Vision Before Budget: The Wealth Framework That Helped Dr. Annie Cole Retire 20 Years Early

- Av

- Episod

- 1297

- Publicerad

- 24 maj 2025

- Förlag

- 0 Recensioner

- 0

- Episod

- 1297 of 1384

- Längd

- 40min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

What if the reason you’re stuck isn’t your budget—but the fact that you started with one?

I’m joined by Dr. Annie Cole, founder of Money Essentials for Women, who turned a $26K social work salary into $1 million in real estate, nearly $400K in investments, and shaved 20 years off her retirement date—all before turning 40.

Her secret? A radically different approach to wealth building that doesn’t start with pinching pennies. Annie walks us through her 5-Step Wealth Framework, including how to create a financial vision that actually aligns with your life, the real reason high-earning women still feel broke, and why investing just $1 could be the best place to start.

In this episode we discuss:

A clear understanding of why budgeting is not your starting line

The mindset shift that took Annie from broke to financially free

Three different ways to structure your budget based on your life goals

Why your income isn’t the biggest factor in wealth-building—and what is

How to start investing today (even if you're scared and have no idea where to start)

How to break free from outdated financial beliefs that keep women playing small

The #1 habit that accelerated Annie’s wealth and financial freedom

How to spend under your means without feeling restricted

Why financial planning > penny pinching

How to release shame and take control, even if you’re starting from zero

Learn more and connect with Annie:

Website: https://money-essentials.com

Instagram: @moneyessentialsforwomen

You’ll Walk Away Knowing:

Budgeting is often seen as restrictive and can keep people stuck.

A life vision is essential for effective financial planning.

Financial goals should align with personal values and aspirations.

Income alone does not equate to financial freedom.

Investing is crucial for building wealth and passive income.

Creating a financial plan can empower individuals to make intentional decisions.

Unexpected expenses are a part of life; having a buffer is important.

Mindset shifts are necessary for overcoming financial limitations.

Women often hold outdated beliefs about money and work.

Money coaching fills the gap between financial advice and personal finance education.

Here is that blog post I wrote that answers the question "How Do I Start Investing?"

If you love what you heard, please be sure to rate and review the podcast. Also, keep in the loop by following us on Instagram at @everyonestalkinmoney

Learn more about your ad choices. Visit megaphone.fm/adchoices

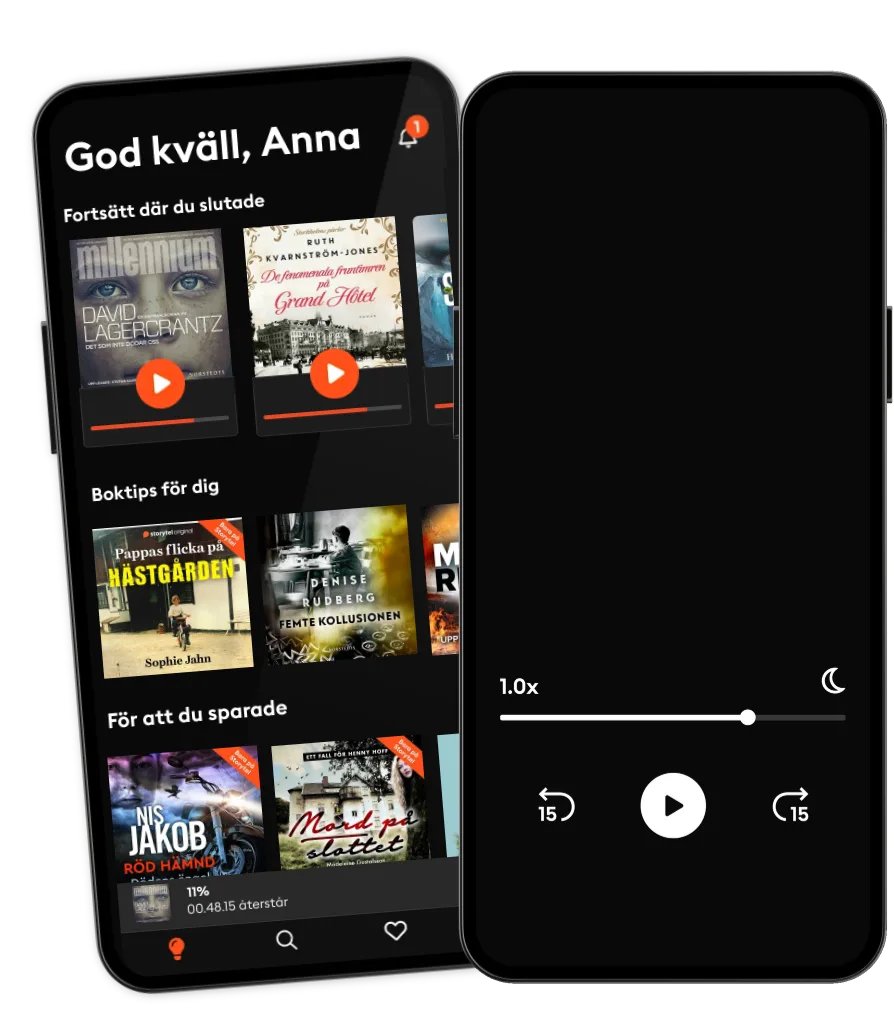

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

- Business DailyBBC World Service

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

- Business DailyBBC World Service

Svenska

Sverige