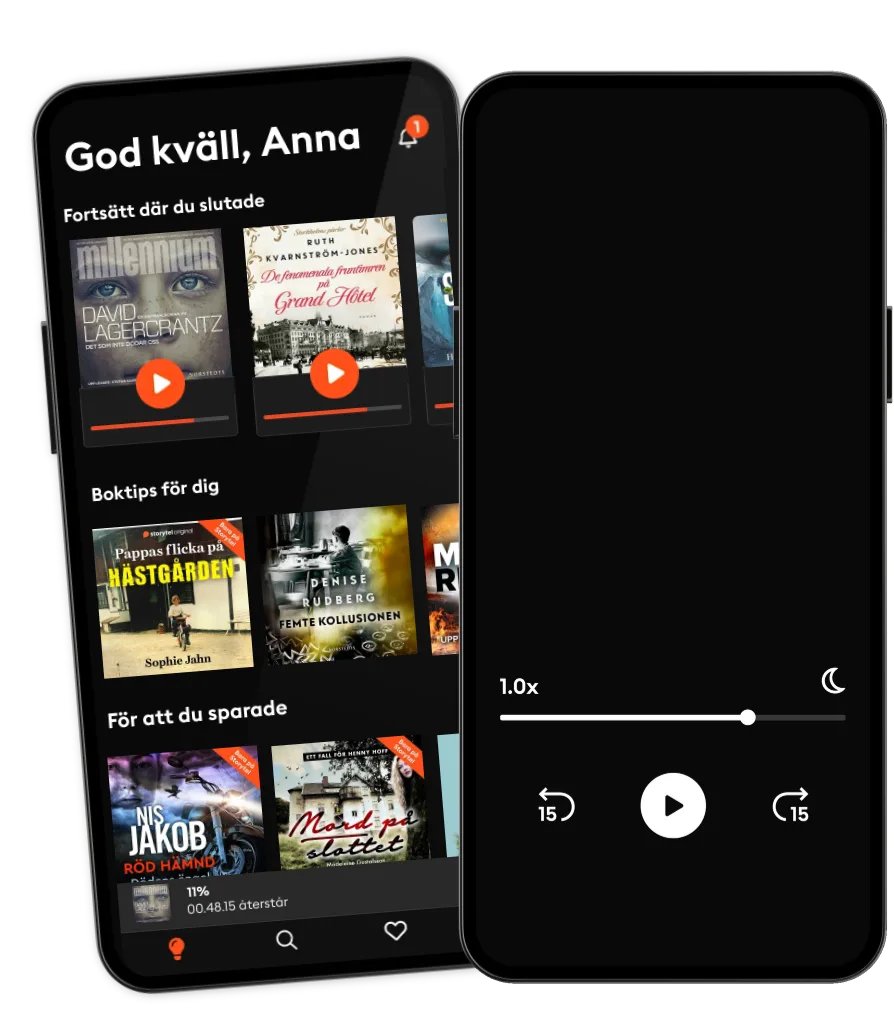

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

The 7 Most Important Equations for Your Retirement: The Fascinating People and Ideas Behind Planning Your Retirement Income

- Av

- Med

- Förlag

- 1 Recensioner

5

- Längd

- 6T 15min

- Språk

- Engelska

- Format

- Kategori

Ekonomi & Business

Physics, chemistry, astronomy, biology; every field has its intellectual giants who made breakthrough discoveries that changed the course of history. What about the topic of retirement planning? Is it a science? Or is retirement income planning just a collection of rules-of-thumb, financial products, and sales pitches? In The 7 Most Important Equations for Your Retirement Moshe Milevsky argues that twenty first century retirement income planning is indeed a science and has its foundations in the work of great sages who made conceptual and controversial breakthroughs over the last eight centuries.

In the book Milevsky highlights the work of seven scholars—summarized by seven equations—who shaped all modern retirement calculations. He tells the stories of Leonardo Fibonnaci the Italian businessman; Benjamin Gompertz the gentleman actuary; Edmund Halley the astronomer; Irving Fisher the stock jock; Paul Samuelson the economic guru; Solomon Heubner the insurance and marketing visionary, and Andrey Kolmogorov the Russian mathematical genius—all giants in their respective fields who collectively laid the foundations for modern retirement income planning.

If you ever wondered what the point of all that high school mathematics was, Moshe Milevsky's answer is: So that you can figure out how to retire . . . while you can still enjoy your money.

© 2019 Tantor Media (Ljudbok): 9781541430204

Utgivningsdatum

Ljudbok: 15 oktober 2019

Andra gillade också ...

- The Little Book of Behavioral Investing: How not to be your own worst enemy (Little Book, Big Profits) James Montier

- Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway's Vice Chairman on Life, Business, and the Pursuit of Wealth With Commentary by David Clark David Clark

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want Jesse Mecham

- The Intelligent Investor Benjamin Graham

- The One-Page Financial Plan: A Simple Way to Be Smart About Your Money Carl Richards

- The Science of Money: How to Increase Your Income and Become Wealthy Brian Tracy

- The Intelligent Investor Rev Ed. Benjamin Graham

- Small Change: Money Mishaps and How to Avoid Them Dan Ariely

- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth T. Harv Eker

- The Einstein Money: The Life and Timeless Financial Wisdom of Benjamin Graham Joe Carlen

- The Top 1%: Habits, Attitudes & Strategies For Exceptional Success Dan Strutzel

- Investing in One Lesson Mark Skousen

- Principles: Life and Work Ray Dalio

- The Value of Debt in Building Wealth: Creating Your Glide Path to a Healthy Financial L.I.F.E. Thomas J. Anderson

- The Buy Nothing, Get Everything Plan: Discover the Joy of Spending Less, Sharing More, and Living Generously Liesl Clark

- High Returns From Low Risk: A Remarkable Stock Market Paradox Jan De Koning

- Mastering The Market Cycle: Getting the odds on your side Howard Marks

- The Ten Roads to Riches, Second Edition: The Ways the Wealthy Got There (And How You Can Too!) Ken Fisher

- The Achievement Habit: Stop Wishing, Start Doing, and Take Command of Your Life Bernard Roth

- The Little Book of Bulletproof Investing: Do's and Don'ts to Protect Your Financial Life Phil DeMuth

- The Money Hackers: How a Group of Misfits Took on Wall Street and Changed Finance Forever Daniel P. Simon

- Invested: How Warren Buffett and Charlie Munger Taught Me to Master My Mind, My Emotions, and My Money (with a Little Help From My Dad) Danielle Town

- Unshakeable: Your Financial Freedom Playbook Tony Robbins

- The Little Book of Alternative Investments: Reaping Rewards by Daring to be Different Phil DeMuth

- Money in One Lesson: How it Works and Why Gavin Jackson

- The Seed: Working For a Bigger Purpose Jon Gordon

- The Science of Getting Rich Wallace D. Wattles

- The 21-Day Financial Fast: Your Path to Financial Peace and Freedom Michelle Singletary

- Make More Money Brian Tracy

- Don’t Retire Broke: An Indespensible Guide to Tax-Efficient Retirement Planning and Financial Freedom Rick Rodgers

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market Peter Lynch

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good Ashley Feinstein Gerstley

- You Can Retire Early!: Everything You Need to Achieve Financial Independence When You Want It Deacon Hayes

- The 21 Success Secrets Self-Made Millionaires: How to Achieve Financial Independence Faster and Easier Than You Ever Thought Possible Brian Tracy

- Warren Buffett's Management Secrets: Proven Tools for Personal and Business Success Mary Buffett

- The Little Book of Main Street Money: 21 Simple Truths That Help Real People Make Real Money Jonathan Clements

- The Richest Man in Babylon George Clason

- The $500 Cup Coffee: A Lifestyle Approach to Financial Independence David Kramer

- Money Machine: The Surprisingly Simple Power of Value Investing Gary Smith

- Your Money and Your Brain: How the New Science of Neuroeconomics Can Help Make You Rich Jason Zweig

- Napoleon Hill’s Golden Rules: The Lost Writings Napoleon Hill

- Learn to Earn: A Beginner's Guide to the Basics of Investing Peter Lynch

- The 10 Pillars of Wealth: Mind-Sets of the World's Richest People: Mind-Sets of the World’s Richest People Alex Becker

- The Dhandho Investor: The Low-Risk Value Method to High Returns Mohnish Pabrai

- The Big Secret for the Small Investor: The Shortest Route to Long-Term Investment Success Joel Greenblatt

- The Little Book Big Profits from Small Stocks + Website: Why You'll Never Buy a Stock Over $10 Again (Little Books. Big Profits) Hilary Kramer

- Unstuck: A Story About Gaining Perspective, Creating Traction, and Pursuing Your Passion Randy Gravitt

- The Millionaire Next Door: The Surprising Secrets Of Americas Wealthy Thomas J. Stanley

- Kaninhålet Leffe Grimwalker

3.8

- Boksamlaren Camilla Davidsson

4

- Inte ditt barn Nilla Kjellsdotter

4.1

- Mellan samma väggar Jojo Moyes

3.9

- Väninnorna på Nordiska Kompaniet Ruth Kvarnström-Jones

4.1

- De fenomenala fruntimren på Grand Hôtel Ruth Kvarnström-Jones

4.5

- Ulven Johan Kant

3.9

- Hembiträdets hemlighet Freida McFadden

4.1

- Hembiträdet Freida McFadden

4.2

- Post Mortem David Lagercrantz

3.8

- Tranorna flyger söderut Lisa Ridzén

4.6

- Sömngångaren Lars Kepler

4.2

- Solglimt Aud Midtsund

4.2

- Kiruna Killer Leffe Grimwalker

4.2

- Ett evigt mörker Mikael Ressem

3.9

Därför kommer du älska Storytel:

1 miljon stories

Lyssna och läs offline

Exklusiva nyheter varje vecka

Kids Mode (barnsäker miljö)

Premium

Lyssna och läs ofta.

1 konto

100 timmar/månad

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Unlimited

Lyssna och läs obegränsat.

1 konto

Lyssna obegränsat

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Family

Dela stories med hela familjen.

2-6 konton

100 timmar/månad för varje konto

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

2 konton

239 kr /månadFlex

Lyssna och läs ibland – spara dina olyssnade timmar.

1 konto

20 timmar/månad

Spara upp till 100 olyssnade timmar

Exklusivt innehåll varje vecka

Avsluta när du vill

Obegränsad lyssning på podcasts

Svenska

Sverige