — is the lack of net new supply versus the amount of demand out there,” said Jeremy Burton, the firm’s portfolio manager for US high yield and leveraged loans. “That leads to the risk that the market as a whole will make subpar credit decisions,” he tells Bloomberg News’ James Crombie and Bloomberg Intelligence senior credit analyst Jody Lurie, in the latest Credit Edge podcast. Burton and Lurie also discuss the state of the consumer, default rates, coercive liability management, as well as risks in the media, health care and software sectors.

See omnystudio.com/listener for privacy information.

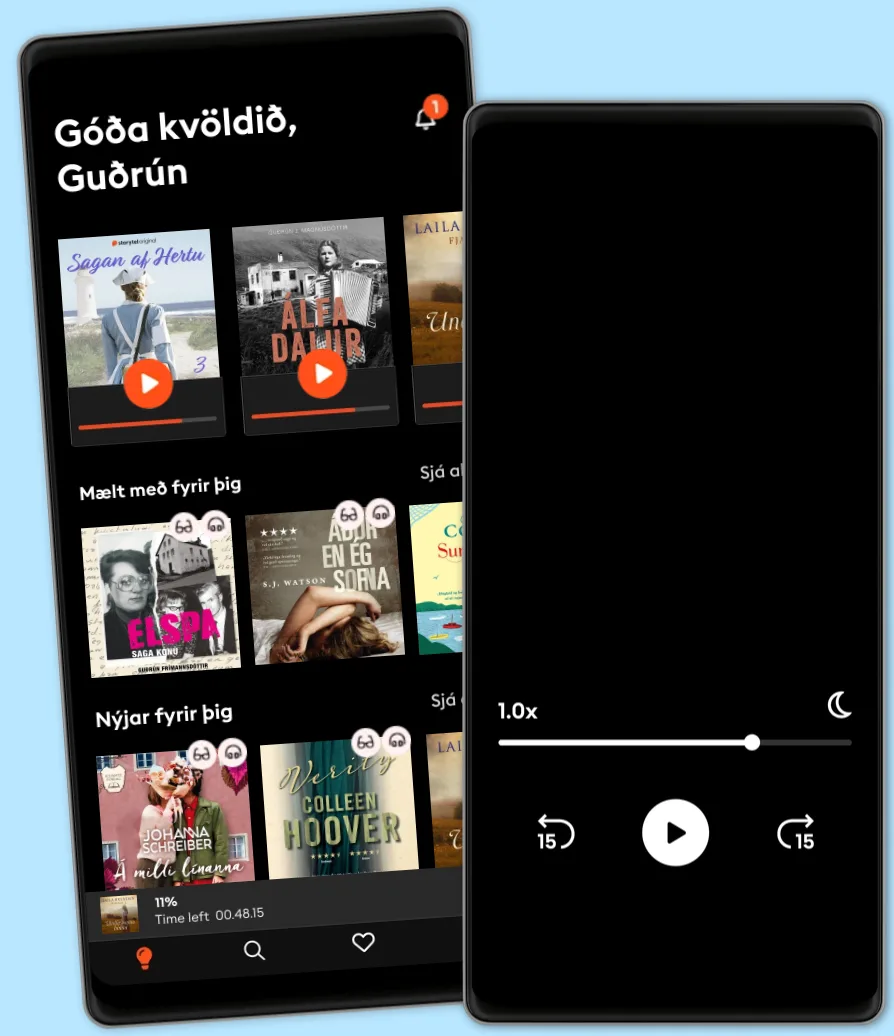

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Other podcasts you might like ...

- HW News Editorial with Sujit NairHW News Network

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- BrainStuffiHeartPodcasts

- The Diary Of A CEO with Steven BartlettDOAC

- The School of GreatnessLewis Howes

- Village Global PodcastVillage Global

- Good Bad BillionaireBBC World Service

- TED Talks DailyTED

- Jocko PodcastJocko DEFCOR Network

- The Resilient MindThe Resilient Mind

- HW News Editorial with Sujit NairHW News Network

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- BrainStuffiHeartPodcasts

- The Diary Of A CEO with Steven BartlettDOAC

- The School of GreatnessLewis Howes

- Village Global PodcastVillage Global

- Good Bad BillionaireBBC World Service

- TED Talks DailyTED

- Jocko PodcastJocko DEFCOR Network

- The Resilient MindThe Resilient Mind

Íslenska

Ísland