Brookfield CEO: Private vs. public markets, investment style and value creation

- Av

- Episod

- 50

- Publicerad

- 13 dec. 2023

- Förlag

- 0 Recensioner

- 0

- Episod

- 50 of 193

- Längd

- 48min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

Bruce Flatt became the CEO of Brookfield in 2002 when the company was primarily a Canadian-based real estate firm with a market value of $5 billion. Under his leadership, it transformed into a global alternative asset manager, managing over $850 billion in assets across various sectors: real estate, infrastructure, renewable energy, private equity, and credit. In light of such diverse investments, what are the benefits of investing in private markets? What are the major global megatrends shaping these investments? And what qualities define a good investor?

The production team on this episode were PLAN-B's Nikolai Ovenberg and Niklas Figenschau Johansen. Background research was done by Sigurd Brekke with input from portfolio manager Erlend Kvendseth.

Links:

• Watch the episode on YouTube: Norges Bank Investment Management - YouTube • Want to learn more about the fund? The fund | Norges Bank Investment Management (nbim.no) • Follow Nicolai Tangen on LinkedIn: Nicolai Tangen | LinkedIn • Follow NBIM on LinkedIn: Norges Bank Investment Management: Administrator for bedriftsside | LinkedIn • Follow NBIM on Instagram: Explore Norges Bank Investment Management on Instagram

Hosted on Acast. See acast.com/privacy for more information.

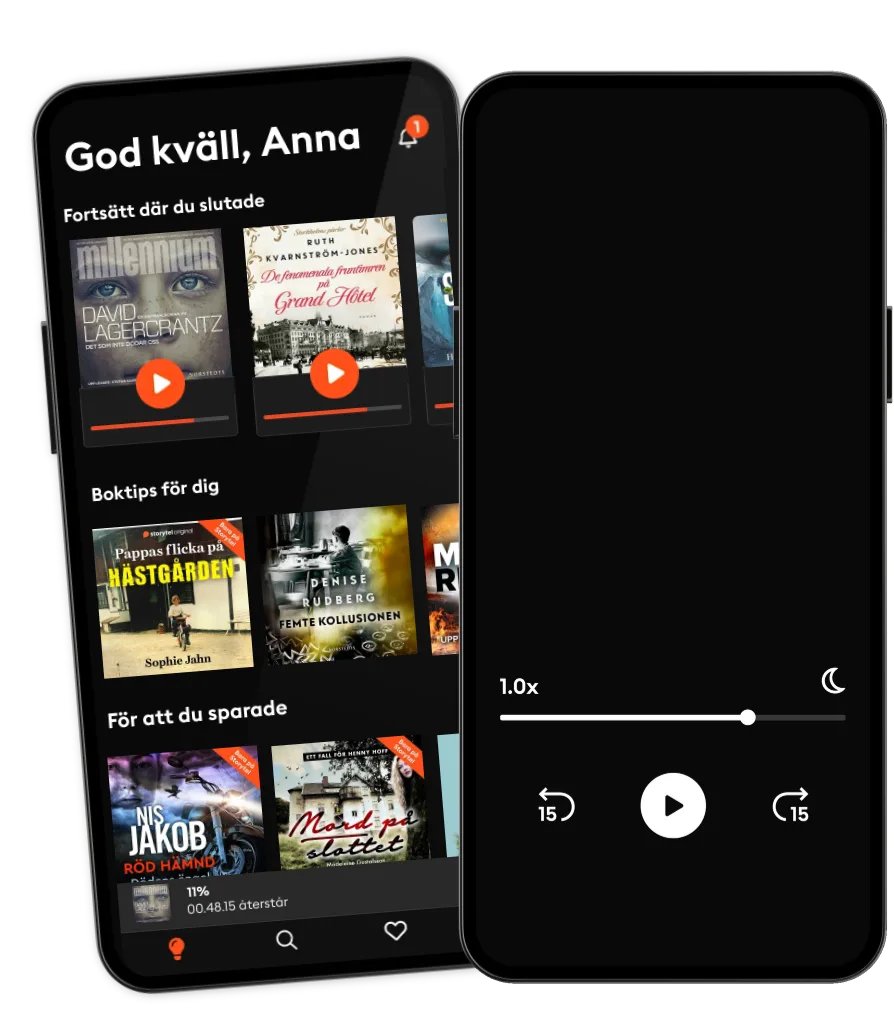

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- Club Shay ShayiHeartPodcasts and Shay Shay Media

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- Club Shay ShayiHeartPodcasts and Shay Shay Media

Svenska

Sverige