- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

Please note: This is a companion version & not the original book. Book Preview:

#1 The 60/40 portfolio, which is a balanced allocation of stocks and bonds, has been working well for investors for over four decades. It is simple and easy to implement, and it has become a perennial favorite among investors.

#2 The 60/40 portfolio has delivered positive returns in 82 percent of rolling one-year periods, 93 percent of rolling three-year periods, and 99 percent of rolling five-year periods. It has only experienced one calendar-year decline greater than 20 percent, but ten calendar-year gains of over 20 percent.

#3 The 60/40 portfolio has been successful because past performance is not always a predictor of future results. However, the conditions that made the 60/40 portfolio so fruitful in the past—namely high and falling interest rates—are no longer present.

#4 The 60/40 portfolio is a drag on returns, and has been for most of the past decade. The Sharpe ratio for both U. S. stocks and bonds over the last ten years is shown in Figure 1. 3.

© 2022 IRB Media (E-bok): 9798822540682

Utgivelsesdato

E-bok: 14. juni 2022

Tagger

Andre liker også ...

- Summary of William J. Bernstein's The Intelligent Asset Allocator IRB Media

- You Weren't Supposed To See That: Secrets Every Investor Should Know Joshua M. Brown

- Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined Lasse Heje Pedersen

- From Zero to Millionaire: A simple, effective and stress-free way to invest in the stock market Nicolas Bérubé

- How to Turn $ 5,000 into a Million Heikin Ashi Trader

- Die With Zero: Getting All You Can from Your Money and Your Life Bill Perkins

- Mastering The Market Cycle: Getting the odds on your side Howard Marks

- The Little Book of Behavioral Investing: How not to be your own worst enemy (Little Book, Big Profits) James Montier

- The Little Book of Investing Like the Pros: Five Steps for Picking Stocks Josh Pearl

- One Good Trade: Inside the Highly Competitive World of Proprietary Trading Mike Bellafiore

- På grensen til evigheten - Del 7-10 Ken Follett

4.8

- Klippehulens folk Jean M. Auel

4.4

- Julestormen Milly Johnson

4.2

- Atlas - Historien om Pa Salt Lucinda Riley

4.7

- Der vi hører hjemme Emily Giffin

4.4

- Steppevandringen Jean M. Auel

4.6

- Din vilje skje - En oppvekst med karismatisk kristendom Anne-Britt Harsem

4.3

- Døden inntraff Mark Billingham

4.1

- Mormor danset i regnet Trude Teige

4.5

- En dag skal du dø Gard Sveen

4

- Pulskuren - Stress riktig, sov bedre, yt mer og lev lenger Torkil Færø

4.6

- Fars rygg Niels Fredrik Dahl

4.4

- Mammutjegerne Jean M. Auel

4.4

- Hestenes dal Jean M. Auel

4.5

- Hulebjørnens klan Jean M. Auel

4.7

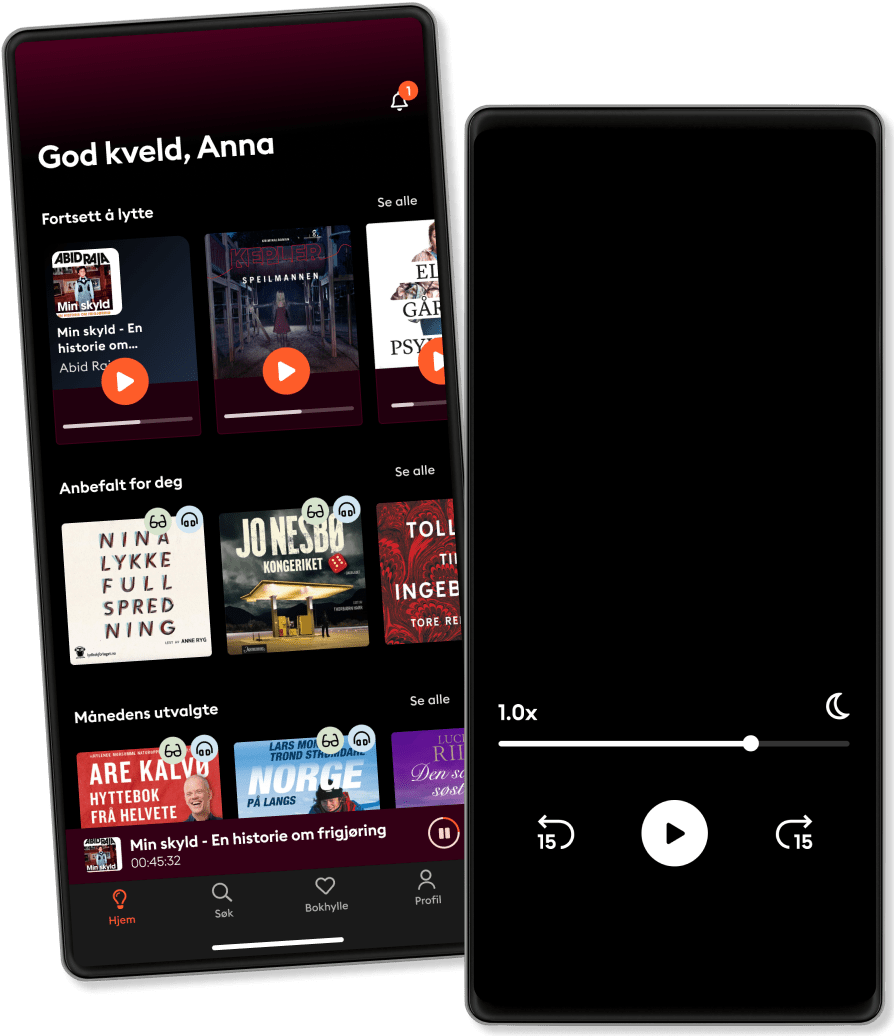

Derfor vil du elske Storytel:

Over 700 000 bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedLytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge