Crux co-founder on how the transferability of tax credits in the Inflation Reduction Act is leveling the energy playing field

- Av

- Episod

- 222

- Publicerad

- 16 feb. 2024

- Förlag

- 0 Recensioner

- 0

- Episod

- 222 of 328

- Längd

- 17min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

On this episode Energy Evolution podcast interviews Alfred Johnson, CEO and co-founder of Crux, about the shift towards clean energy and the tax credits offered by the Inflation Reduction Act (IRA). The IRA is creating hundreds of billions of dollars in tax credits for companies that deploy renewable energy. Transferable tax credits enable companies to sell those credits and access capital quickly. Crux is a platform for developers, tax credit buyers, and financial institutions to transact and manage transferable tax credits. The company's inaugural market report on the state of clean energy tax credit transactions found that there was between $7 billion and $9 billion in volume of 2023 tax credit transactions. They reported that the transferability of the credits levels the playing field for smaller projects and new technologies. Please subscribe to Energy Evolution to stay current on the energy transition and its implications. Veteran journalists Dan Testa and Taylor Kuykendall co-host the show.

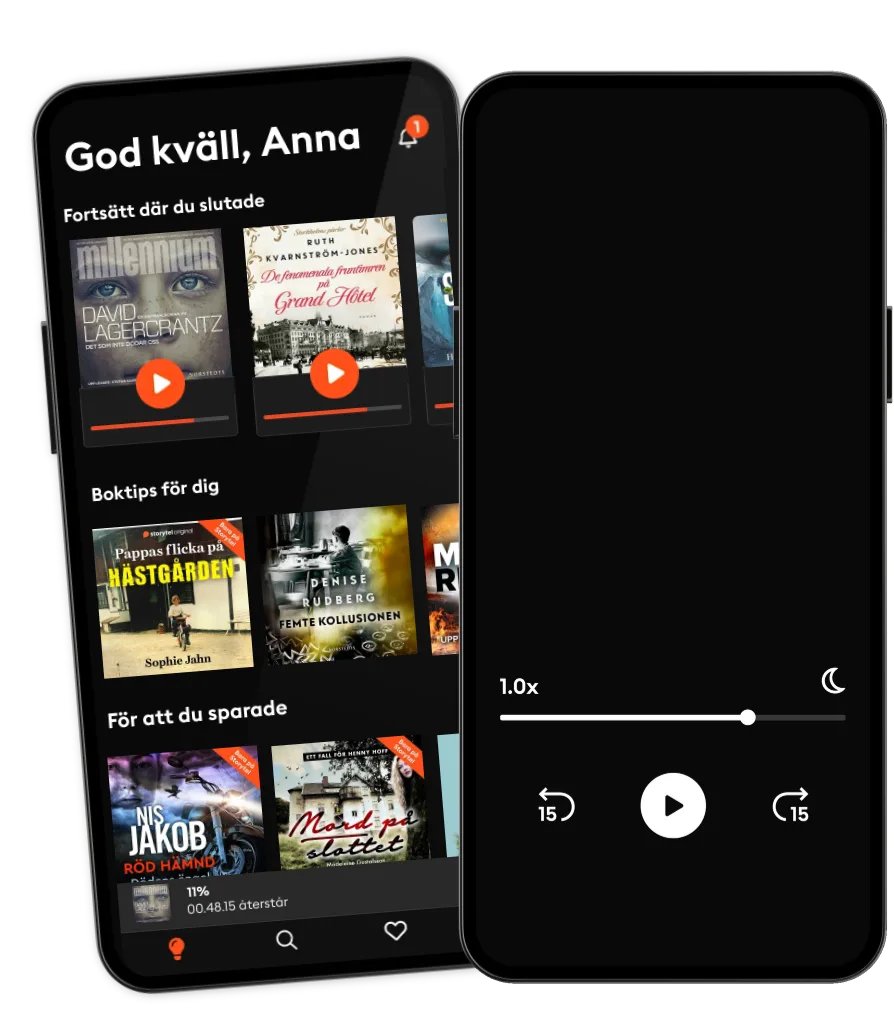

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

Svenska

Sverige