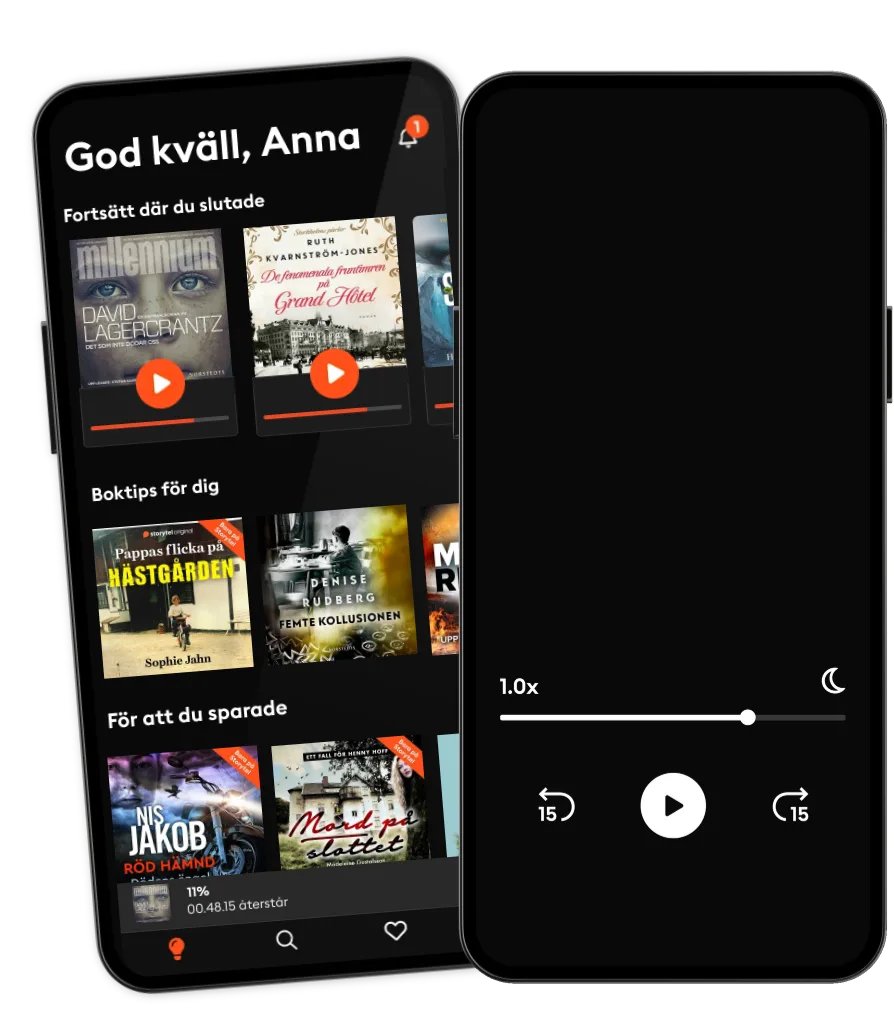

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

The Little Book of Behavioral Investing: How not to be your own worst enemy (Little Book, Big Profits)

- Av

- Med

- Förlag

- 401 betyg

4.3

- Längd

- 5tim 2min

- Språk

- Engelska

- Format

- Kategori

Ekonomi & Business

Ben Graham, the father of value investing, once said: "The investor's chief problem—and even his worst enemy—is likely to be himself." Sadly, Graham's words are still true today. Bias, emotion, and overconfidence are just three of the many behavioral traits that can lead investors to lose money or achieve lower returns. Fortunately, behavioral finance, which recognizes that there is a psychological element to all investor decision making, is now firmly embedded in the mainstream of finance. Applying behavioral principles to an investment portfolio can help investors avoid some of the mental pitfalls that so often cost them, and financial institutions, billions. In The Little Book of Behavioral Investing, behavioral finance expert James Montier takes you on a guided tour of the most common behavioral challenges and mental pitfalls that investors encounter, and provides you with strategies to eliminate these traits. Along the way, he shows how some of the world's best investors have tackled the behavioral biases that drag down investment returns, so that you might be able to learn from their experiences. Montier explains the importance of learning to prepare, plan, and then commit to a strategy—that is, do your investment research while you are in a "cold" rational state, when nothing much is happening in the markets—and then pre-commit to following your analysis and action steps. He also stresses the folly of trying to forecast what the markets will do, and reveals how the idea of investing without pretending you know the future gives you a very different perspective. Throughout the audio book, Montier stresses why the need to focus on process rather than outcomes is critical in investing. Focusing upon process, he shows, frees us up from worrying about aspects of investment that we really can't control—such as returns. By focusing upon process, we maximize our potential to generate good long-term profits. The Little Book of Behavioral Investing offers a range of time-tested ways to identify and avoid the pitfalls of investor bias. By following these simple strategies, you will learn to overcome your own worst enemy when it comes to investments—yourself.

© 2010 Ascent Audio (Ljudbok): 9781596595552

Utgivningsdatum

Ljudbok: 5 mars 2010

Andra gillade också ...

- Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway's Vice Chairman on Life, Business, and the Pursuit of Wealth With Commentary by David Clark David Clark

- You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits Joel Greenblatt

- The Little Book That Builds Wealth: Morningstar's Knock-out Formula Pat Dorsey

- The New Buffettology: How Warren Buffett Got and Stayed Rich in Markets Like This and How You Can Too! Mary Buffett

- Mastering The Market Cycle: Getting the odds on your side Howard Marks

- The Big Secret for the Small Investor: The Shortest Route to Long-Term Investment Success Joel Greenblatt

- Warren Buffett's Ground Rules: Words of Wisdom from the Partnership Letters of the World's Greatest Investor Jeremy C. Miller

- A Random Walk Down Wall Street: Including a Life-Cycle Guide to Personal Investing Burton G. Malkiel

- Warren Buffett's Management Secrets: Proven Tools for Personal and Business Success Mary Buffett

- Common Stocks and Uncommon Profits and Other Writings (2nd Edition): 2nd Edition Philip A. Fisher

- Beating the Street: How to Use What You Already Know to Make Money in the Market Peter Lynch

- The Dhandho Investor: The Low-Risk Value Method to High Returns Mohnish Pabrai

- Common Stocks and Common Sense: The Strategies, Analyses, Decisions, and Emotions of a Particularly Successful Value Investor Edgar Wachenheim

- The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit Aswath Damodaran

- The Warren Buffett Stock Portfolio: Warren Buffett's Stock Picks: When and Why He Is Investing in Them Mary Buffett

- The Triumph of Value Investing: Smart Money Tactics for the Post-Recession Era Janet Lowe

- The Little Book of Bulletproof Investing: Do's and Don'ts to Protect Your Financial Life Phil DeMuth

- Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition John C. Bogle

- Damn Right!: Billionare Charlie Munger: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger (Revised) Janet Lowe

- The Little Book of Trading: Trend Following Strategy for Big Winnings Michael Covel

- Invested: How Warren Buffett and Charlie Munger Taught Me to Master My Mind, My Emotions, and My Money (with a Little Help From My Dad) Danielle Town

- Investing in One Lesson Mark Skousen

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market Peter Lynch

- The Little Book That Still Beats the Market Joel Greenblatt

- The Little Book of Market Wizards: Lessons from the Greatest Traders Jack D. Schwager

- Learn to Earn: A Beginner's Guide to the Basics of Investing Peter Lynch

- The Little Book of Bull's Eye Investing: Finding Value, Generating Absolute Returns, and Controlling Risk in Turbulent Markets John Mauldin

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous Investor Mary Buffett

- Richer, Wiser, Happier: How the World's Greatest Investors Win in Markets and Life William Green

- The Little Book of Big Dividends: A Safe Formula for Guaranteed Returns Terry Savage

- The Einstein Money: The Life and Timeless Financial Wisdom of Benjamin Graham Joe Carlen

- Common Sense: The Investors Guide to Equality, Opportunity and Growth: The Investor's Guide to Equality, Opportunity, and Growth Joel Greenblatt

- Forbes Greatest Investing Stories Richard Phalon

- Hedge Fund Market Wizards: How Winning Traders Win Jack D. Schwager

- The Little Book of Sideways Markets: How to Make Money in Markets that Go Nowhere Vitally Katsenelson

- The Elements of Investing Charles D. Ellis

- The Sages: Warren Buffett, George Soros, Paul Volcker, and the Maelstrom of Markets Charles Morris

- The Intelligent Investor Rev Ed. Benjamin Graham

- The Bogleheads' Guide to Investing: Second Edition Michael LeBoeuf

- The Book of Investing Wisdom: Classic Writings by Great Stock-Pickers and Legends of Wall Street Peter Krass

- Warren Buffett: Inside the Ultimate Money Mind Robert G. Hagstrom

- The Motley Fool Million Dollar Portfolio David Gardner

- Warren Buffett on Business: Principles from the Sage of Omaha Warren Buffett

- The Art of Value Investing: Essential Strategies for Market-Beating Returns John Heins

- The Intelligent Investor Benjamin Graham

- The Little Book of Stock Market Cycles: How to Take Advantage of Time-Proven Market Patterns Jeffrey A. Hirsch

- The Millionaire Next Door: The Surprising Secrets Of Americas Wealthy Thomas J. Stanley

- The Little Book Of Stock Market Profits: The Best Strategies of All Time Made Even Better Mitch Zacks

- The Millionaire Next Door: The Surprising Secrets Of Americas Wealthy Thomas J. Stanley

- The Little Book That Saves Your Assets: What the Rich Do to Stay Wealthy in Up and Down Markets David Darst

- The Little Book of Investing Like the Pros: Five Steps for Picking Stocks Josh Pearl

- How I Made $2,000,000 in the Stock Market Nicolas Darvas

- Alibaba: The House that Jack Ma Built Duncan Clark

- 7 Secrets to Investing Like Warren Buffett Mary Buffett

- Bogle on Mutual Funds: New Perspectives For The Intelligent Investor John C. Bogle

- John Neff on Investing John Neff

- The Little Book of Bull Moves: How to Keep Your Portfolio Up When the Market is Up, Down, or Sideways Peter D. Schiff

- The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between William Bernstein

- Value Investing: From Graham to Buffett and Beyond, 2nd Edition Mark Cooper

- Principles: Life and Work Ray Dalio

- The Little Book of Safe Money Jason Zweig

- The Little Book of Alternative Investments: Reaping Rewards by Daring to be Different Phil DeMuth

- The Elements of Investing: Easy Lessons for Every Investor: Easy Lessons for Every Investor, Updated Edition Charles D. Ellis

- The Five Rules for Successful Stock Investing: Morningstar's Guide to Building Wealth and Winning in the Market Pat Dorsey

- How to Invest David M. Rubenstein

- Winning the Loser's Game: Timeless Strategies for Successful Investing, Eighth Edition Charles D. Ellis

- The Richest Man in Babylon George S. Clason

- How the Mighty Fall Jim Collins

- Building a Small Business that Warren Buffett Would Love Adam Brownlee

- Dividend Investing: A Simple, Concise & Complete Guide to Dividend Investing Jonathan Marlow

- The Millionaire Mind Thomas J. Stanley

- Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Moves, 3rd Edition Kathy Lien

- Principles for Dealing with the Changing World Order: Why Nations Succeed or Fail Ray Dalio

- Reminiscences of a Stock Operator (Original Classic Edition) Edwin Lefevre

- Följeslagaren Sofie Sarenbrant

4

- Tornet Dag Öhrlund

3.8

- Skugga över Slagtjärn Rolf Börjlind

4.1

- Nattankare Kristina Ohlsson

4.1

- Konstnären Dag Öhrlund

4.1

- Välkomna till vårt äktenskap Julia Dufvenius

4

- Alfa Lina Areklew

3.9

- En dold skönhet Lucinda Riley

4.3

- När stjärnorna faller Mari Jungstedt

4

- Vår sjätte attaché Denise Rudberg

4.3

- Vägen in Peter Lindmark

4.4

- Ingen väg ut Lee Child

3.6

- Skottskador Mikael Ressem

4.1

- När du dör morfar, så dör jag med : mitt liv i skuggan av Arbogakvinnan Leone Milton

4.1

- Stål-Berit Martina Haag

3.2

Därför kommer du älska Storytel:

1 miljon stories

Lyssna och läs offline

Exklusiva nyheter varje vecka

Kids Mode (barnsäker miljö)

Premium

Lyssna och läs ofta.

1 konto

100 timmar/månad

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Unlimited

Lyssna och läs obegränsat.

1 konto

Lyssna obegränsat

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Family

Dela stories med hela familjen.

2-6 konton

100 timmar/månad för varje konto

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

2 konton

239 kr /månadFlex

Lyssna och läs ibland – spara dina olyssnade timmar.

1 konto

20 timmar/månad

Spara upp till 100 olyssnade timmar

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Svenska

Sverige