- 0 Umsagnir

- 0

- Episode

- 231 of 240

- Lengd

- 44Mín.

- Tungumál

- enska

- Gerð

- Flokkur

- Viðskiptabækur

The ETF "Thunderdome" is an unforgiving and relentless environment. Which makes the exchange-traded funds from JPMorgan Asset Management so noteworthy. Led by its Chief Executive Officer George Gatch, the firm has carved out a unique niche — active ETFs — and then used its institutional muscle to move up the leaderboard while driving down costs. In an era where 75% of all active funds are seeing outflows, JPMorgan has found a way to thrive; in fact, it’s now the fourth biggest active fund company in the US. On this episode of Trillions, Eric Balchunas and Joel Weber speak with Gatch about JPMorgan's secret sauce, his strategy in the active category, how his biggest products became such hits, why fixed income remains a promising space, what to watch in private markets and why he's avoiding crypto.

See omnystudio.com/listener for privacy information.

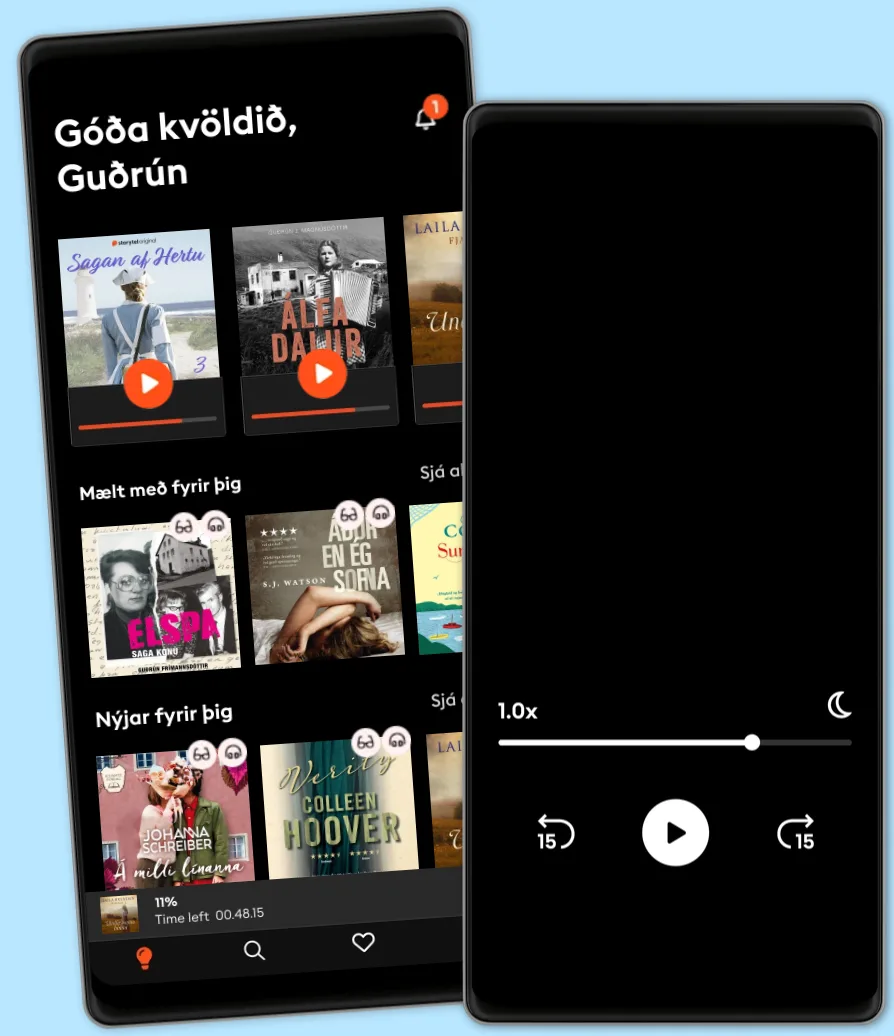

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Other podcasts you might like ...

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- FixableTED

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- The BreakdownBlockworks

- Reuters World NewsReuters

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- FixableTED

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- The BreakdownBlockworks

- Reuters World NewsReuters

Íslenska

Ísland