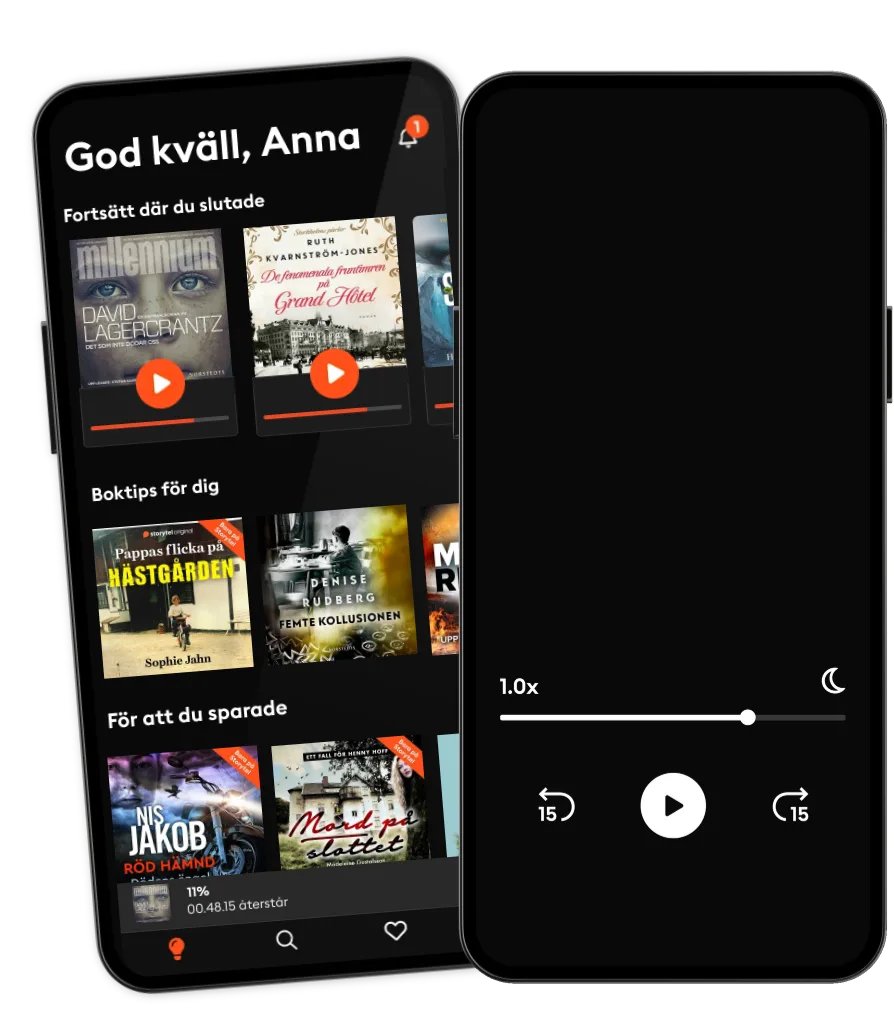

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C Corporations

- Av

- Med

- Förlag

- Längd

- 3T 27min

- Språk

- Engelska

- Format

- Kategori

Ekonomi & Business

If you're a business owner wanting to learn more about taxes without going through boring textbooks, then pay attention...

Benjamin Franklin once said that, “in life, only two things are certain: death and taxes.” He wasn't exaggerating about the latter. And because you must deal with taxes for as long as you live and earn money, you must get it right every time.

Unlike any other infractions or violations, tax-related offenses have major repercussions. At a minimum, you will pay fines and expenses. But if your tax violations are serious, you may end up in jail. Think about this: the infamous mafia gangster boss Al Capone was indicted and sent to prison not because of his violent crimes, but because of tax violations. Hence, you must take your taxes very seriously.

So, what does it take to manage your taxes successfully and avoid the massive inconveniences associated with being flagged by the Internal Revenue Service for tax violations? There are so many answers to this question, but they can be summed up in one term: tax accounting. And that is what this book is all about.

Written with non-accountant entrepreneurs in mind, this book can help you learn important tax accounting principles for ensuring optimal tax management in your business. These include:

• What tax accounting is. • Important tax accounting guidelines. • The difference between accounting and bookkeeping. • How to claim tax deductions legally. • How to choose the right business entity. • And much, much more!

By the time you're finished with this audiobook, you'll be armed with sufficient knowledge to ensure proper management of your businesses' income taxes.

And while you can never avoid taxes, what you'll learn here can make you and the IRS the best of friends.

So, listen to this audiobook now and start your journey towards optimal tax management for your small business.

© 2021 Greg Shields (Ljudbok): 9781664981904

Utgivningsdatum

Ljudbok: 20 februari 2021

Taggar

Andra gillade också ...

- Accounting: Step by Step Guide to Accounting Principles & Basic Accounting for Small business Mark Smith

- Accounting for Dummies 3rd Ed. John A. Tracy

- US Corporate Tax System Introbooks Team

- Accounting: Business and Numbers That You Need to Succeed Gerard Howles

- Financial Statements Thomas R. Ittelson

- Accounting Fundamentals Introbooks Team

- Accounting: Dividends, Debt, and Financial Risks Explained Gerard Howles

- Accounting: Tips about Balance Sheets, Salary, Taxes, and More Gerard Howles

- Accounting: Be Your Own Boss and Accountant the Right Way Gerard Howles

- Think and Grow Rich Napoleon Hill

- Accounting: Tips about Balance Sheets, Gross Income, and Statements Gerard Howles

- Introduction to Accounting IntroBooks

- Accounting: A Beginner’s Guide to Understanding Financial & Managerial Accounting John Kent

- Accounting: How to Calculate Costs and Profits from Stocks, Businesses, and More Gerard Howles

- Reading Financial Reports for Dummies Lita Epstein, MBA

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working and Staying Tax Compliant Abroad Olivier Wagner

- Analyzing Financial Statements Eric Press (PhD)

- Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway's Vice Chairman on Life, Business, and the Pursuit of Wealth With Commentary by David Clark David Clark

- The Intelligent Investor Rev Ed. Benjamin Graham

- Hedge Funds for Dummies Ann C. Logue, MBA

- The E-Myth Accountant: Why Most Accounting Practices Don’t Work and What to Do about It Michael E. Gerber

- Swing Trading For Dummies: 2nd Edition Omar Bassal, CFA

- Bookkeeping: The Ultimate Guide For Beginners to Learn in Step by Step The Simple and Effective Methods of Bookkeeping for Small Business Max ruel

- Money Machine: The Surprisingly Simple Power of Value Investing Gary Smith

- Investing in One Lesson Mark Skousen

- Mastering The Market Cycle: Getting the odds on your side Howard Marks

- Financial Literacy for Managers: Finance and Accounting for Better Decision-Making Richard A. Lambert

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity Paul Pignataro

- Marketing for Dummies (2nd Ed.) Alexander Hiam

- Personal Finance For Dummies: 9th Edition Eric Tyson, MBA

- Warren Buffett's Ground Rules: Words of Wisdom from the Partnership Letters of the World's Greatest Investor Jeremy C. Miller

- Mortgage Management For Dummies Robert S. Griswold, MSBA

- The Effective Executive: The Definitive Guide to Getting the Right Things Done Peter F. Drucker

- Bookkeeping and Accounting: The Complete Guide to Accounting Principles, Bookkeeping and Taxes for Small Business without Becoming an Accountant Brendon Coleman

- Financial Accounting For Dummies: 2nd Edition Maire Loughran

- The Essential Drucker: In One Volume the Best of Sixty Years of Peter Drucker's Essential Writings on Management Peter F. Drucker

- The Achievement Habit: Stop Wishing, Start Doing, and Take Command of Your Life Bernard Roth

- Starting an Online Business All-in-One For Dummies: 6th Edition Shannon Belew

- Financial Accounting Explained Introbooks Team

- A Little History of Economics Niall Kishtainy

- Eat That Frog! Third Edition: 21 Great Ways to Stop Procrastinating and Get More Done in Less Time Brian Tracy

- Financial Statements Explained Introbooks Team

- Financial Statement Analysis Explained Introbooks Team

- Economics for Dummies: 3rd Edition Sean Masaki Flynn, PhD

- The Hidden Wealth Nations: The Scourge of Tax Havens Gabriel Zucman

- Blue Ocean Strategy W. Chan Kim

- Making Ideas Happen: Overcoming the Obstacles Between Vision and Reality Scott Belsky

- Kaninhålet Leffe Grimwalker

3.8

- Boksamlaren Camilla Davidsson

4

- Inte ditt barn Nilla Kjellsdotter

4.1

- Mellan samma väggar Jojo Moyes

3.9

- Väninnorna på Nordiska Kompaniet Ruth Kvarnström-Jones

4.1

- De fenomenala fruntimren på Grand Hôtel Ruth Kvarnström-Jones

4.5

- Ulven Johan Kant

3.9

- Hembiträdets hemlighet Freida McFadden

4.1

- Hembiträdet Freida McFadden

4.2

- Post Mortem David Lagercrantz

3.8

- Tranorna flyger söderut Lisa Ridzén

4.6

- Sömngångaren Lars Kepler

4.2

- Solglimt Aud Midtsund

4.2

- Kiruna Killer Leffe Grimwalker

4.2

- Ett evigt mörker Mikael Ressem

3.9

Därför kommer du älska Storytel:

1 miljon stories

Lyssna och läs offline

Exklusiva nyheter varje vecka

Kids Mode (barnsäker miljö)

Premium

Lyssna och läs ofta.

1 konto

100 timmar/månad

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Unlimited

Lyssna och läs obegränsat.

1 konto

Lyssna obegränsat

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Family

Dela stories med hela familjen.

2-6 konton

100 timmar/månad för varje konto

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

2 konton

239 kr /månadFlex

Lyssna och läs ibland – spara dina olyssnade timmar.

1 konto

20 timmar/månad

Spara upp till 100 olyssnade timmar

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Svenska

Sverige