- 0 Umsagnir

- 0

- Episode

- 112 of 1115

- Lengd

- 33Mín.

- Tungumál

- enska

- Gerð

- Flokkur

- Viðskiptabækur

When we think of computer-driven or "quant" investing, we often think fast moves, algorithms making buy and sell orders at incredibly short timeframes. So in theory, the likes of great long-term investors, like Warren Buffett, should be safe from the robot revolution. But maybe not so fast! On this week's Odd Lots podcast, we speak to John Alberg of Euclidean Technologies and Zachary Lipton of Carnegie Mellon, about their new research on the next generation of quant investing. Alberg and Lipton explain a recent paper in which they used machine learning to forecast the future fundamentals of companies, and the opportunity that offers in terms of beating the market over the long term.

See omnystudio.com/listener for privacy information.

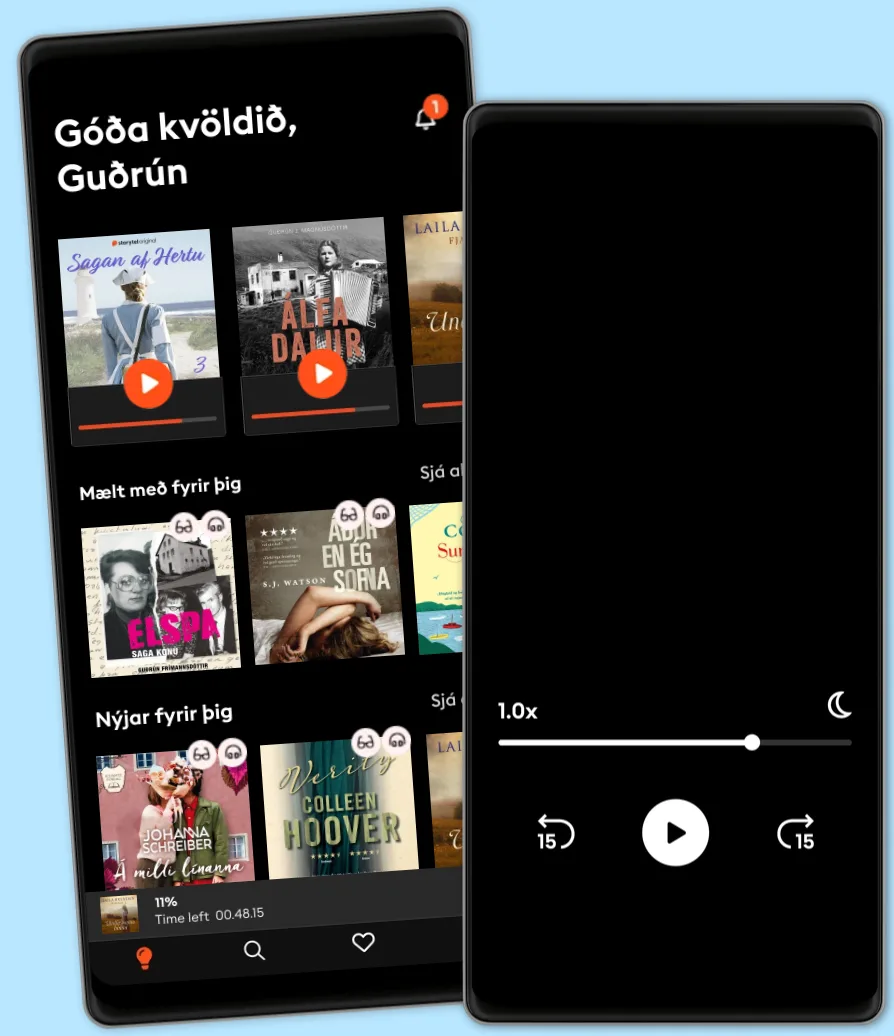

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Other podcasts you might like ...

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- FixableTED

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- The BreakdownBlockworks

- Reuters World NewsReuters

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- FixableTED

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- The BreakdownBlockworks

- Reuters World NewsReuters

Íslenska

Ísland