3 Key Components of a Trading System

- Höfundur

- Episode

- 46

- Published

- 5 sep. 2017

- Útgefandi

- 0 Umsagnir

- 0

- Episode

- 46 of 1247

- Lengd

- 14Mín.

- Tungumál

- enska

- Gerð

- Flokkur

- Viðskiptabækur

Entries don't mean anything unless you know your exit and position size. Entries are just prices. Entries, exits, and a position sizing algorithm are the 3 crown jewels to a basic trading system. Don't look at intraday charts - they are worthless and contain the most random data compared to Daily, Weekly, or Monthly charts - in that order. Trading is a game of failure - like baseball. You simulate your trading rules to a) see if they would have been profitable; and b) give you an idea if you have strong feelings about the frequency of losses and the drawdown. Trading is systematized attrition of your capital until a winner hits. Risking 1-2% per trade is insane. Start with 0.10% or 1/10th of 1%. Break your capital up into 1,000 units. Don't trade size in your initial entries. Wait for the market to show you which way it's going to go before you add more. Forget price targets. That's ego talking so that you can be "reasonable" with yourself around greed and fear. How do you know that what is a 3-bagger can't become a 10-bagger? Learn from Scott Kaminski, Victor Sperandeo, Peter Borish, Tony Saliba, or Michael Martin.

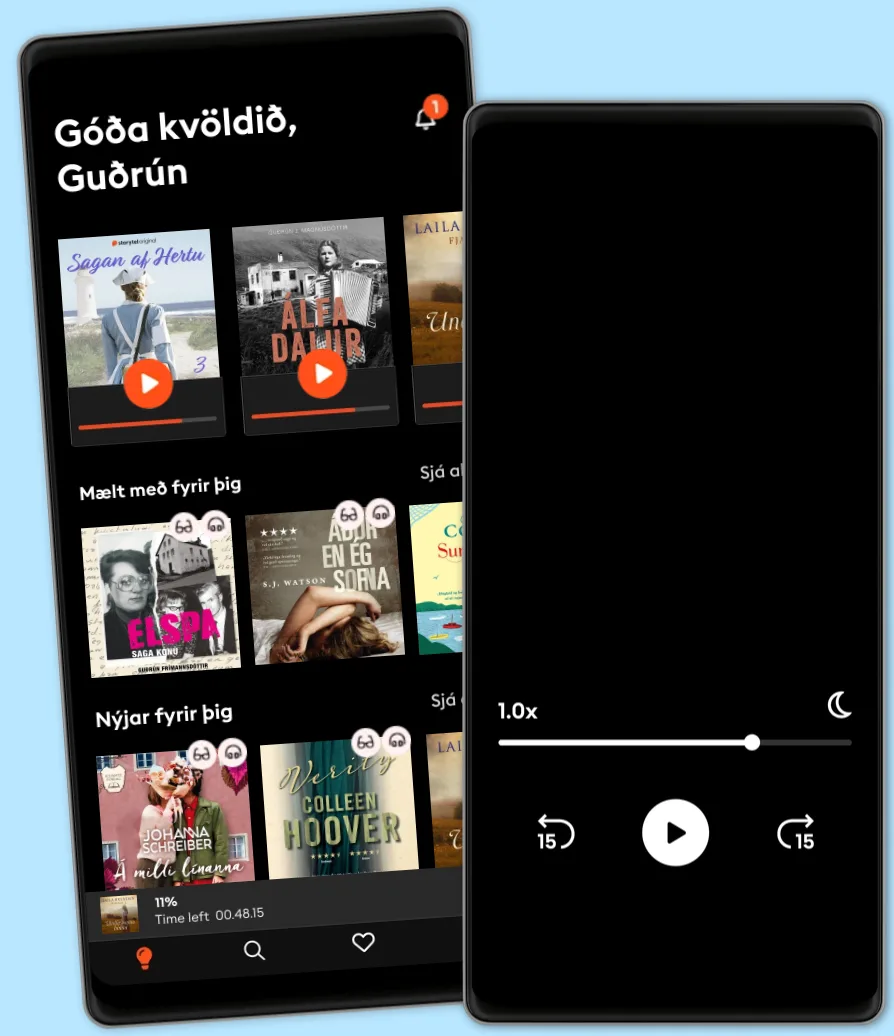

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Other podcasts you might like ...

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- FixableTED

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- The BreakdownBlockworks

- Reuters World NewsReuters

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- FixableTED

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- The BreakdownBlockworks

- Reuters World NewsReuters

Íslenska

Ísland