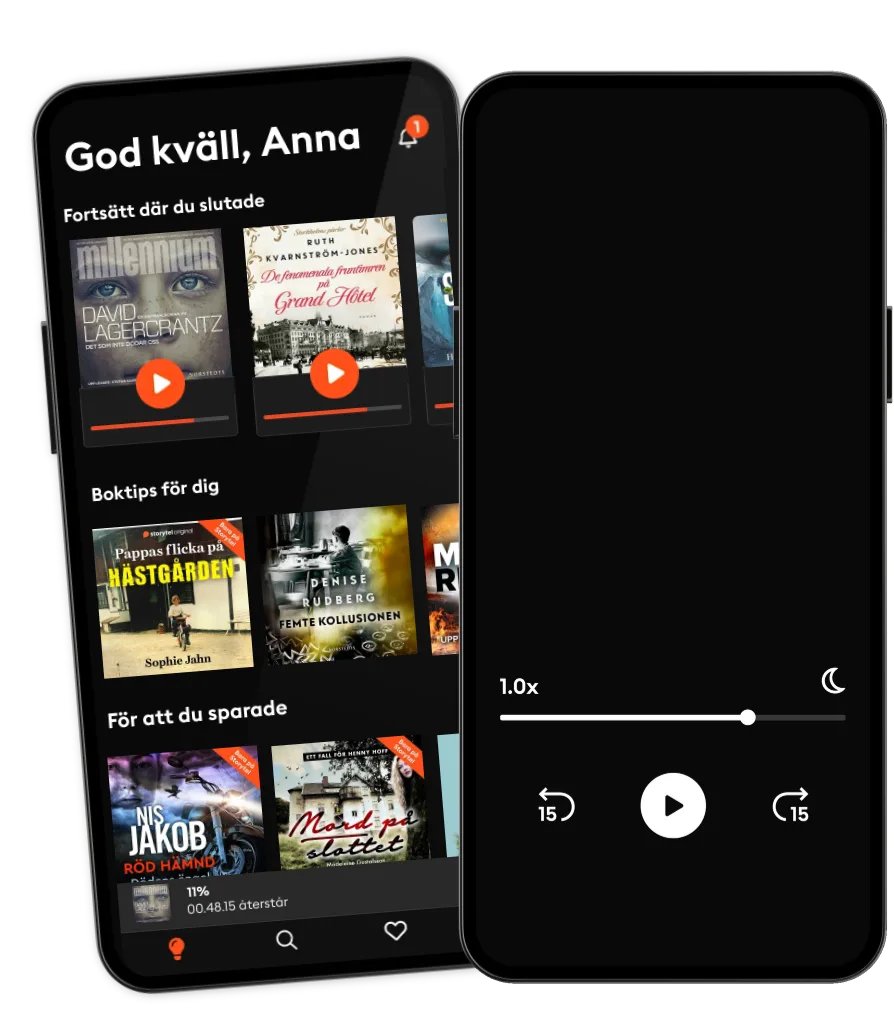

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse

- Av

- Med

- Förlag

- 4 Recensioner

5

- Längd

- 6T 29min

- Språk

- Engelska

- Format

- Kategori

Ekonomi & Business

The media tells us that "deregulation" and "unfettered free markets" have wrecked our economy and will continue to make things worse without a heavy dose of federal regulation. But the real blame lies elsewhere. In Meltdown, bestselling author Thomas E. Woods, Jr., unearths the real causes behind the collapse of housing values and the stock market—and it turns out the culprits reside more in Washington than on Wall Street.

And the trillions of dollars in federal bailouts? Our politicians' ham-handed attempts to fix the problems they themselves created will only make things much worse.

Woods, a senior fellow at the Ludwig von Mises Institute and winner of the 2006 Templeton Enterprise Award, busts the media myths and government spin. He explains how government intervention in the economy—from the Democratic hobby horse called Fannie Mae to affirmative action programs like the Community Redevelopment Act—actually caused the housing bubble.

Most important, Woods, author of the New York Times bestseller The Politically Incorrect Guide to American History, traces this most recent boom-and-bust—and all such booms and busts of the past century—back to one of the most revered government institutions of all: the Federal Reserve System, which allows busybody bureaucrats and ambitious politicians to pull the strings of our financial sector and manipulate the value of the very money we use.

Meltdown, which features a foreword by Congressman Ron Paul (R—Texas), also provides a timely history lesson to counter the current clamor for a new New Deal. The Great Depression, Woods demonstrates, was only as deep and as long as it was because of the government interventions by Herbert Hoover (no free-market capitalist, despite what your high school history teacher may have taught you) and Franklin D. Roosevelt (no savior of the American economy, in spite of what the mainstream media says). If you want to understand what caused the financial meltdown—and why none of the big-government solutions being tried today will work—Meltdown explains it all.

© 2009 Tantor Media (Ljudbok): 9781400182091

Utgivningsdatum

Ljudbok: 16 mars 2009

Taggar

Andra gillade också ...

- The Big Three in Economics: Adam Smith, Karl Marx, and John Maynard Keynes Mark Skousen

- The Making of Modern Economics, Second Edition: The Lives and Ideas of the Great Thinkers Mark Skousen

- A Little History of Economics Niall Kishtainy

- Applied Economics: Thinking Beyond Stage One Thomas Sowell

- America’s Great Depression Murray N. Rothbard

- The New Confessions of an Economic Hit Man John Perkins

- Misunderstanding Financial Crises: Why We Don't See Them Coming Gary B. Gorton

- The Politically Incorrect Guide to Capitalism Dr. Robert P. Murphy

- Milton Friedman: A Guide to His Economic Thought Eamonn Butler

- Wealth, Poverty, and Politics: An International Perspective Thomas Sowell

- The Bed of Procrustes: Philosophical and Practical Aphorisms Nassim Nicholas Taleb

- This Time is Different: Eight Centuries of Financial Folly Carmen Reinhart

- Crash Proof 2.0: How to Profit From the Economic Collapse Peter D. Schiff

- Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets Nassim Nicholas Taleb

- Free Market Revolution: How Ayn Rand’s Ideas Can End Big Government Don Watkins

- Debt – Updated and Expanded: The First 5,000 Years David Graeber

- The Great Degeneration: How Institutions Decay and Economies Die Niall Ferguson

- Panic!: The Story of Modern Financial Insanity Michael Lewis

- The Wealth of Nations Adam Smith

- The Fourth Age: Smart Robots, Conscious Computers, and the Future of Humanity Byron Reese

- Capital and Ideology Thomas Piketty

- The Myth of Capitalism: Monopolies and the Death of Competition Denise Hearn

- The Future of Capitalism: Facing the New Anxieties Paul Collier

- Anarchy, State, and Utopia: Second Edition Robert Nozick

- All the Presidents' Bankers: The Hidden Alliances That Drive American Power Nomi Prins

- The Death Money: The Coming Collapse of the International Monetary System (Int'Edit.) James Rickards

- The Coming Economic Collapse: How You Can Thrive When Oil Costs $200 a Barrel Stephen Leeb PhD

- The Politically Incorrect Guide to the Great Depression and the New Deal Dr. Robert P. Murphy

- Blue Ocean Strategy W. Chan Kim

- Kochland: The Secret History of Koch Industries and Corporate Power in America Christopher Leonard

- China's Economy: What Everyone Needs to Know® Arthur R. Kroeber

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market Peter Lynch

- Crashes, Crises, and Calamities: How We Can Use Science to Read the Early-Warning Signs Len Fisher

- Predictably Irrational: The Hidden Forces that Shape Our Decisions Dan Ariely

- Adaptive Markets: Financial Evolution at the Speed of Thought Andrew W. Lo

- The Great Escape: Health, Wealth, and the Origins of Inequality Angus Deaton

- Human Action (Third Revised Edition): A Treatise on Economics Ludwig von Mises

- The Einstein Money: The Life and Timeless Financial Wisdom of Benjamin Graham Joe Carlen

- Narrative Economics: How Stories Go Viral and Drive Major Economic Events Robert J. Shiller

- The Triumph of Value Investing: Smart Money Tactics for the Post-Recession Era Janet Lowe

- Capitalism 4.0: The Birth of a New Economy in the Aftermath of Crisis Anatole Kaletsky

- What the Most Successful People Do Before Breakfast Laura Vanderkam

- The Little Book of Currency Trading: How to Make Big Profits in the World of Forex Kathy Lien

- Fear: Trump in the White House Bob Woodward

- The Great Degeneration Niall Ferguson

- Nullification: How to Resist Federal Tyranny in the 21st Century Thomas E. Woods, Jr.

- Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway's Vice Chairman on Life, Business, and the Pursuit of Wealth With Commentary by David Clark David Clark

- Halmdockan Leffe Grimwalker

4.1

- Väninnorna på Nordiska Kompaniet Ruth Kvarnström-Jones

4.1

- Lockbetet Leffe Grimwalker

4.1

- Kodnamn Urd Mikael Ressem

3.8

- Säpogruppen 1 – Ryssvillan Anders Jallai

4.2

- De fenomenala fruntimren på Grand Hôtel Ruth Kvarnström-Jones

4.5

- Fallet Valentina Anna Bågstam

4

- Spelets regler Maria Fallström

4.1

- Sömngångaren Lars Kepler

4.2

- Ord mot ord Steve Cavanagh

4.4

- Post Mortem David Lagercrantz

3.8

- Hembiträdet Freida McFadden

4.2

- Läkarens älskarinna Daniel Hurst

3.8

- Bland vita ulliga moln Jenny Colgan

3.8

- Tranorna flyger söderut Lisa Ridzén

4.6

Därför kommer du älska Storytel:

1 miljon stories

Lyssna och läs offline

Exklusiva nyheter varje vecka

Kids Mode (barnsäker miljö)

Premium

Lyssna och läs ofta.

1 konto

100 timmar/månad

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Unlimited

Lyssna och läs obegränsat.

1 konto

Lyssna obegränsat

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Family

Dela stories med hela familjen.

2-6 konton

100 timmar/månad för varje konto

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

2 konton

239 kr /månadFlex

Lyssna och läs ibland – spara dina olyssnade timmar.

1 konto

20 timmar/månad

Spara upp till 100 olyssnade timmar

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Svenska

Sverige