Słuchaj i czytaj 50% taniej przez 4 miesiące!

Znajdź swoją nową ulubioną historię - teraz za jedyne 19,95 zł miesięcznie przez pierwsze 4 miesiące

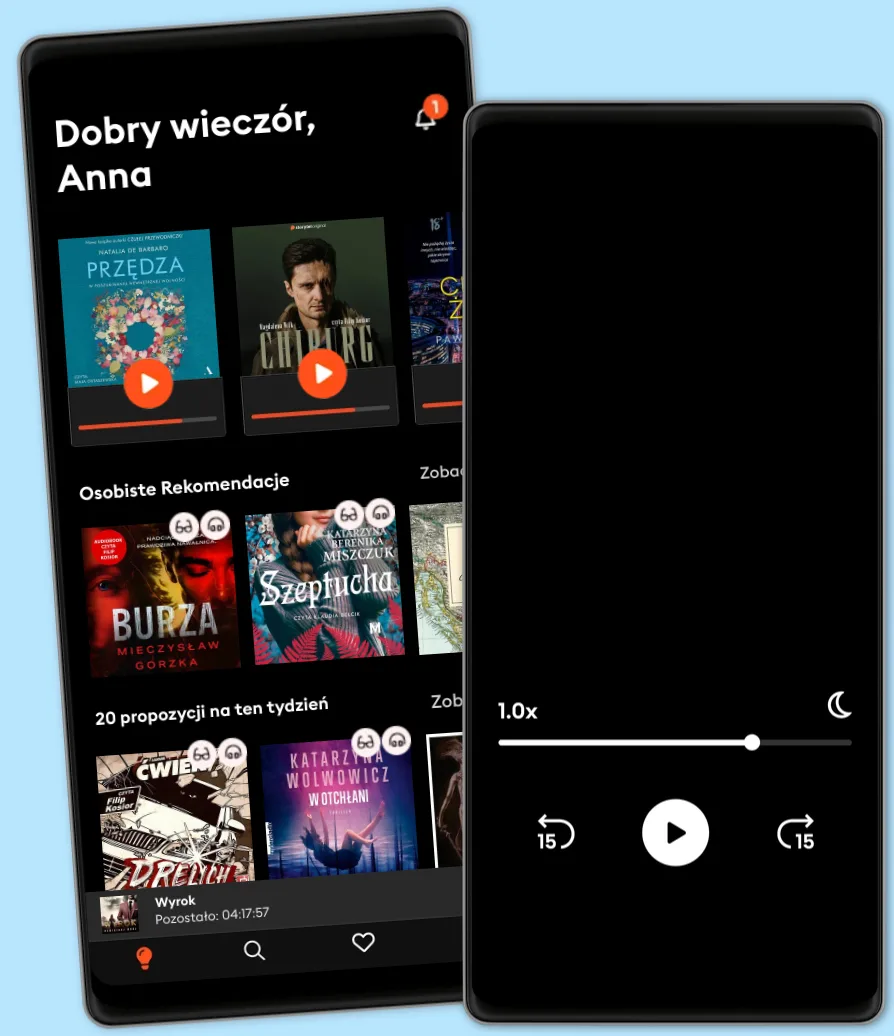

- Czytaj i słuchaj jak chcesz i ile chcesz

- Ponad 500 000 tytułów

- Tytuły dostępne wyłącznie w Storytel oraz Storytel Originals

- Łatwa rezygnacja w dowolnym momencie

How to Make Your Money Last: The Indispensable Retirement Guide

- Autor

- Z:

- Wydawca

- 1 ocena

1

- Czas trwania

- 12 Godz. 31 min

- Język

- Angielski

- Format

- Kategoria

Biznes i ekonomia

NOW COMPLETELY UPDATED to reflect the changes in tax legislation, health insurance, and the new investment realities. In this “highly valuable resource” (Publishers Weekly, starred review) Quinn “provides simple, straightforward” (The New York Times) solutions to the universal retirement dilemma—how to make your limited savings last for life—covering mortgages, social security, income investing, annuities, and more!

Will you run out of money in your older age? That’s the biggest worry for people newly retired or planning to retire. Fortunately, you don’t have to plan in the dark. Jane Bryant Quinn tells you how to squeeze a higher income from all your assets—including your social security account (get every dollar you’re entitled to), a pension (discover whether a lump sum or a lifetime monthly income will pay you more), your home equity (sell, rent, or take a reverse mortgage?), savings (how to use them safely to raise your monthly income), retirement accounts (invest the money for growth in ways that let you sleep at night), and—critically—how much of your savings you can afford to spend every year without running out. There are easy ways to figure all this out. Who knew? Quinn also shows you how to evaluate your real risks. If you stick with super-safe investment choices, your money might not last and your lifestyle might erode. The same might be true if you rely on traditional income investments. Quinn rethinks the meaning of “income investing,” by combining reliable cash flow during the early years of your retirement with low-risk growth investments, to provide extra money for your later years. Odds are, you’ll live longer than you might imagine, meaning that your savings will stretch for many more years than you might have planned for. With the help of this book, you can turn those retirement funds into a “homemade” paycheck that will last for life.

© 2016 Simon & Schuster Audio (Audiobook): 9781442395671

Wydanie

Audiobook: 5 stycznia 2016

Tagi

Inni polubili także ...

- The Respectful Leader: Seven Ways to Influence Without Intimidation Gregg Ward

- Simple Giving: Easy Ways to Give Every Day Jennifer Iacovelli

- Get Momentum: How to Start When You're Stuck Jason W Womack

- Your Portable Empire: How to Make Money Anywhere While Doing What You Love Pat O'Bryan

- Your Best Just Got Better: Work Smarter, Think Bigger, Make More Jason W Womack

- The Power of Reputation: Strengthen the Asset That Will Make or Break Your Career Chris Komisarjevsky

- Retirement Planning in Eight Easy Steps: The Brief Guide to Lifelong Financial Freedom Joel Kranc

- Jesus, Life Coach: Learn from the Best Laurie Beth Jones

- Live with Intent: Creating Your Future Thomas Reichart

- Make Your Own Rules: A Renegade Guide to Unconventional Success Josh Young

- Happy Go Money: Spend Smart, Save Right and Enjoy Life Melissa Leong

- Simple Secrets: 7 Principles to Inspire Success Kathy Davis

- If Only He Knew: A Valuable Guide to Knowing, Understanding, and Loving Your Wife Gary Smalley

- You Only Live Once: The Roadmap to Financial Wellness and a Purposeful Life Jason Vitug

- 30 Days To Start and Grow Your Pet Sitting and Dog Walking Business: A Step-By-Step Guide to Launch, Attract Clients, and Make a Profit Kristin Morrison

- Rest If You Must, But Don't You Quit Vic Johnson

- Launch Your Dream: A 30-Day Plan for Turning Your Passion into Your Profession Dale Partridge

- Master Your Money Type: Using Your Financial Personality to Create a Life of Wealth and Freedom Jordan E. Goodman

- From Mopping Floors to Making Millions on Instagram: 5 Steps to Building an Online Brand Ronne Brown

- Don't Wear Flip-Flops to Your Interview: And Other Obvious Tips That You Should Be Following to Get the Job You Want Paul Powers

- Self Made: The definitive guide to business startup success Bianca Miller-Cole

- Mom and Dad, We Need to Talk: How to Have Essential Conversations With Your Parents About Their Finances Cameron Huddleston

- 101 Content Ideas: Build Your Brand Through Creating Endless Content for Video, Audio, and Written Formats Dre Baldwin

- Rehumanize Your Business: How Personal Videos Accelerate Sales and Improve Customer Experience Ethan Beute

- The 100% Solution Colleen Patrick

- Small Business, Big Vision: Lessons on How to Dominate Your Market from Self-Made Entrepreneurs Who Did it Right Matthew Toren

- Changing the Channel: 12 Easy Ways to Make Millions for Your Business Tribby Masterson

- It's Not What You Say: How to Sell Your Message When It Matters Most Michael Parker

- Thinking Like a Boss: Uncover and Overcome The Lies Holding You Back From Success Kate Crocco

- Dream Year: Make the Leap from a Job You Hate to a Life You Love Ben Arment

- The Money-Making Mom: How Every Woman Can Earn More and Make a Difference Crystal Paine

- The Complete Idiot's Guide To Managing Your Money Christy Heady

- Confessions of a Credit Junkie: Everything You Need to Know to Avoid the Mistakes I Made Beverly Harzog

- Optimize Yourself with Optimal Thinking Rosalene Glickman

- Working Whole: How To Unite Your Spiritual Beliefs And Your Work To Live Fulfilled Kourtney Whitehead

- Fix It Rob Ketterling

- Shift Your Brilliance: Harness the Power of You, Inc. Simon T Bailey

- Permission to Be Black: My Journey with Jay-Z and Jesus A. D. "Lumkile" Thomason

- How To Be Successful By Being Yourself: The Surprising Truth About Turning Fear and Doubt into Confidence and Success David Taylor

- Reposition Yourself: Living Life Without Limits T.D. Jakes

- The Millionaire Mystique: How Working Women Become Wealthy – And How You Can, Too!: How Working Women Become Wealthy - And How You Can, Too! Jude Millerr Burke

- Real Communication: How to Be You and Lead True Gabrielle Dolan

- Profitable Podcasting: Grow Your Business, Expand Your Platform, and Build a Nation of True Fans Stephen Woessner

- How Did I Start My Business Satheesh Gopalan

- Frugal Living: Collecting and Saving Thousands of Dollars for Yourself and NGOs Mindy Baker

- Be Different: How to Be the Change in a Toxic Workplace Dianna Booher

- Treating People Well: The Extraordinary Power of Civility at Work and in Life Lea Berman

- Don't Get Mad, Get Successful Bozana Skojo

- Your Ultimate Success Plan: Stop Holding Yourself Back and Get Recognized, Rewarded and Promoted Tamara Jacobs

- Wieża jaskółki Andrzej Sapkowski

4.9

- Harry Potter i Kamień Filozoficzny J.K. Rowling

4.7

- Wilczyca Mieczysław Gorzka

4.6

- Harry Potter i Komnata Tajemnic J.K. Rowling

4.8

- Zła przeszłość Mieczysław Gorzka

4.8

- Kasprowy Remigiusz Mróz

4.5

- Wolta Dariusz Gizak

4.7

- Wiedźmin Andrzej Sapkowski

4.7

- Gra o tron George R.R. Martin

4.9

- Harry Potter i Więzień Azkabanu J.K. Rowling

4.8

- Zło Katarzyna Wolwowicz

4.8

- Dwa strzały. Komisarz Oczko (23) Tomasz Wandzel

4.6

- Krew elfów Andrzej Sapkowski

4.8

- Pierwsza sprawa. Komisarz Oczko (1) Tomasz Wandzel

4.3

- Tajemnicze jajo Pamela Butchart

4.3

Wybierz swoją subskrypcję:

Ponad 500 000 tytułów w cenie jednego abonamentu

Słuchaj i czytaj w trybie offline

Ekskluzywne produkcje audio Storytel Original

Tryb dziecięcy Kids Mode

Anuluj kiedy chcesz

Unlimited

Dla tych, którzy chcą słuchać i czytać bez limitów.

1 konto

Nielimitowany Dostęp

1 konto

Słuchanie bez limitów

Anuluj w dowolnym momencie

Unlimited na rok

Dla tych, którzy chcą słuchać i czytać bez limitów.

1 konto

Nielimitowany Dostęp

1 konto

Słuchanie bez limitów

Anuluj w dowolnym momencie

Basic

Dla tych, którzy słuchają i czytają od czasu do czasu.

1 konto

10 godzin/miesięcznie

1 konto

10 godzin / miesiąc

Anuluj w dowolnym momencie

Family

Dla tych, którzy chcą dzielić się historiami ze znajomymi i rodziną.

2-3 kont

Nielimitowany Dostęp

2–3 konta

Słuchanie bez limitów

Anuluj w dowolnym momencie

2 konta

59.90 zł /30 dniPolski

Polska