When Insurers Go Bust: An Economic Analysis of the Role and Design of Prudential Regulation

- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

In the 1990s, large insurance companies failed in virtually every major market, prompting a fierce and ongoing debate about how to better protect policyholders. Drawing lessons from the failures of four insurance companies, When Insurers Go Bust dramatically advances this debate by arguing that the current approach to insurance regulation should be replaced with mechanisms that replicate the governance of non-financial firms.

Rather than immediately addressing the minutiae of supervision, Guillaume Plantin and Jean-Charles Rochet first identify a fundamental economic rationale for supervising the solvency of insurance companies: policyholders are the "bankers" of insurance companies. But because policyholders are too dispersed to effectively monitor insurers, it might be efficient to delegate monitoring to an institution--a prudential authority. Applying recent developments in corporate finance theory and the economic theory of organizations, the authors describe in practical terms how such authorities could be created and given the incentives to behave exactly like bankers behave toward borrowers, as "tough" claimholders.

© 2009 Princeton University Press (E-bok): 9781400827770

Utgivelsesdato

E-bok: 11. april 2009

Tagger

Andre liker også ...

- The Long Shadow of Default: Britain's Unpaid War Debts to the United States, 1917-2020 David James Gill

- Millionaire Habits: How to Achieve Financial Independence, Retire Early, and Make a Difference by Focusing on Yourself First Steve Adcock

- Home Buying For Dummies 3rd Edition Eric Tyson

- No One Would Listen: A True Financial Thriller Harry Markopolos

- Stock Investing for Dummies 2nd Ed. Paul Mladjenovic

- Bond Investing For Dummies: 2nd Edition Russell Wild

- A Hedge Fund Tale of Reach and Grasp: … Or What's a Heaven For: ...Or What's a Heaven For Barton Biggs

- Living Well in a Down Economy for Dummies Tracy Barr

- Real Estate Investing for Dummies: 4th Edition Robert S. Griswold, MBA, MSBA, CRE

- Investing For Dummies 4th Edition Eric Tyson

- Julestormen Milly Johnson

4.2

- Klippehulens folk Jean M. Auel

4.4

- Ingen plan B Lee Child

4

- Atlas - Historien om Pa Salt Lucinda Riley

4.7

- Apotekerens datter Charlotte Betts

4.2

- Den ukjente morder - Arsenikkmysteriet i Hamar Michael Grundt Spang

4.1

- Mormor danset i regnet Trude Teige

4.5

- Pulskuren - Stress riktig, sov bedre, yt mer og lev lenger Torkil Færø

4.6

- En dag skal du dø Gard Sveen

4

- Din vilje skje - En oppvekst med karismatisk kristendom Anne-Britt Harsem

4.3

- Steppevandringen Jean M. Auel

4.6

- Der vi hører hjemme Emily Giffin

4.4

- De hellige hulers land Jean M. Auel

4.1

- Mammutjegerne Jean M. Auel

4.4

- Veien over klippene Gøril Emilie Hellen

4.3

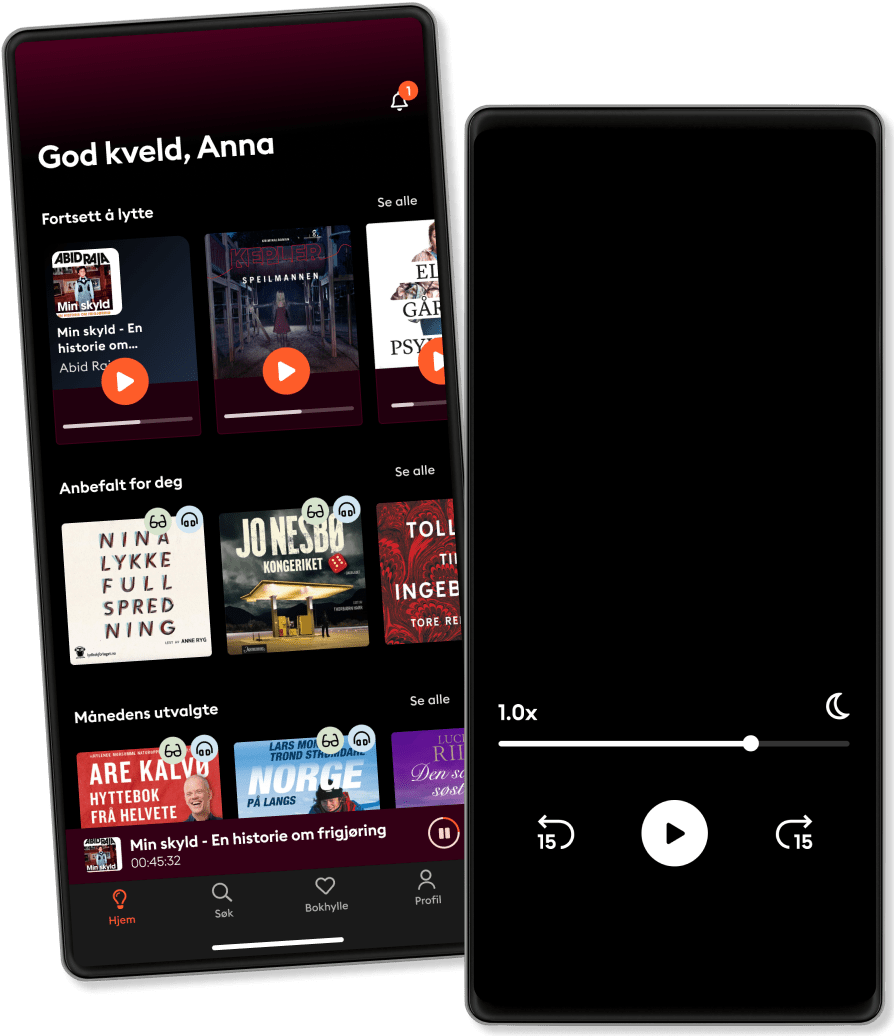

Derfor vil du elske Storytel:

Over 700 000 bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Lytt så mye du vil

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Lytt så mye du vil

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedBasic

For deg som lytter og leser av og til.

1 konto

20 timer/måned

Lytt opp til 20 timer per måned

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Lytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge