SVB: The End of Banking as We Know It?

- Av

- Episod

- 149

- Publicerad

- 16 mars 2023

- Förlag

- 0 Recensioner

- 0

- Episod

- 149 of 227

- Längd

- 53min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

We had initially prepared an entirely different episode for today, but last week's Silicon Valley Bank collapse, the largest in U.S. history since 2008, meant a quick change of plans.

What happened? What is unique about this bank run, and what isn't? How much should regulators be blamed, and how much should bank management be? Do social media and today's frantic digital environment mean this is the end of banking as we know it?

Luigi and Bethany talk to two experts with unique insights into the crisis: Chicago Booth Professor Douglas Diamond, who won the 2022 Nobel Prize for his decades-long work on bank runs, and Eric Rosengren, former Boston Fed President, for his view as a regulator. They discuss the factors that led to the collapse, including risky lending practices, lack of oversight, and the challenges of regulating the rapidly evolving world of banking. They also explore the broader implications of the collapse, including the impact on the broader financial system and the role of regulation in promoting financial stability.

Show Notes:

Nobel Laureate Douglas Diamond on How the Fed Could Have Prevented SVB’s Collapse • , by Brooke Fox, on ProMarketHow Do We Avoid the Next SVB? • by Chicago Booth Professor Anil Kashyap, on ProMarket • Link to the advertised Chicago Booth Review podcast: https://www.chicagobooth.edu/review/podcast?source=cbr-sn-cap-camp:podcast23-20230320 Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

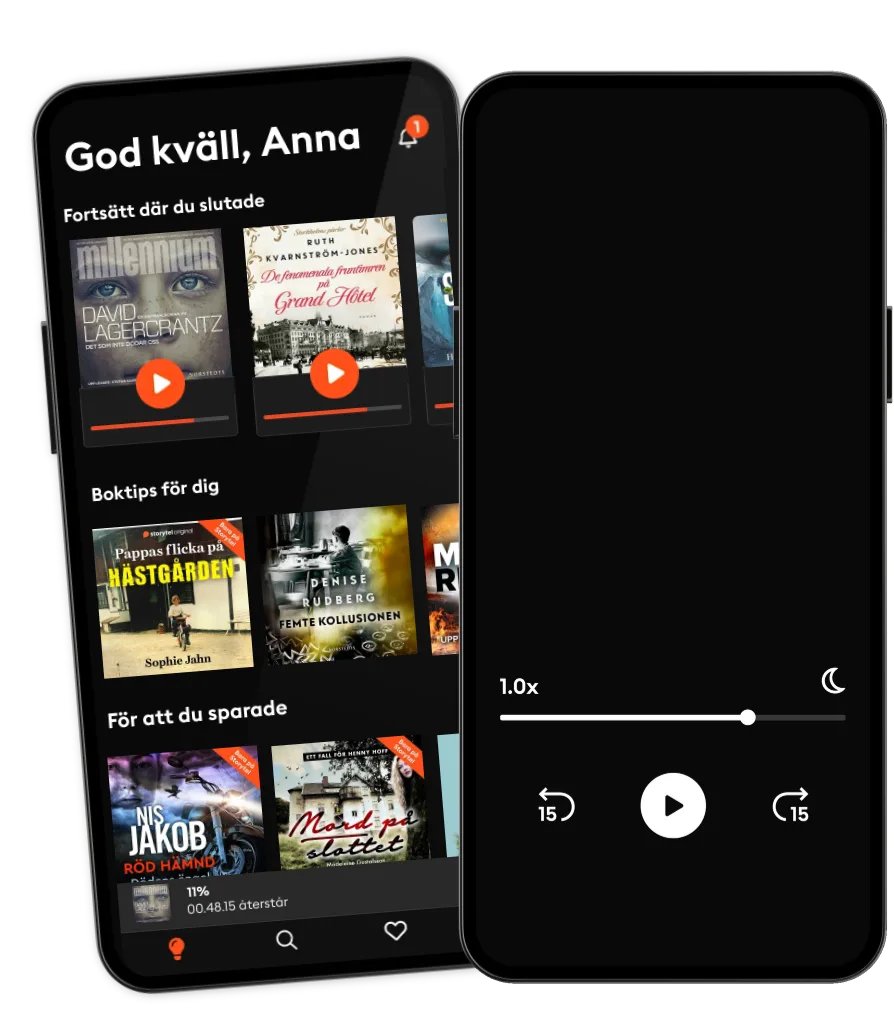

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

Svenska

Sverige