Amundi Tips AT1s in ‘Goldilocks’ View; Shipping Focus

- Av

- Episod

- 63

- Publicerad

- 4 apr. 2024

- Förlag

- 0 Recensioner

- 0

- Episod

- 63 of 145

- Längd

- 44min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

Europe’s largest asset manager, Amundi, expects Additional Tier 1 bank bonds to extend gains in what it sees as a broadly positive market for corporate debt. “We’re obviously in this kind of Goldilocks scenario, I think, where the central bank put remains on the table,” Steven Fawn, head of global credit at Amundi Asset Management, tells Bloomberg News’ James Crombie and Bloomberg Intelligence’s Stephane Kovatchev. “Sub-debt is one part of the market which we like,” Fawn says in the latest Credit Edge podcast, referring to subordinated bonds, including bank AT1s. In addition, the portfolio manager discusses Amundi’s macroeconomic outlook, fund flows and positioning by industry sector and ratings tier. Also in this episode, BI’s Kovatchev analyzes the impact of the Baltimore bridge collapse on the global supply chain.

See omnystudio.com/listener for privacy information.

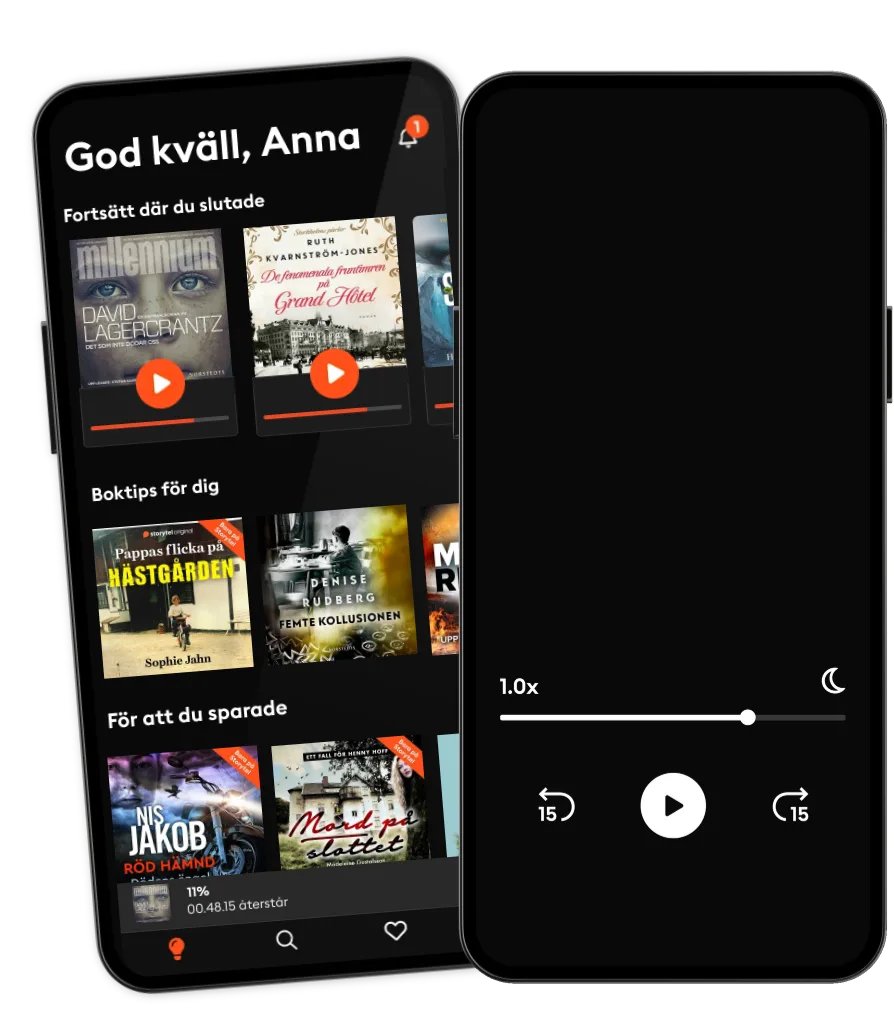

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- Club Shay ShayiHeartPodcasts and Shay Shay Media

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- Club Shay ShayiHeartPodcasts and Shay Shay Media

Svenska

Sverige