Słuchaj i czytaj 50% taniej przez 4 miesiące!

Znajdź swoją nową ulubioną historię - teraz za jedyne 19,95 zł miesięcznie przez pierwsze 4 miesiące

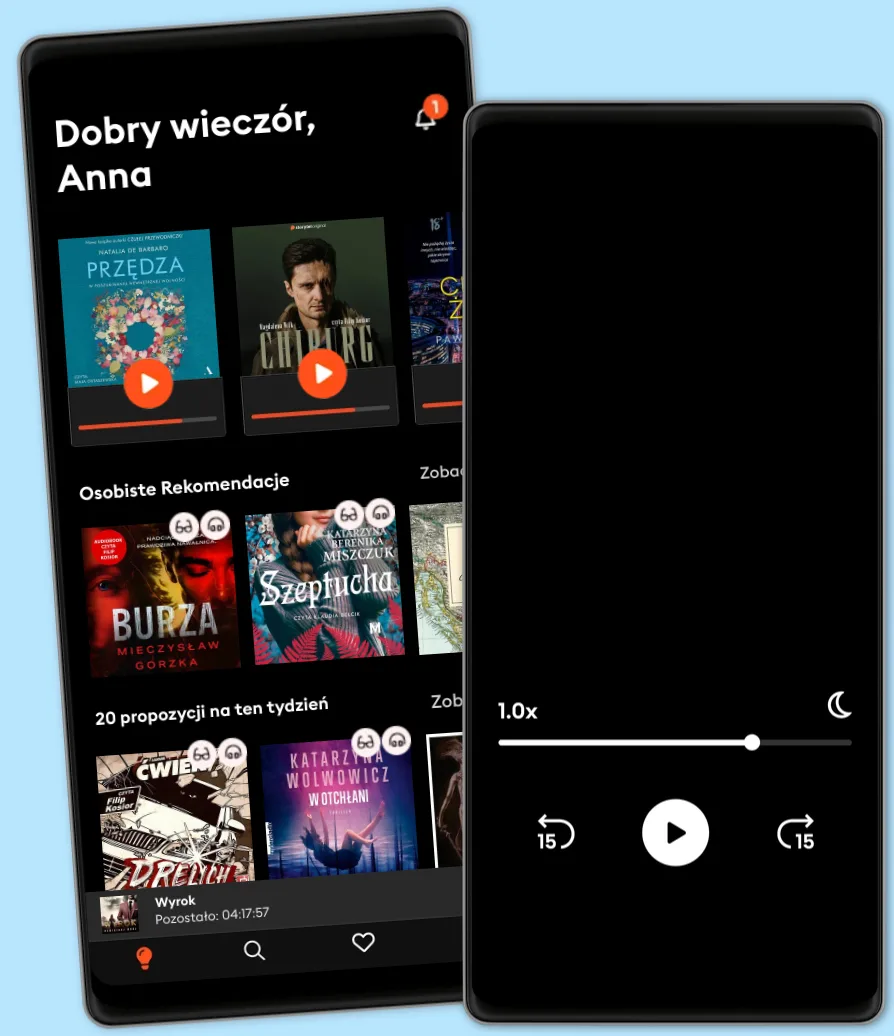

- Czytaj i słuchaj jak chcesz i ile chcesz

- Ponad 500 000 tytułów

- Tytuły dostępne wyłącznie w Storytel oraz Storytel Originals

- Łatwa rezygnacja w dowolnym momencie

The Only Three Questions That Count: Investing by Knowing What Others Don't

- Autor

- Z:

- Wydawca

- 15 ocena

3.8

- Czas trwania

- 15 Godz. 13 min

- Język

- Angielski

- Format

- Kategoria

Rozwój osobisty

Ken Fisher questions authority. He challenges the conventional wisdom of investing, overturns glib theories with hard facts, and blows up complacent beliefs about money and markets. But the authority he challenges most of all is his own-because challenging yourself, Fisher says, is the key to successful investing.

In today's competitive market environment, the best way to achieve investment success is by knowing something that others don't. But many of us, amateurs and professionals alike, believe we don't or can't know what others don't-so we continue to make market bets based on "conventional wisdom."

Here Fisher debunks the conventional market myths that many of our investment decisions are based upon, and reveals a precise methodology that will allow you to know what others don't. The methodology-which has helped Fisher achieve success throughout his long financial career-is as easy as asking three simple questions. The first will help listeners see things the way they really are. The second will help them see things that other investors often miss. And the third will help them understand their relationship with today's markets. While the questions aren't what one might expect-as they have nothing to do with the market's P/E ratio or interest rate forecasts-they will help the listener make better investment decisions by identifying what he can know-unique to him-that others do not. Most importantly, he'll learn how to use the questions to improve his investment performance.

Filled with in-depth insights, expert advice, and engaging anecdotes, The Only Three Questions That Count provides listeners with a dynamic strategy and set of tools that will give them a distinct edge over other investors.

© 2007 Ascent Audio (Audiobook): 9781596591806

Wydanie

Audiobook: 7 grudnia 2007

Tagi

Inni polubili także ...

- The Aspirational Investor: Taming the Markets to Achieve Your Life's Goals Ashvin B. Chhabra

- The Little Book of Main Street Money: 21 Simple Truths That Help Real People Make Real Money Jonathan Clements

- Lifecycle Investing: A New, Safe, and Audacious Way to Improve the Performance of Your Retirement Portfolio Barry Nalebuff

- The Little Book of Alternative Investments: Reaping Rewards by Daring to be Different Phil DeMuth

- The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between William Bernstein

- Crash Proof 2.0: How to Profit From the Economic Collapse Peter D. Schiff

- Angel Investing: The Gust Guide to Making Money & Having Fun Investing in Startups David S. Rose

- The Little Book Big Profits from Small Stocks + Website: Why You'll Never Buy a Stock Over $10 Again (Little Books. Big Profits) Hilary Kramer

- How a Second Grader Beats Wall Street: Golden Rules Any Investor Can Learn Allan S. Roth

- The Little Book of Safe Money Jason Zweig

- The Value of Debt in Building Wealth: Creating Your Glide Path to a Healthy Financial L.I.F.E. Thomas J. Anderson

- The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds Maneet Ahuja

- Debunkery Ken Fisher

- Big Mistakes: The Best Investors and Their Worst Investments Michael Batnick

- Money Machine: The Surprisingly Simple Power of Value Investing Gary Smith

- Jim Cramer's Stay Mad for Life: Get Rich, Stay Rich (Make Your Kids Even Richer) James J. Cramer

- Gamechanger Investing Hilary Kramer

- John Neff on Investing John Neff

- The Little Book of Sideways Markets: How to Make Money in Markets that Go Nowhere Vitally Katsenelson

- Jim Cramer's Real Money: Sane Investing in an Insane World James J. Cramer

- The Book of Investing Wisdom: Classic Writings by Great Stock-Pickers and Legends of Wall Street Peter Krass

- The Little Book of Bull Moves in Bear Markets: How to Keep Your Portfolio Up When the Market is Down Peter D. Schiff

- The Elements of Investing Charles D. Ellis

- The Smartest Investment Book You'll Ever Read: The Simple, Stress-Free Way to Reach You Dan Solin

- Motley Fool You have More Than You Think: The Foolish Guide to Personal Finance David Gardner

- Jim Cramer's Getting Back to Even James J. Cramer

- Double Your Profits: In Six Months or Less Bob Fifer

- Forbes Greatest Investing Stories Richard Phalon

- The Self-Made Billionaire Effect: How Extreme Producers Create Massive Value Mitch Cohen

- The Little Book of Hedge Funds: What You Need to Know About Hedge Funds but the Managers Won't Tell You Anthony Scaramucci

- The Elements of Investing: Easy Lessons for Every Investor: Easy Lessons for Every Investor, Updated Edition Charles D. Ellis

- Think Twice: Harnessing the Power of Counterintuition Michael J. Mauboussin

- Managing Investment Robert Taggart (Ph.D.)

- Financial Statements Thomas R. Ittelson

- The Little Book of Bull Moves: How to Keep Your Portfolio Up When the Market is Up, Down, or Sideways Peter D. Schiff

- Price of Prosperity Peter L. Bernstein

- Skin in the Game: No Longer Just a C-Level Employee Jim Gilreath

- The Motley Fool's Rule Makers, Rule Breakers: The Foolish Guide to Picking Stocks David Gardner

- The Art of Value Investing: Essential Strategies for Market-Beating Returns John Heins

- Analyzing Financial Statements Eric Press (PhD)

- The Einstein Money: The Life and Timeless Financial Wisdom of Benjamin Graham Joe Carlen

- The Essentials of Risk Management, Second Edition Michel Crouhy

- High Returns From Low Risk: A Remarkable Stock Market Paradox Jan De Koning

- Financial Literacy for Managers: Finance and Accounting for Better Decision-Making Richard A. Lambert

- The Startup Gold Mine: How to Tap the Hidden Innovation Agendas of Large Companies to Fund and Grow Your Business Neil Soni

- The Lazy Person's Guide To Investing: A Book for Procrastinators, the Financially Challenged, and Everyone Who Worries About Dealing with Their Money Paul B. Farrell

- The Nature Investing: Resilient Investment Strategies Through Biomimicry Katherine Collins

- The E-Myth Accountant: Why Most Accounting Practices Don’t Work and What to Do about It Michael E. Gerber

- The Little Book of the Shrinking Dollar: What You Can Do to Protect Your Money Now Addison Wiggin

- Enough: True Measures of Money, Business, and Life John C. Bogle

- Real Estate Investing for Beginners: Essentials to Start Investing Wisely Tycho Press

- The Profit Pattern: The Top 10 Tools to Transform Your Business: Drive Performance, Empower Your People, Accelerate Productivity and Profitability John Mautner

- How to Smell a Rat: The Five Signs of Financial Fraud Ken Fisher

- The Science Success: How Market-Based Management Built the World's Largest Private Company Charles G. Koch

- Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tilt the Odds in Your Favor Spencer Jakab

- Islands of Profit in a Sea Red Ink: Why 40% of Your Business is Unprofitable, and How to Fix It Jonathan L.S. Byrnes

- The Startup Checklist: 25 Steps to a Scalable, High-Growth Business David S. Rose

- The 10 Pillars of Wealth: Mind-Sets of the World's Richest People: Mind-Sets of the World’s Richest People Alex Becker

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000 Jason Calacanis

- Youtility for Real Estate: Why Smart Real Estate Professionals are Helping, Not Selling Jay Baer

- Building a Small Business that Warren Buffett Would Love Adam Brownlee

- Weekend Millionaire's Real Estate FAQ: Answers All Your Questions About Making a Fortune in Real Estate Roger Dawson

- Inside the Tornado Geoffrey A. Moore

- The Ten Roads to Riches, Second Edition: The Ways the Wealthy Got There (And How You Can Too!) Ken Fisher

- Disciplined Entrepreneurship: 24 Steps to a Successful Startup Bill Aulet

- Scale: Seven Proven Principles to Grow Your Business and Get Your Life Back David Finkel

- Beyond Competitive Advantage-How to Solve the Puzzle of Sustaining Growth While Creating Value: How to Solve the Puzzle of Sustaining Growth While Creating Value Todd Zenger

- Do More Faster: TechStars Lessons to Accelerate Your Startup Brad Feld

- Street Smarts: An All-Purpose Tool Kit for Entrepreneurs Bo Burlingham

- Killing Giants: 10 Strategies to Topple the Goliath in Your Industry Stephen Denny

- So You Want to Start a Hedge Fund: Lessons for Managers and Allocators Ted Seides

- Startup Money Made Easy: The Inc. Guide to Every Financial Question About Starting, Running, and Growing Your Business Maria Aspan

- The Value Investors: Lessons from the World's Top Fund Managers, 2nd Edition Ronald Chan

- Goodbye Gordon Gekko: How to Find Your Fortune Without Losing Your Soul Anthony Scaramucci

- The 21st Century Case for Gold: A New Information Theory of Money George Gilder

- Creating Sales Stars: A Guide to Managing the Millennials on Your Team: HarperCollins Leadership Stephan Schiffman

- Sidehustle: How to Start a Business for Less Than $1,000 Tom Corson-Knowles

- The Smartest Portfolio You'll Ever Own: A Do-It-Yourself Breakthrough Strategy Daniel R. Solin

- The Motley Fool Million Dollar Portfolio David Gardner

- Nothing Down for the 2000s: Dynamic New Wealth Strategies in Real Estate Robert G. Allen

- Mergers & Acquisitions from A to Z Fourth Edition Andrew J. Sherman

- Execution IS the Strategy: How Leaders Achieve Maximum Results in Minimum Time Laura Stack

- What's Your Digital Business Model?: Six Questions to Help You Build the Next-Generation Enterprise Peter Weill

- Bogle on Mutual Funds: New Perspectives For The Intelligent Investor John C. Bogle

- The Most Successful Small Business in the World: The First Ten Principles Michael E. Gerber

- The New Business of Consulting: The Basics and Beyond Elaine Biech

- Loaded: Money, Psychology, and How to Get Ahead without Leaving Your Values Behind Sarah Newcomb

- Wieża jaskółki Andrzej Sapkowski

4.9

- Harry Potter i Kamień Filozoficzny J.K. Rowling

4.7

- Zła przeszłość Mieczysław Gorzka

4.8

- Kasprowy Remigiusz Mróz

4.5

- Harry Potter i Komnata Tajemnic J.K. Rowling

4.8

- Zło Katarzyna Wolwowicz

4.8

- Wolta Dariusz Gizak

4.7

- Wiedźmin Andrzej Sapkowski

4.7

- Wilczyca Mieczysław Gorzka

4.6

- Harry Potter i Więzień Azkabanu J.K. Rowling

4.8

- Gra o tron George R.R. Martin

4.9

- Krew elfów Andrzej Sapkowski

4.8

- Pierwsza sprawa. Komisarz Oczko (1) Tomasz Wandzel

4.3

- Tajemnicze jajo Pamela Butchart

4.3

- Szczęścia można się nauczyć Ewa Woydyłło

4.8

Wybierz swoją subskrypcję:

Ponad 500 000 tytułów w cenie jednego abonamentu

Słuchaj i czytaj w trybie offline

Ekskluzywne produkcje audio Storytel Original

Tryb dziecięcy Kids Mode

Anuluj kiedy chcesz

Unlimited

Dla tych, którzy chcą słuchać i czytać bez limitów.

1 konto

Nielimitowany Dostęp

1 konto

Słuchanie bez limitów

Anuluj w dowolnym momencie

Unlimited na rok

Dla tych, którzy chcą słuchać i czytać bez limitów.

1 konto

Nielimitowany Dostęp

1 konto

Słuchanie bez limitów

Anuluj w dowolnym momencie

Basic

Dla tych, którzy słuchają i czytają od czasu do czasu.

1 konto

10 godzin/miesięcznie

1 konto

10 godzin / miesiąc

Anuluj w dowolnym momencie

Family

Dla tych, którzy chcą dzielić się historiami ze znajomymi i rodziną.

2-3 kont

Nielimitowany Dostęp

2–3 konta

Słuchanie bez limitów

Anuluj w dowolnym momencie

2 konta

59.90 zł /30 dniPolski

Polska