- 0 Recensioner

- 0

- Episod

- 111 of 1082

- Längd

- 27min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

There are two popular schools of thought with regards to how markets work. There's the efficient markets hypothesis (EMH) which says that it's basically impossible to beat the market, because all information is completely priced in at all times (more or less). On the other side is an increasingly popular behavioral view which argues that various human emotions and biases are always creating situations that aren't justified by the data. On this week's episode of the Odd Lots podcast, we speak to Andrew Lo, a professor of finance at the MIT Sloan School of Management about his own theory, which he calls Adaptive Markets. The theory attempts to bridge the behavioral approach with the efficient markets view. He argues that the proper way to view the market is through an ecological lens, examining the players as flora and fauna of a complicated system, to help determine who's thriving, who's dying, and where asset prices will go.

See omnystudio.com/listener for privacy information.

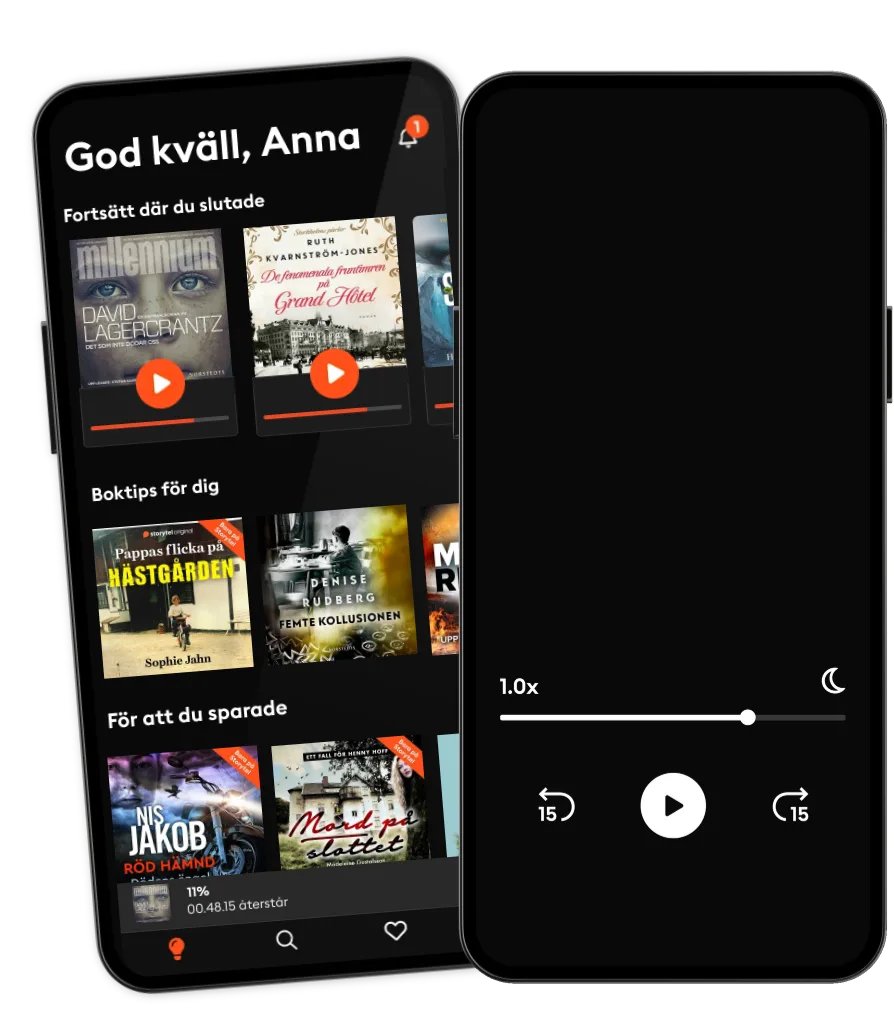

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- Goldman Sachs ExchangesGoldman Sachs

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- Goldman Sachs ExchangesGoldman Sachs

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

Svenska

Sverige