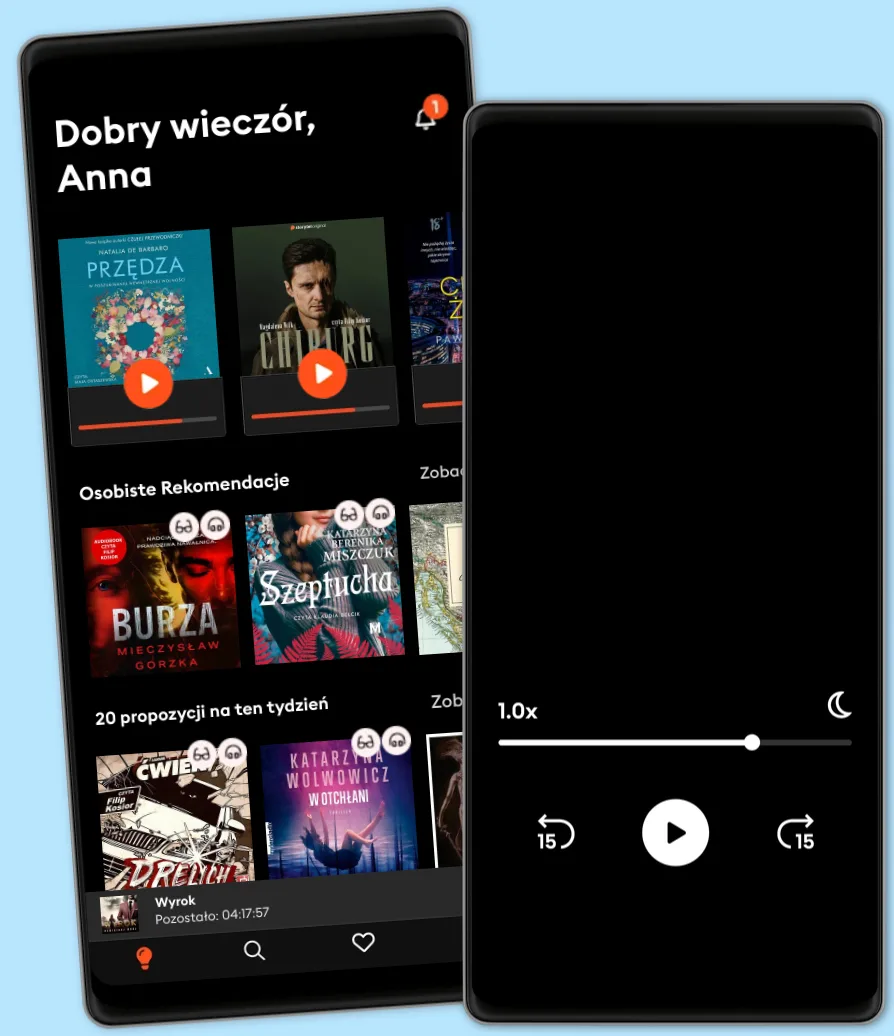

Słuchaj i czytaj kiedy chcesz

Romans na spacerze? Kryminał w drodze do pracy? Wciągający thriller, gdy gotujesz? Z ponad 500 tys. tytułów do wyboru, nigdy nie zabraknie Ci najlepszych historii. Zacznij słuchać już dziś - ale uważaj, te emocje uzależniają!

- Wypróbuj przez 7 dni

- Czytaj i słuchaj jak chcesz i ile chcesz

- Ponad 500 000 tytułów

- Tytuły dostępne wyłącznie w Storytel oraz Storytel Originals

- Łatwa rezygnacja w dowolnym momencie

Money Wise: How to Create, Grow, and Preserve Your Wealth

- Autor

- Wydawca

- Język

- Angielski

- Format

- Kategoria

Biznes i ekonomia

A legendary Wall Street investor reveals how to gain, keep, spend, grow and bequeath wealth

Financial advisers, newspapers, television, and radio reports often qualify information about mutual funds and other investments as "according to Lipper." They all mean the various Lipper Fund Indices developed by Mike Lipper. Now you can learn, as he has learned, the lessons of creating, managing, and preserving wealth. These lessons are vital for the newly wealthy, the would-be wealthy, the second and third generations of wealth, investment advisers and other wealth managers, and charities and other nonprofits. They come straight from Mike's own fifty years of experience as an investor and as a member of a family that has spent four generations on Wall Street.

Mike's ideas have direct application to you:

- How to measure your wealth.

- You as a balance sheet.

- You as the single biggest contributor to your satisfaction as an investor.

- What kind or kinds of investor personalities describe you.

- When and how to use unconventional thinking.

- When you should use multiple portfolios.

- How to share your wealth with others.

There are millions of millionaires in the United States. If you've gotten there, or want to get there, this book will help you answer the question: What now? From the New York Society of Security Analysts

Michael Lipper's book is very timely, especially considering the current turbulence in the financial markets. So often these days, many of us get questions about money management from family, friends, and customers. Often these questions come from people who need an analytical structure to respond to what is hitting them with shocking speed.

Two of Michael Lipper's statements really hit home. First, is the dangerous failure to think about the "consequences of being wrong." Second, is "if you do not understand the game, do not play." This comes from his experience of avoiding Enron after reading its annual report, and being unable to figure out how they got such big earnings out of their balance sheet." These and other lessons come from a long career in the financial business. Money Wise is filled with explanations and lessons on essential topics such as risk, your personal balance sheet, picking money managers, the dangers in trading, investor psychology, hedge funds, private equity, and investing in new trends. Read this book and give it to those asking questions on how to create and keep wealth.—William A. Hayes

© 2025 St. Martin's Press (E-book): 9781429933360

Wydanie

E-book: 23 września 2025

- Wieża jaskółki Andrzej Sapkowski

4.9

- Harry Potter i Kamień Filozoficzny J.K. Rowling

4.7

- Goście weselni Alison Espach

4.5

- Wilczyca Mieczysław Gorzka

4.6

- Dwa strzały. Komisarz Oczko (23) Tomasz Wandzel

4.6

- Harry Potter i Komnata Tajemnic J.K. Rowling

4.8

- Wiedźmin Andrzej Sapkowski

4.7

- Gra o tron George R.R. Martin

4.9

- Krew elfów Andrzej Sapkowski

4.8

- Harry Potter i Więzień Azkabanu J.K. Rowling

4.8

- Zła przeszłość Mieczysław Gorzka

4.8

- Pierwsza sprawa. Komisarz Oczko (1) Tomasz Wandzel

4.3

- Wojsławicka masakra kosą łańcuchową Andrzej Pilipiuk

4.7

- Poszukiwacz Zwłok Mieczysław Gorzka

4.8

- Papieżyca Magdalena Kornak

4.4

Wybierz swoją subskrypcję:

Ponad 500 000 tytułów w cenie jednego abonamentu

Wypróbuj przez 7 dni

Słuchaj i czytaj w trybie offline

Ekskluzywne produkcje audio Storytel Original

Tryb dziecięcy Kids Mode

Anuluj kiedy chcesz

Unlimited

Dla tych, którzy chcą słuchać i czytać bez limitów.

39.90 zł /30 dni

1 konto

Słuchanie bez limitów

Anuluj w dowolnym momencie

Unlimited na rok

Dla tych, którzy chcą słuchać i czytać bez limitów.

39.90 zł /30 dni

1 konto

Słuchanie bez limitów

Anuluj w dowolnym momencie

Basic

Dla tych, którzy słuchają i czytają od czasu do czasu.

22.90 zł /30 dni

1 konto

10 godzin / miesiąc

Anuluj w dowolnym momencie

Family

Dla tych, którzy chcą dzielić się historiami ze znajomymi i rodziną.

Od 59.90 zł /30 dni

2–3 konta

Słuchanie bez limitów

Anuluj w dowolnym momencie

59.90 zł /30 dni

Polski

Polska