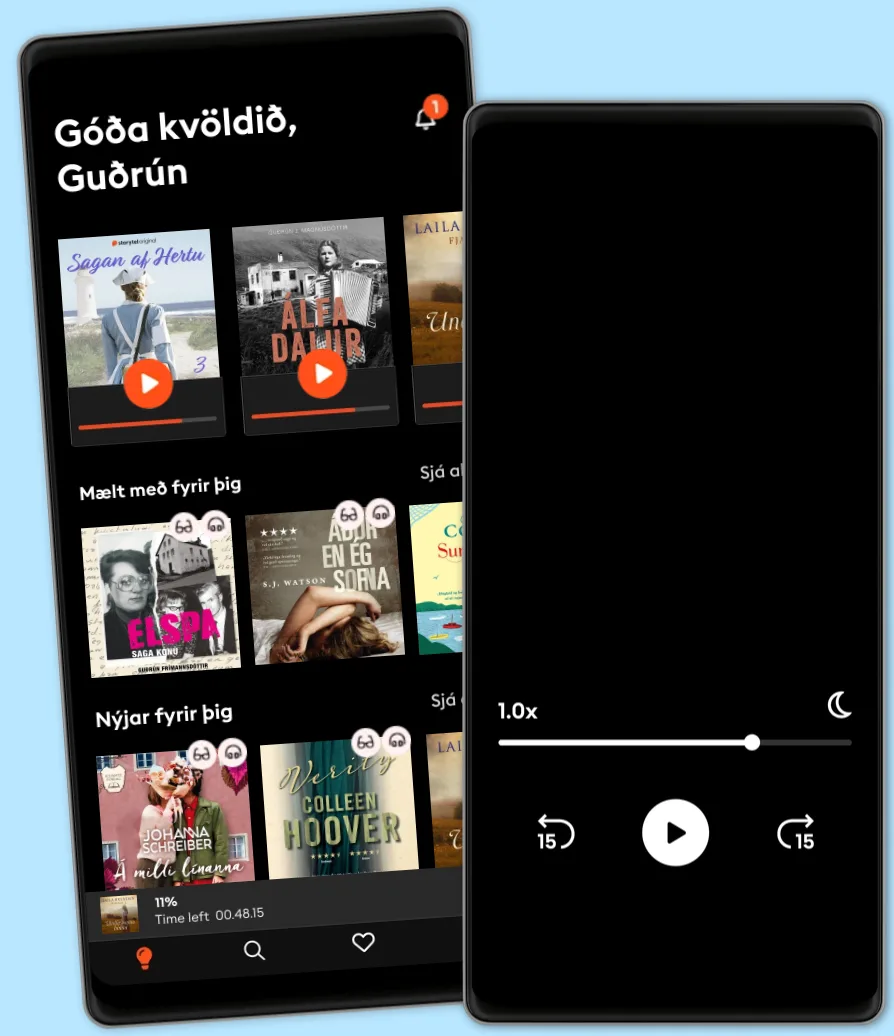

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Annuity 360: Learn All You Need to Know About Annuities: Which Ones to Avoid and Which One to Buy for a Successful Retirement

- Eftir

- Með:

- Útgefandi

- 1 einkunn

1

- Lengd

- 1 Klst. 26 mín.

- Tungumál

- enska

- Snið

- Bókaflokkur

Sjálfsrækt

My number one goal in writing this book is to educate American pre-retirees and retirees on the extreme value of investing in an accumulation-based annuity. In this book, you will learn how you can eliminate the advisory fees that you pay on bonds that you may currently hold within your portfolio if you have a financial advisor. We will also discuss the metric power of a strategic bond replacement, the power of zero, and the current price-to-earnings ratio of bonds.

A fixed indexed annuity can help you do the following with your wealth:

1. Protect your money from market loss (fixed indexed annuities offered by highly rated annuity carriers did not lose a dime in account value in 2008 or 2009 during the worldwide recession caused by the mortgage loan crisis that resulted in the S&P 500 losing 50.1 percent of its value from March 1, 2008 to March 31, 2009) 2. Grow your money with market-like gains (typical annual growth of five to seven-plus percent) 3. Generate a lifetime income (your retirement will likely last 30+ years; it might be a good idea to place some of your assets into a fixed indexed annuity to set a “safety net” around a portion of the retirement income that you wish to generate) 4. Eliminate market risk associated with bonds by replacing the fixed-income bonds in your portfolio with a fixed indexed annuity 5. Eliminate the advisory fees you are likely currently paying to generate fixed income with bonds in your portfolio by replacing them with fixed indexed annuities (the annuity companies pay the advisor, you don’t. This is called a bond replacement)

If the above benefits sound appealing to you, then I invite you to explore the rest of this book and ultimately invest a portion of your hard-earned wealth into a fixed indexed annuity to build a successful retirement.

© 2022 Ford Stokes (Hljóðbók): 9798822630048

Útgáfudagur

Hljóðbók: 11 november 2022

Aðrir höfðu einnig áhuga á...

- Sálarstríð Steindór Ívarsson

4.6

- Hennar hinsta stund Carla Kovach

4.1

- Skilnaðurinn Moa Herngren

4

- Fiðrildaherbergið Lucinda Riley

4.4

- Hvarfið Torill Thorup

4.4

- Kvöldið sem hún hvarf Eva Björg Ægisdóttir

4.3

- Dökkir skuggar Laila Brenden

4.4

- Franska sveitabýlið Jo Thomas

4

- Myrká Arnaldur Indriðason

4.4

- Hildur Satu Rämö

4.3

- Vinkonur að eilífu? Sarah Morgan

4.1

- Litla leynivíkin í Króatíu Julie Caplin

4.2

- Aldrei aldrei Colleen Hoover

3.1

- Ég læt sem ég sofi Yrsa Sigurðardóttir

4.1

- Fjölskyldudeilan Torill Thorup

4.4

Veldu áskrift

Yfir 900.000 hljóð- og rafbækur

Yfir 400 titlar frá Storytel Original

Barnvænt viðmót með Kids Mode

Vistaðu bækurnar fyrir ferðalögin

Unlimited

Besti valkosturinn fyrir einn notanda

3290 kr /mánuði

Yfir 900.000 hljóð- og rafbækur

Engin skuldbinding

Getur sagt upp hvenær sem er

Family

Fyrir þau sem vilja deila sögum með fjölskyldu og vinum.

Byrjar á 3990 kr /mánuður

Yfir 900.000 hljóð- og rafbækur

Engin skuldbinding

Getur sagt upp hvenær sem er

3990 kr /mánuði

Íslenska

Ísland