Why You Should Trade Volatility-Adjusted Position Sizes

- Av

- Episod

- 50

- Publicerad

- 11 sep. 2017

- Förlag

- 0 Recensioner

- 0

- Episod

- 50 of 1247

- Längd

- 11min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

The Average True Range (ATR) is a measurement that professional traders use to adjust their position sizes to normalize risk across all instruments. Normalizing risk allows you to look at Gold the same way you look at Sugar or AMZN for that matter - they are all the same percentage risk to your portfolio. Don't make the mistake of trading with "tiers" as no one optimizes their trading for the number of shares. You are trading like an amateur if you are trading a security risking $2 if the daily volatility is $6. Downtiming to intraday time frames is a foolish endeavor and even in doing so, you can't change the fact that the daily vol at $6 is too big for what you're trying to do at $2. Average True Range ATR Gorilla Glue #4 Jack Herer

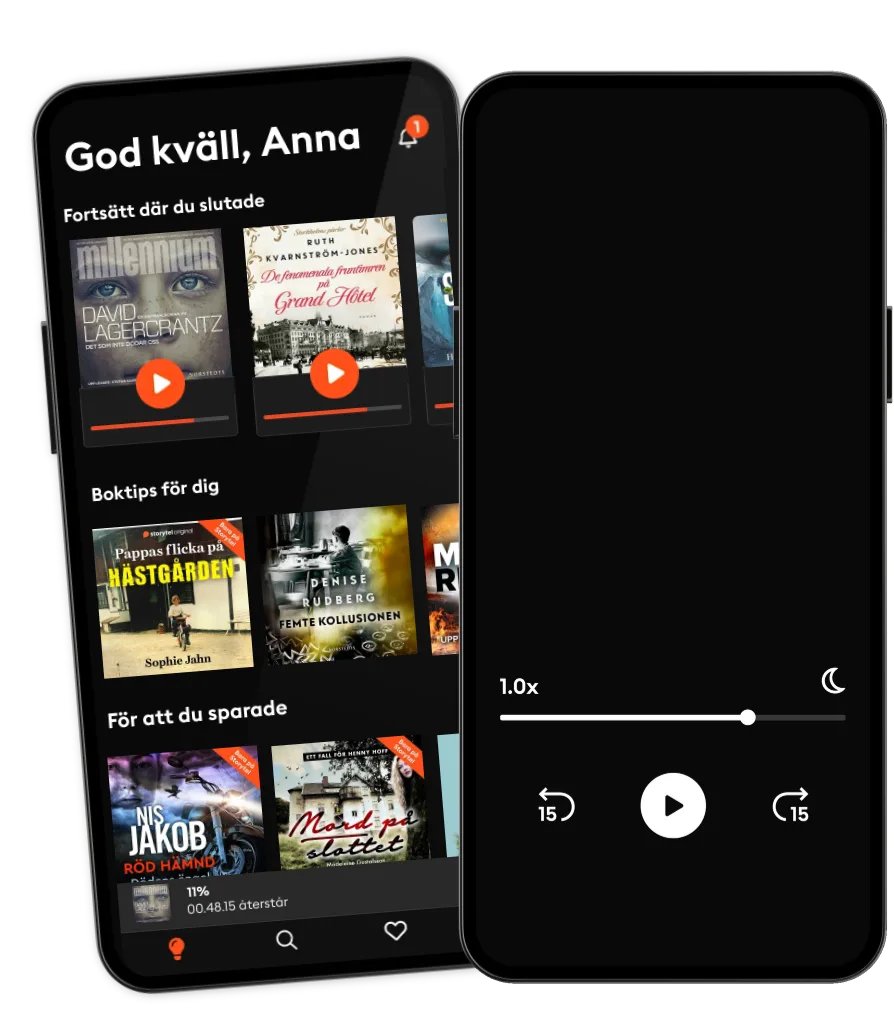

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

- The Journal.The Wall Street Journal & Spotify Studios

- 1,5 graderAndreas Bäckäng

- Self-Compassionate ProfessorPhD

- Redefining CyberSecuritySean Martin

- The Pathless Path with Paul MillerdPaul Millerd

- Coder RadioThe Mad Botter

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- FinansfokusInvesteraMera

- Sustainability Talks – by CordialCordial AB

- The Big FlopWondery

Svenska

Sverige