Two ways frequent trading reverses profitability

- Av

- Episod

- 105

- Publicerad

- 29 nov. 2017

- Förlag

- 0 Recensioner

- 0

- Episod

- 105 of 1247

- Längd

- 13min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

Risk is an asset class. Keep in in your portfolio when it pays you to do so. That means overnight and over the weekend. When you day trade, you are churning your own account. In a recent interview with Chats With Traders, my friend Aaron Brown said that traders generally leave way too much money on the table. The real money is holding the best risks. You can define where you are going "risk off" by placing protective stop orders on your winners and Stop Loss orders on recent fills. Staying in good trades longer frees up time so that you can do more research, read, or go have fun doing whatever gives you pleasure. Exercise: Go to your best trades and enter them in a spreadsheet. Column A is your Entry. Column B is your exit. Column C is where it is now. Column D is what the worst price was between the prices in column B and C. Look at the percentage of those names where the price is Column C today is higher than Column B but also where the price is column D never went below Column A. This helps you understand the opportunity cost of short-term trading and how it works against you.

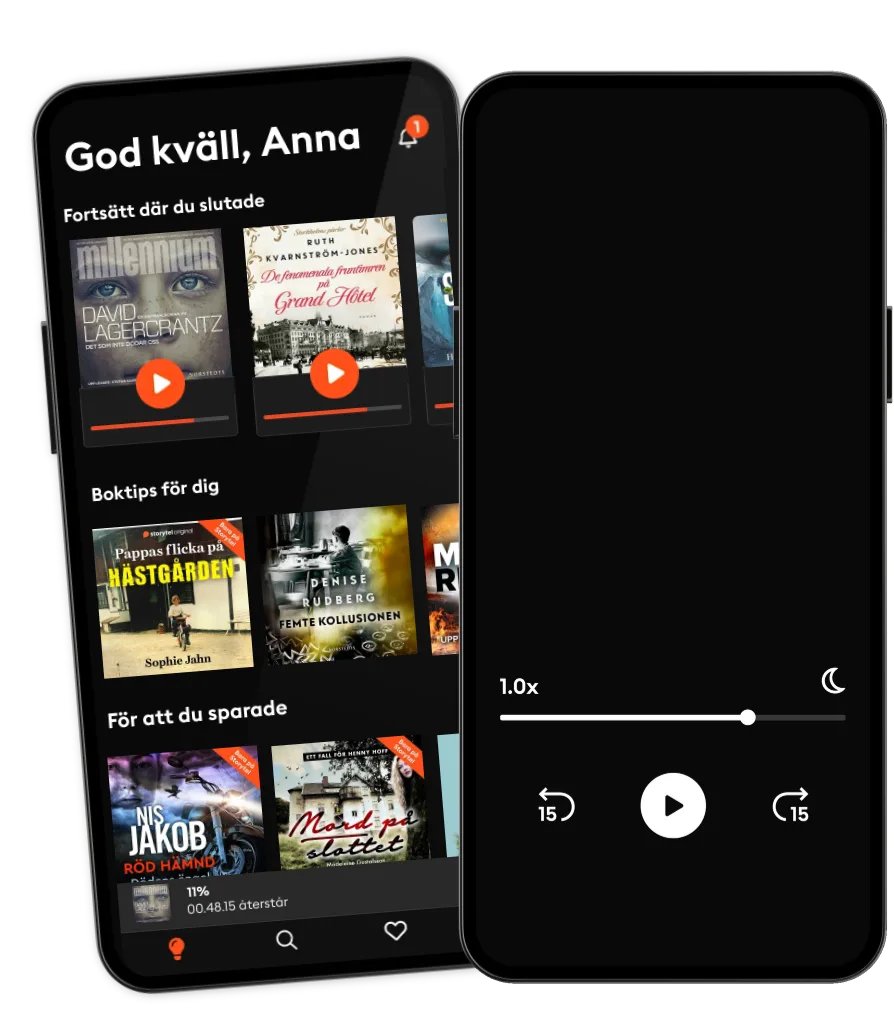

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

Svenska

Sverige