How to avoid huge losses and improve your equity curve

- Av

- Episod

- 88

- Publicerad

- 2 nov. 2017

- Förlag

- 0 Recensioner

- 0

- Episod

- 88 of 1247

- Längd

- 12min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

Be open to learning new things and new ideas. They can lead you to garner insight on your trading. We make our money as traders in position sizing. I use position sizing to be analogous with risk management. I can always move my entries and exits to accommodate my trading size. It's the effect of volatility on my position that determines my open trade equity - which can be positive or negative. If the dollar-volatility of the instrument you're trading is large than your risk unit, you might have to pass on that (and several other) instrument. If the daily vol on a gold contract is $4,000 and you only want to risk 1/2% on a trade on your $200,000 account, gold is too volatile for you to trade. If gold's daily vol is $40, then the dollar volatility is $4,000. You can change that. Trying to trade gold within the range of the normal vol and only risk $10 per ounce will likely get you stopped out for a loss much more frequently as the vol is non-directional and random on any given day. You can't change the vol anymore than you can change someone's personality or behavior. Free audiobook - Listen to your Inner Voice

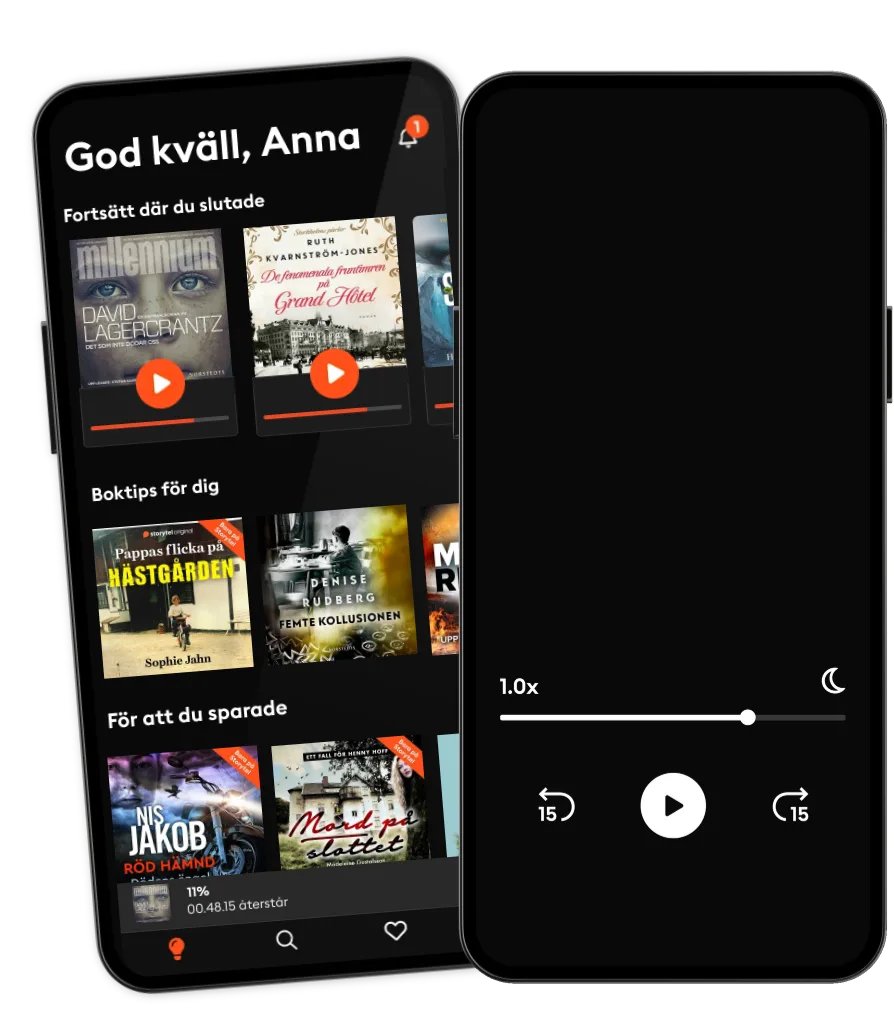

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- Club Shay ShayiHeartPodcasts and Shay Shay Media

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- Club Shay ShayiHeartPodcasts and Shay Shay Media

Svenska

Sverige