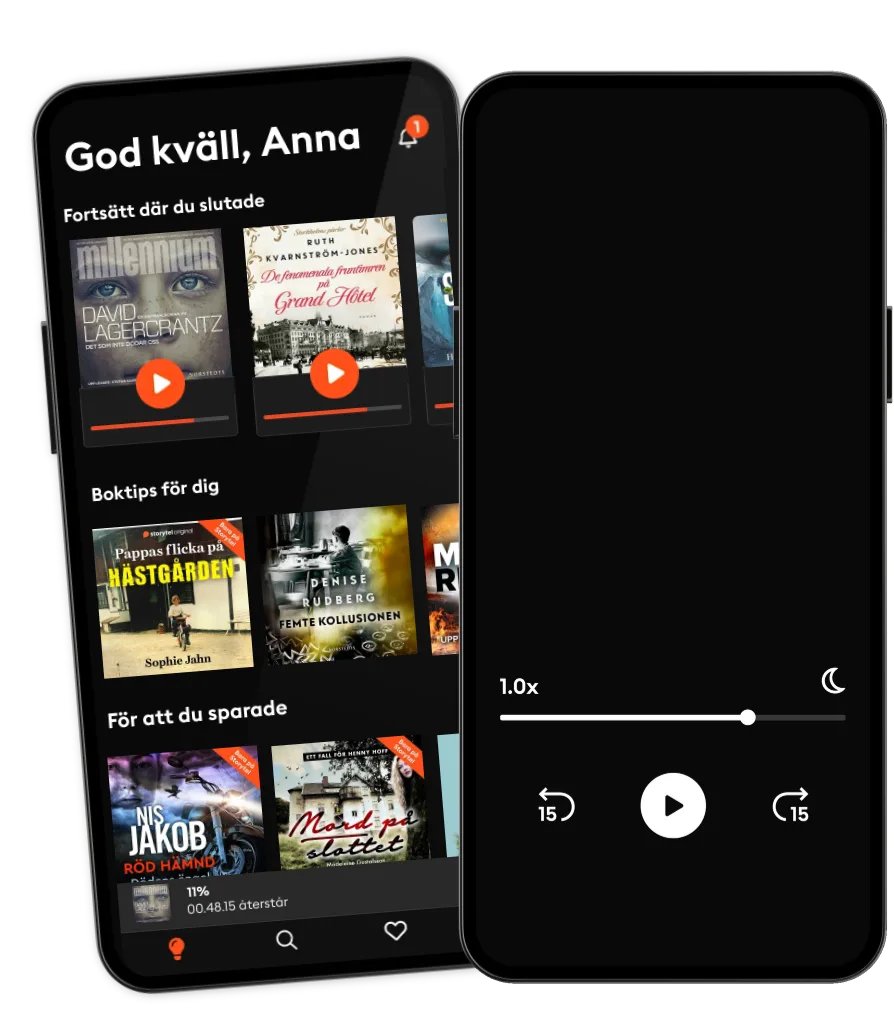

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Fundamentals of Credit and Credit Analysis: Corporate Credit Analysis

- Av

- Med

- Förlag

- Längd

- 4tim 5min

- Språk

- Engelska

- Format

- Kategori

Ekonomi & Business

Arnold Ziegel formed Mountain Mentors Associates after his retirement from a corporate banking career of more than 30 years at Citibank. The lessons learned from his experience in dealing with entrepreneurs, multinational corporations, highly leveraged companies, financial institutions, and structured finance led to the development and delivery of numerous senior level credit risk training programs for major global financial institutions from 2002 through the present. This book was conceived and written as a result of the development of these courses and his experience as a corporate banker. It illustrates the fundamental issues of credit and credit analysis in a manner that tries to take away its mystery. The overriding theme of this book is that when an investor extends credit of any type, the goal is "to get your money back", and with a return that is commensurate with the risk.

The goal of credit analysis is not to make "yes or no" decisions about the extension of credit, but to identify the degree of risk associated with a particular obligor or a particular credit instrument. This is consistent with modern banking industry portfolio management and the rating systems of credit agencies. Once the 'riskiness" of an obligor or credit instrument is established, it can be priced or structured to match the risk demands or investment criteria of the entity that is extending the credit. A simple quote from Mr. J. P. Morgan is used often in this text - "Lending is not based primarily on money or property. No sir, the first thing is character". This statement represents one of the conflicts in modern credit analysis - that of models for decision making versus traditional credit analysis. The 2008 financial crisis was rooted in the mortgage backed securities business.

Sophisticated models were used by investors, banks, and rating agencies to judge the credit worthiness of billions (and maybe trillions) of dollars worth of residential mortgage loans that were packaged into securities and distributed to investors. The models indicated that these securities would have very low losses. Of course, huge losses were incurred. Mr. Morgan had a good point. In this case is was both property and character. The properties that were the collateral for many of the mortgages had much less value than was anticipated. The valuation of the collateral was naïve and flawed. Many assumptions were made that the value of homes would rise without pause. Many mortgage loans were made that were at or even above the appraised value of a residence.

But character was a huge, perhaps larger, factor behind these losses. Many of the residential mortgage loans were made to individuals who knew that they did not have the income to make the required payments on the mortgages. Many of the mortgage brokers and lenders who made these loans also knew that many of the borrowers were not properly qualified. And, many of the bankers who securitized these loans also may have doubted the credit quality of some of the underlying mortgages. If bankers and rating agencies understood the extent of the fraud and lax standards in the fundamental loans backing the mortgage securities, or were willing to acknowledge it, the fiasco would not have occurred.

© 2020 Ascent Audio (Ljudbok): 9781663727800

Utgivningsdatum

Ljudbok: 27 april 2020

Andra gillade också ...

- The Opportunity Index: A Solution-Based Framework to Dismantle the Racial Wealth Gap Gavin Lewis

- The Age of Deleveraging: Investment Strategies for a Decade of Slow Growth and Deflation A. Gary Shilling

- Get Scrappy: Smarter Digital Marketing for Businesses Big and Small Nick Westergaard

- Creating Business Agility: How Convergence of Cloud, Social, Mobile, Video, and Big Data Enables Competitive Advantage Rodney Heisterberg

- Income Generating Solutions: How to Create a River of Extra Cash Flow! John Cummuta

- Positively Geared Lloyd Edge

- Let's Close a Deal: Turn Contacts into Paying Customers for Your Company, Product, Service or Cause Christine Clifford

- Knock Out Networking for Financial Advisors and Other Sales Producers: More Prospects, More Referrals, More Business Michael Goldberg

- Successful Black Entrepreneurs: Hidden Histories, Inspirational Stories, and Extraordinary Business Achievements Steven Rogers

- The Benevolent Dictator: Empower Your Employees, Build Your Business, and Outwit the Competition Michael Feuer

- On Top of the Cloud: How CIOs Leverage New Technologies to Drive Change and Build Value Across the Enterprise Hunter Muller

- Skills for Career Success: Maximizing Your Potential at Work Elaine Biech

- If You Build It Will They Come?: Three Steps to Test and Validate Any Market Opportunity Rob Adams

- Exit Path: How to Win the Startup End Game Touraj Parang

- Marketing in the Participation Age : A Guide to Motivating People to Join, Share, Take Part, Connect and Engage: A Guide to Motivating People to Join, Share, Take Part, Connect, and Engage Daina Middleton

- The Power of Evolved Leadership: Inspire Top Performance by Fostering Inclusive Teams Stephen Young

- From Scrappy to Self-Made: What Entrepreneurs Can Learn from an Ethiopian Refugee to Turn Roadblocks into an Empire Yonas Hagos

- The Missing Links: Launching A High Performing Company Culture Phillip Meade PhD

- At the Speed of Irrelevance: How America Blew Its AI Leadership Position and How to Regain It, 1st Edition Al Naqvi

- Streetsmart Financial Basics for Nonprofit Managers: 4th Edition Thomas A. McLaughlin

- NOT Accountable: Rethinking the Constitutionality of Public Employee Unions Philip K. Howard

- Jolt!: Get the Jump on a World That's Constantly Changing Phil Howard Cooke

- PreachersNSneakers: Authenticity in an Age of For-Profit Faith and (Wannabe) Celebrities Benjamin Kirby

- How to Hire A-Players: Finding the Top People for Your Team- Even If You Don't Have a Recruiting Department Eric Herrenkohl

- Ending Checkbox Diversity: Rewriting the Story of Performative Allyship in Corporate America Dannie Lynn Fountain

- Stop Guessing: The 9 Behaviors of Great Problem Solvers Nat Greene

- The Making of a Market Guru : Forbes Presents 25 Years of Ken Fisher: Forbes Presents 25 Years of Ken Fisher Aaron Anderson

- How to Make Money While you Sleep!: A 7-Step Plan for Starting Your Own Profitable Online Business Brett McFall

- Dealing with the Tough Stuff: How to Achieve Results from Key Conversations Alison Hill

- The Golden Apple: Redefining Work-Life Balance for a Diverse Workforce Mason Donovan

- Finding the Uncommon Deal: A Top New York Lawyer Explains How to Buy a Home For the Lowest Possible Price Adam Leitman Bailey

- The Offsite: A Leadership Challenge Fable Robert H. Thompson

- Enterprise Strategy for Blockchain Ravi Sarathy

- Prosperity in The Age of Decline: How to Lead Your Business and Preserve Wealth Through the Coming Business Cycles Alan Beaulieu

- Digital Trailblazer: Essential Lessons to Jumpstart Transformation and Accelerate Your Technology Leadership Isaac Sacolick

- The Resilient Founder: Lessons in Endurance from Startup Entrepreneurs Mahendra Ramsinghani

- Buy Now: The Ultimate Guide to Owning and Investing in Property Lloyd Edge

- Startupland: How Three Guys Risked Everything to Turn an Idea into a Global Business Carlye Adler

- The Insider's Edge to Real Estate Investing: Game-Changing Strategies to Outperform the Market James Nelson

- Healthy Leadership for Thriving Organizations: Creating Contexts Where People Flourish Justin A. Irving

- The Predictive Edge: Outsmart the Market using Generative AI and ChatGPT in Financial Forecasting Alejandro Lopez-Lira

- How to Price Effectively: A Guide for Managers and Entrepreneurs Utpal Dholakia

- Konstnären Dag Öhrlund

4.1

- Följeslagaren Sofie Sarenbrant

4

- Vår sjätte attaché Denise Rudberg

4.3

- När stjärnorna faller Mari Jungstedt

4

- Välkomna till vårt äktenskap Julia Dufvenius

4

- Skugga över Slagtjärn Rolf Börjlind

4.1

- Främmande blod Nis Jakob

4.3

- Ett orimligt straff Carin Hjulström

4.4

- Din för evigt Natalie Normann

4.2

- Sommarvindar över Saltudden Ida Fryklund

3.7

- Besökaren Dag Öhrlund

3.9

- Jägarhjärta Lars Wilderäng

3.7

- Nattankare Kristina Ohlsson

4.1

- Kodnamn Antrax Mikael Ressem

3.8

- Tornet Dag Öhrlund

3.8

Därför kommer du älska Storytel

1 miljon stories

Lyssna och läs offline

Exklusiva nyheter varje vecka

Kids Mode (barnsäker miljö)

Premium

Lyssna och läs ofta.

169 kr /månad

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Unlimited

Lyssna och läs obegränsat.

229 kr /månad

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Family

Dela stories med hela familjen.

Från 239 kr /månad

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

239 kr /månad

Flex

Lyssna och läs ibland – spara dina olyssnade timmar.

99 kr /månad

Spara upp till 100 olyssnade timmar

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Svenska

Sverige