How to avoid foreseeable blind spots

- Höfundur

- Episode

- 139

- Published

- 25 jan. 2018

- Útgefandi

- 0 Umsagnir

- 0

- Episode

- 139 of 1247

- Lengd

- 7Mín.

- Tungumál

- enska

- Gerð

- Flokkur

- Viðskiptabækur

Sometimes the best trades are the ones that you don't enter. I know this might sound cute, but entering orders around big announcements can be a big gamble. Consider how you feel around trading the EIA, API, NOPA Crush numbers, quarterly earning announcements, and the FOMC announcements. Are you keeping orders on the book or do you lift them? Is part of the payoff the excitement around the trade ? Lift the orders around these moments of uncertainly. If you're trading options, that's a different story. I don't think it's a good idea to make your bones trying to trade announcements as a strategy. Allocators won't know how you can model this in a way that has high expected values, and in today's world, low daily volatility. Cancel existing orders around the releasing of key data points. I'm not saying to offset existing positions.

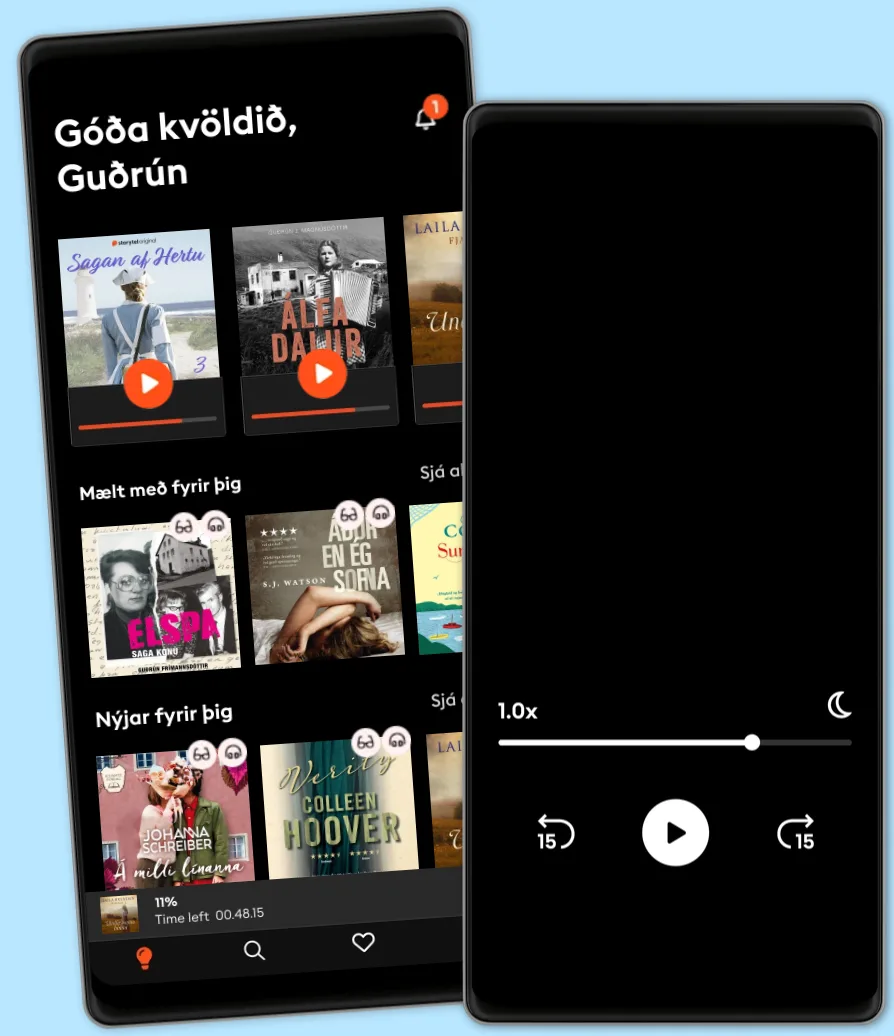

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Other podcasts you might like ...

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- FixableTED

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- The BreakdownBlockworks

- Reuters World NewsReuters

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- FixableTED

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- The BreakdownBlockworks

- Reuters World NewsReuters

Íslenska

Ísland