Adaptive Markets: Financial Evolution at the Speed of Thought

- Av

- Med

- Forlag

- 33 Anmeldelser

4.2

- Spilletid

- 20T 21M

- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

Half of all Americans have money in the stock market, yet economists can't agree on whether investors and markets are rational and efficient, as modern financial theory assumes, or irrational and inefficient, as behavioral economists believe—and as financial bubbles, crashes, and crises suggest. This is one of the biggest debates in economics, and the value or futility of investment management and financial regulation hang on the outcome. In this groundbreaking book, Andrew W. Lo cuts through this debate with a new framework, the Adaptive Markets Hypothesis, in which rationality and irrationality coexist.

Drawing on psychology, evolutionary biology, neuroscience, artificial intelligence, and other fields, Adaptive Markets shows that the theory of market efficiency isn't wrong but merely incomplete. When markets are unstable, investors react instinctively, creating inefficiencies for others to exploit. Lo's new paradigm explains how financial evolution shapes behavior and markets at the speed of thought—a fact revealed by swings between stability and crisis, profit and loss, and innovation and regulation.

© 2018 Tantor Media (Lydbok): 9781541485297

© 2019 Princeton University Press (E-bok): 9780691196800

Utgivelsesdato

Lydbok: 18. januar 2018

E-bok: 14. mai 2019

Andre liker også ...

- Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway's Vice Chairman on Life, Business, and the Pursuit of Wealth With Commentary by David Clark David Clark

- Principles: Life and Work Ray Dalio

- The Warren Buffett Stock Portfolio: Warren Buffett's Stock Picks: When and Why He Is Investing in Them Mary Buffett

- The Little Book of Behavioral Investing: How not to be your own worst enemy (Little Book, Big Profits) James Montier

- Never Split the Difference: Negotiating As If Your Life Depended On It Chris Voss

- The Intelligent Investor Benjamin Graham

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a Nation Scott Nations

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market Peter Lynch

- Range: How Generalists Triumph in a Specialized World David Epstein

- The Intelligent Investor Rev Ed. Benjamin Graham

- Warren Buffett Speaks: Wit and Wisdom from the World's Greatest Investor Janet Lowe

- The Big Secret for the Small Investor: The Shortest Route to Long-Term Investment Success Joel Greenblatt

- A Random Walk Down Wall Street: Including a Life-Cycle Guide to Personal Investing Burton G. Malkiel

- Debt – Updated and Expanded: The First 5,000 Years David Graeber

- The Little Book That Still Beats the Market Joel Greenblatt

- The Triumph of Value Investing: Smart Money Tactics for the Post-Recession Era Janet Lowe

- Irrational Exuberance: Revised and Expanded Third Edition Robert J. Shiller

- The Dhandho Investor: The Low-Risk Value Method to High Returns Mohnish Pabrai

- The Big Three in Economics: Adam Smith, Karl Marx, and John Maynard Keynes Mark Skousen

- Investing in One Lesson Mark Skousen

- A Little History of Economics Niall Kishtainy

- Flash Crash: A Trading Savant, a Global Manhunt and the Most Mysterious Market Crash in History Liam Vaughan

- The Richest Man in Babylon George Clason

- The End of the World is Just the Beginning: Mapping the Collapse of Globalization Peter Zeihan

- Kochland: The Secret History of Koch Industries and Corporate Power in America Christopher Leonard

- Capital and Ideology Thomas Piketty

- Common Stocks and Uncommon Profits and Other Writings (2nd Edition): 2nd Edition Philip A. Fisher

- Narrative Economics: How Stories Go Viral and Drive Major Economic Events Robert J. Shiller

- The Sages: Warren Buffett, George Soros, Paul Volcker, and the Maelstrom of Markets Charles Morris

- Warren Buffett's Ground Rules: Words of Wisdom from the Partnership Letters of the World's Greatest Investor Jeremy C. Miller

- The Future of Capitalism: Facing the New Anxieties Paul Collier

- Warren Buffett's Management Secrets: Proven Tools for Personal and Business Success Mary Buffett

- Damn Right!: Billionare Charlie Munger: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger (Revised) Janet Lowe

- Blue Ocean Strategy W. Chan Kim

- Good to Great Jim Collins

- The Myth of Capitalism: Monopolies and the Death of Competition Denise Hearn

- Homo Deus: A Brief History of Tomorrow Yuval Noah Harari

- The Making of Modern Economics, Second Edition: The Lives and Ideas of the Great Thinkers Mark Skousen

- Unshakeable: Your Financial Freedom Playbook Tony Robbins

- Predictably Irrational: The Hidden Forces that Shape Our Decisions Dan Ariely

- The Achievement Habit: Stop Wishing, Start Doing, and Take Command of Your Life Bernard Roth

- Beating the Street: How to Use What You Already Know to Make Money in the Market Peter Lynch

- Sapiens: A Brief History of Humankind Yuval Noah Harari

- This Time is Different: Eight Centuries of Financial Folly Carmen Reinhart

- The Bed of Procrustes: Philosophical and Practical Aphorisms Nassim Nicholas Taleb

- The Effective Executive: The Definitive Guide to Getting the Right Things Done Peter F. Drucker

- Built to Last: Successful Habits of Visionary Companies Jim Collins

- Mine drømmers land Merice Briffa

4.2

- Veien over klippene Gøril Emilie Hellen

4.3

- Lysets rustning - Del 1 Ken Follett

4.5

- Mordkoden Helge Thime-Iversen

4.1

- Jakten på en serieovergriper Anne-Britt Harsem

4.8

- Den Navnløse Arven Ellen Gustavsen

4.2

- Brent Jane Casey

3.9

- Sluttspill Mary Higgins Clark

3.9

- Skriket Jan-Erik Fjell

4.3

- Mormor danset i regnet Trude Teige

4.5

- Jordmoren i Auschwitz Anna Stuart

4.8

- Pulskuren - Stress riktig, sov bedre, yt mer og lev lenger Torkil Færø

4.6

- Atlas - Historien om Pa Salt Lucinda Riley

4.7

- Skyggeadvokaten Eva J. Stensrud

4.5

- Doppler Erlend Loe

4.1

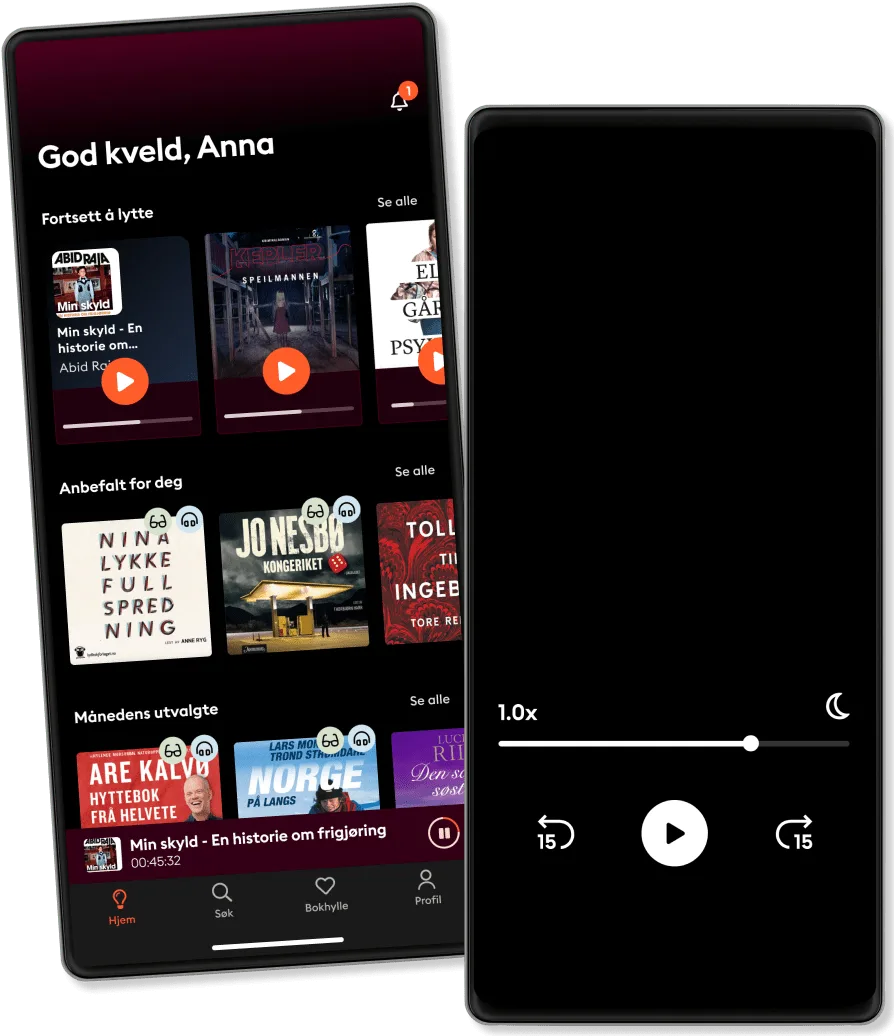

Derfor vil du elske Storytel:

Over 700 000 bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Lytt så mye du vil

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Lytt så mye du vil

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedBasic

For deg som lytter og leser av og til.

1 konto

20 timer/måned

Lytt opp til 20 timer per måned

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Lytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge