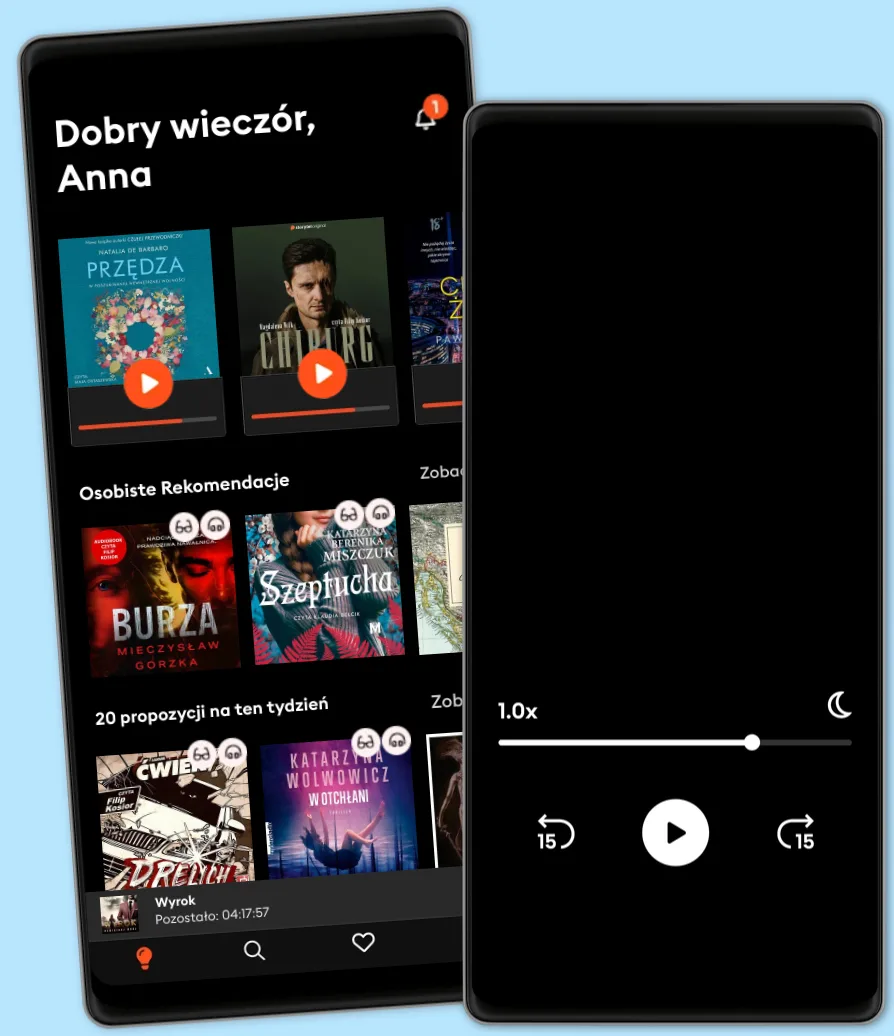

Słuchaj i czytaj kiedy chcesz

Romans na spacerze? Kryminał w drodze do pracy? Wciągający thriller, gdy gotujesz? Z ponad 500 tys. tytułów do wyboru, nigdy nie zabraknie Ci najlepszych historii. Zacznij słuchać już dziś - ale uważaj, te emocje uzależniają!

- Wypróbuj przez 7 dni

- Czytaj i słuchaj jak chcesz i ile chcesz

- Ponad 500 000 tytułów

- Tytuły dostępne wyłącznie w Storytel oraz Storytel Originals

- Łatwa rezygnacja w dowolnym momencie

Why Stock Markets Crash: Critical Events in Complex Financial Systems

- Autor

- Wydawca

- Serie

49 z 51

- Język

- Angielski

- Format

- Kategoria

Biznes i ekonomia

The scientific study of complex systems has transformed a wide range of disciplines in recent years, enabling researchers in both the natural and social sciences to model and predict phenomena as diverse as earthquakes, global warming, demographic patterns, financial crises, and the failure of materials. In this book, Didier Sornette boldly applies his varied experience in these areas to propose a simple, powerful, and general theory of how, why, and when stock markets crash.

Most attempts to explain market failures seek to pinpoint triggering mechanisms that occur hours, days, or weeks before the collapse. Sornette proposes a radically different view: the underlying cause can be sought months and even years before the abrupt, catastrophic event in the build-up of cooperative speculation, which often translates into an accelerating rise of the market price, otherwise known as a "bubble." Anchoring his sophisticated, step-by-step analysis in leading-edge physical and statistical modeling techniques, he unearths remarkable insights and some predictions--among them, that the "end of the growth era" will occur around 2050.

Sornette probes major historical precedents, from the decades-long "tulip mania" in the Netherlands that wilted suddenly in 1637 to the South Sea Bubble that ended with the first huge market crash in England in 1720, to the Great Crash of October 1929 and Black Monday in 1987, to cite just a few. He concludes that most explanations other than cooperative self-organization fail to account for the subtle bubbles by which the markets lay the groundwork for catastrophe.

Any investor or investment professional who seeks a genuine understanding of looming financial disasters should read this book. Physicists, geologists, biologists, economists, and others will welcome Why Stock Markets Crash as a highly original "scientific tale," as Sornette aptly puts it, of the exciting and sometimes fearsome--but no longer quite so unfathomable--world of stock markets.

© 2017 Princeton University Press (E-book): 9781400885091

Wydanie

E-book: 21 marca 2017

Tagi

Inni polubili także ...

- Folly, Grace, and Power: The Mysterious Act of Preaching John Koessler

- Business and Populism: The Odd Couple?

- The Cost of Free Money: How Unfettered Capital Threatens Our Economic Future Paola Subacchi

- Recovering the Reformed Confession: Our Theology, Piety, and Practice R. Scott Clark

- Why Congress Phillip A. Wallach

- Bright Hope for Tomorrow: How Anticipating Jesus’ Return Gives Strength for Today Chris Davis

- The Hermeneutics of the Biblical Writers: Learning to Interpret Scripture from the Prophets and Apostles Abner Chou

- The Silk Road Rediscovered: How Indian and Chinese Companies Are Becoming Globally Stronger by Winning in Each Other's Markets Anil K. Gupta

- The Sufis: Index Edition Idries Shah

- Biography of God Skip Heitzig

- Letter To James C. Conkling Abraham Lincoln

- When Free Markets Fail: Saving the Market When It Can't Save Itself Scott McCleskey

- The Mosaic of Christian Belief: Twenty Centuries of Unity and Diversity Roger E. Olson

- Human Rights in a Divided World: Catholicism as a Living Tradition David Hollenbach

- Divine Providence: A Classic Work for Modern Readers Stephen Charnock

- The Hidden History of Monopolies: How Big Business Destroyed the American Dream Thom Hartmann

- The Elements of Voice First Style: A Practical Guide to Voice User Interface Design Ahmed Bouzid

- Awaiting the King: Reforming Public Theology James K. A. Smith

- Victories Never Last: Reading and Caregiving in a Time of Plague Robert Zaretsky

- Moderate Conservatism: Reclaiming the Center John Kekes

- The Doctrine of God: A Theology of Lordship John M. Frame

- The Minor Prophets: An Expositional Commentary, Volume 1: Hosea–Jonah James Montgomery Boice

- Survival of the Virtuous: The Evolution of Moral Psychology Dennis L. Krebs

- The End of Money: Counterfeiters, Preachers, Techies, Dreamers--and the Coming Cashless Society David Wolman

- Psalms and Proverbs for Commuters Audio Bible - King James Version, KJV: 31 Days of Praise and Wisdom from the King James Version Bible Zondervan

- Providence in the Story of Scripture: The Work of God through Creation, Fall, Redemption, and New Creation Adamson Co

- Acts: An Expositional Commentary James Montgomery Boice

- A Shot of Faith (to the Head): Be a Confident Believer in an Age of Cranky Atheists Mitch Stokes

- Hindu Influence in Mesopotamia and Iran London Swaminathan

- Watchdog: How Protecting Consumers Can Save Our Families, Our Economy, and Our Democracy Richard Cordray

- Money in the Twenty-First Century: Cheap, Mobile, and Digital Richard Holden

- Underserved: Harnessing the Principles of Lincoln's Vision for Reconstruction for Today's Forgotten Communities Chris Pilkerton

- The Story of Reality: Audio Lectures: How the World Began, How it Ends, and Everything Important that Happens in Between Gregory Koukl

- Created Equal: Clarence Thomas in His Own Words Michael Pack

- The Old Testament in Seven Sentences: A Small Introduction to a Vast Topic Christopher JH Wright

- Outcasts: An Anthology Members Of The Ohio Writers Association

- The Backstage of the Care Economy: Transnational Perspectives on the Commercialisation of Care Helma Lutz

- Enquiry Concerning Political Justice: And Its Influence on Morals and Happiness William Godwin

- The Masters of Enterprise H.W. Brands

- The English Constitution Walter Bagehot

- Nehemiah: An Expositional Commentary James Montgomery Boice

- Family: The Compact Among Generations James E. Hughes

- Anchor Man: How a Father Can Anchor His Family in Christ for the Next 100 Years Steve Farrar

- A Popular Survey of the New Testament Norman L. Geisler

- Give Smart: Philanthropy that Gets Results Joel L. Fleishman

- Fired Up about Capitalism Tom Malleson

- What Retirees Want: A Holistic View of Life's Third Age Robert Morison

- Flame of Love: A Theology of the Holy Spirit (Second Edition) Clark H. Pinnock

- A Jesus-Shaped Life: How Diving Deeper into Theology Can Transform Us and Our World with the Radical Kindness of God Lisa Harper

- The Westminster Confession of Faith: For Study Classes G. I. Williamson

- The Augustine Way: Retrieving a Vision for the Church's Apologetic Witness Mark D. Allen

- Genomic Politics: How the Revolution in Genomic Science Is Shaping American Society Jennifer Hochschild

- Wieża jaskółki Andrzej Sapkowski

4.9

- Harry Potter i Kamień Filozoficzny J.K. Rowling

4.7

- Goście weselni Alison Espach

4.5

- Harry Potter i Komnata Tajemnic J.K. Rowling

4.8

- Wilczyca Mieczysław Gorzka

4.6

- Wiedźmin Andrzej Sapkowski

4.7

- Papieżyca Magdalena Kornak

4.4

- Krew elfów Andrzej Sapkowski

4.8

- Gra o tron George R.R. Martin

4.9

- Niewierna Katarzyna Wolwowicz

4.7

- Harry Potter i Więzień Azkabanu J.K. Rowling

4.8

- Wojsławicka masakra kosą łańcuchową Andrzej Pilipiuk

4.7

- Dwa strzały. Komisarz Oczko (23) Tomasz Wandzel

4.6

- Pierwsza sprawa. Komisarz Oczko (1) Tomasz Wandzel

4.3

- Substytucja Remigiusz Mróz

4.7

Wybierz swoją subskrypcję:

Ponad 500 000 tytułów w cenie jednego abonamentu

Wypróbuj przez 7 dni

Słuchaj i czytaj w trybie offline

Ekskluzywne produkcje audio Storytel Original

Tryb dziecięcy Kids Mode

Anuluj kiedy chcesz

Unlimited

Dla tych, którzy chcą słuchać i czytać bez limitów.

39.90 zł /30 dni

1 konto

Słuchanie bez limitów

Anuluj w dowolnym momencie

Unlimited na rok

Dla tych, którzy chcą słuchać i czytać bez limitów.

39.90 zł /30 dni

1 konto

Słuchanie bez limitów

Anuluj w dowolnym momencie

Basic

Dla tych, którzy słuchają i czytają od czasu do czasu.

22.90 zł /30 dni

1 konto

10 godzin / miesiąc

Anuluj w dowolnym momencie

Family

Dla tych, którzy chcą dzielić się historiami ze znajomymi i rodziną.

Od 59.90 zł /30 dni

2–3 konta

Słuchanie bez limitów

Anuluj w dowolnym momencie

59.90 zł /30 dni

Polski

Polska