20VC: The Biggest Misconceptions & Hardest Truths About Seed Investing Today; Why The Best Founders Don't Need You, Why Uncapped SAFEs Are Good, Why Reserves Are Bad, Why Signalling is BS, Why Price Doesn't Matter with David Tisch & Terrence Rohan

- Av

- Episod

- 1119

- Publicerad

- 5 feb. 2024

- Förlag

- 0 Recensioner

- 0

- Episod

- 1119 of 1395

- Längd

- 1T 29min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

David Tisch is the Managing Partner of BoxGroup, one of the leading seed-stage investment firms of the last decade having invested in over 500 seed-stage startups, including Plaid, Ro, Ramp, PillPack, Amplitude, Stripe, Warby Parker, Harry's, Flexport, Classpass, Airtable and more. Terrence Rohan is the Managing Director @ Otherwise Fund, a fund that discretely empowers a network of today's top founders to make multi-stage venture investments. Terrence has invested in the likes of Figma, Hugging Face, Vanta, Notion and Robinhood to name a few. In Today's Seed Investing Special We Discuss: 1. Is Seed Investing Now a Commoditised Asset Class: • Why does Dave Tisch believe seed investing will remain the most inefficient market? What does that mean for the future of returns at seed? • Why should you always pay up and be price-insensitive at seed rounds? • Why does David believe that no one is great at seed investing? • Why does David believe that you cannot index the seed market? 2. The Biggest BS Elements of Venture Capital: Signaling: • Why does David believe that the theory of signaling is total BS? Why does Terrence disagree and think it is valid and common? Group Decision-Making: • Why does Terrence believe that investing decisions should be made solo and groups merely encourage consensus decision-making? Reserves: • Why does Terrence believe reserves hurt DPI and are not good? How does David respond given his growth fund? Venture Value Add: • Why do David and Terrence think venture value add services platforms are BS and not worth it? 3. The World of LPs: • What is the single biggest misalignment between VCs and LPs? • What are David and Terrence's biggest pieces of advice for emerging managers today? • Should LPs expect depressed returns from venture as the asset class commoditises?

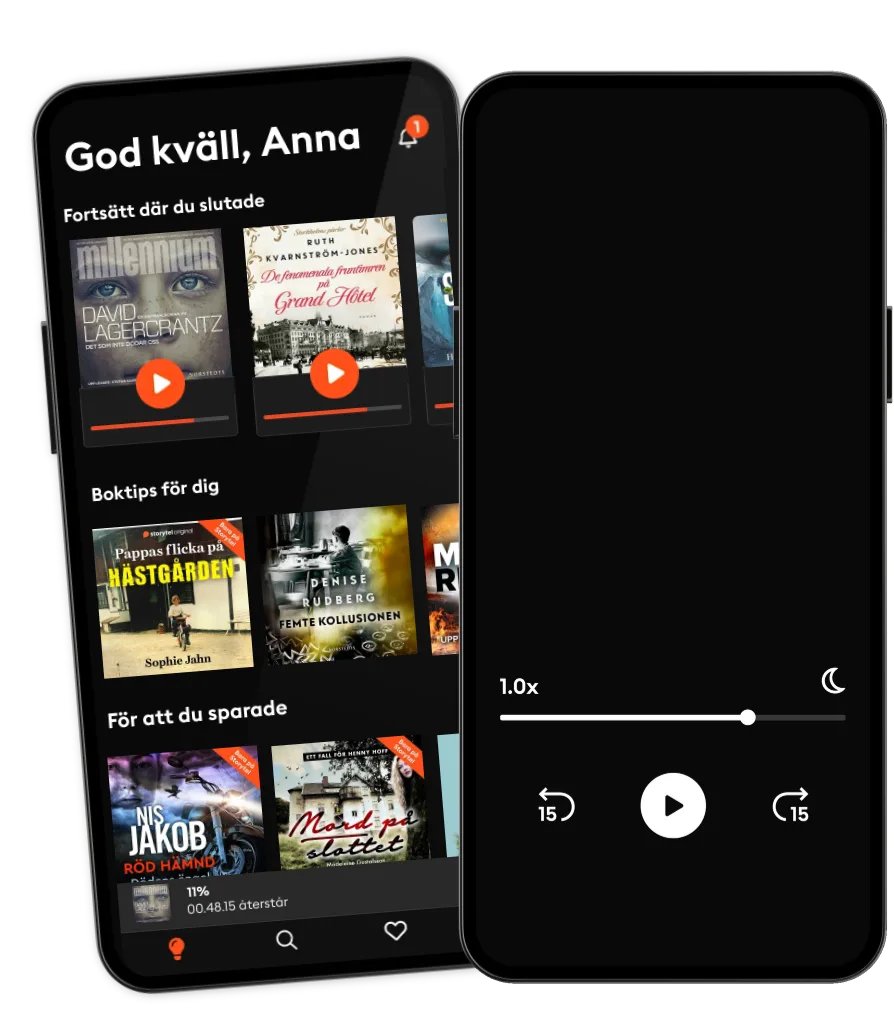

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

Svenska

Sverige