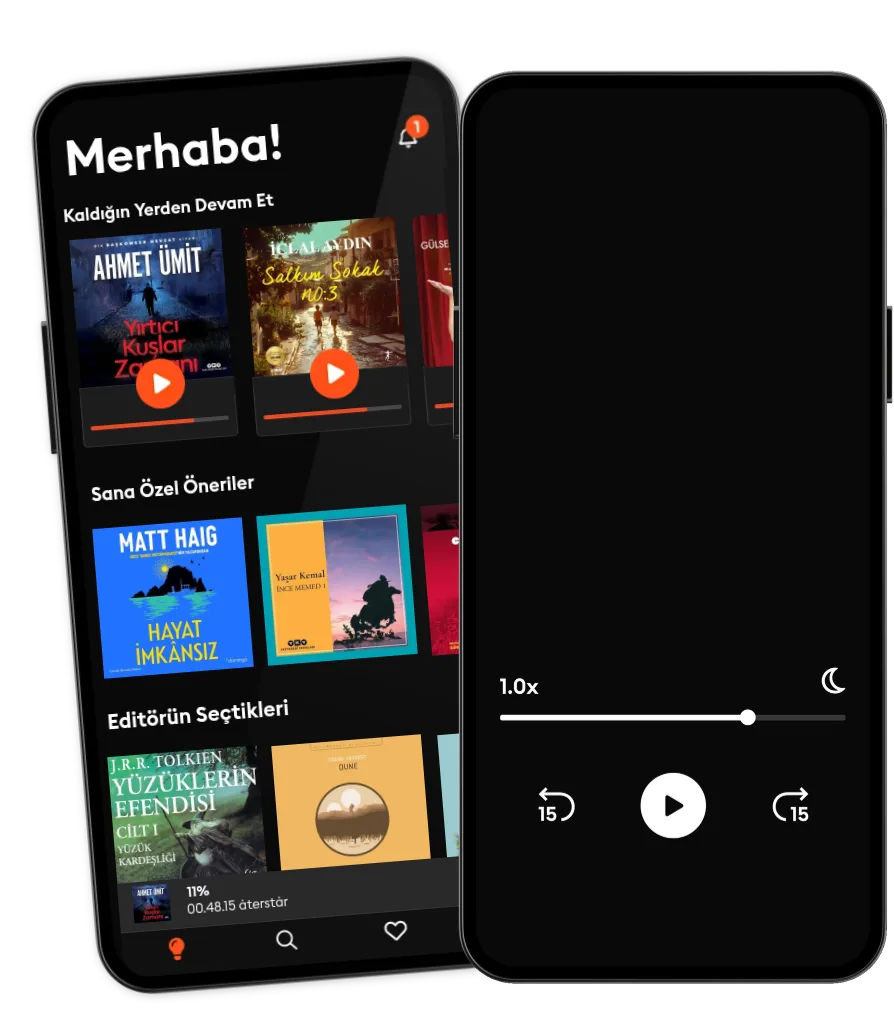

Dinle ya da oku

Sesli kitapların büyülü dünyasına adım at.

- İlk 4 ay ₺124,99/ay

- Binlerce sesli kitap ve e-kitap.

- Dilediğin kadar dinle ya da oku.

- Çevrimdışı modu.

- İstediğin zaman iptal et.

What I Learned About Investing from Darwin

- Yazan

- Seslendiren:

- Yayınevi

- 4 puanlama

4.5

- Süre

- 12Sa 35dk

- Dil

- İngilizce

- Format

- Kategori

İş Kitapları

The investment profession is in a state of crisis. The vast majority of equity fund managers are unable to beat the market over the long term, which has led to massive outflows from active funds to passive funds. Where should investors turn in search of a new approach?

Pulak Prasad offers a philosophy of patient long-term investing based on an unexpected source: evolutionary biology. He draws key lessons from core Darwinian concepts, mixing vivid examples from the natural world with compelling stories of good and bad investing decisions—including his own. How can bumblebees' survival strategies help us accept that we might miss out on Tesla? What does an experiment in breeding tame foxes reveal about the traits of successful businesses? Why might a small frog's mimicry of the croak of a larger rival shed light on the signs of corporate dishonesty?

Informed by successful evolutionary strategies, Prasad outlines his counterintuitive principles for long-term gain. He provides three mantras of investing: Avoid big risks; buy high quality at a fair price; and don't be lazy—be very lazy. Prasad makes a persuasive case for a strategy that rules out the vast majority of investment opportunities and advocates permanently owning high-quality businesses.

© 2023 Tantor Media (Sesli Kitap): 9798350823547

Yayın tarihi

Sesli Kitap: 22 Ağustos 2023

Etiketler

Bunları da beğenebilirsin...

- Where Are the Customers' Yachts?: Or a Good Hard Look at Wall Street Fred Schwed Jr.

- The Business of Venture Capital : The Art of Raising a Fund, Structuring Investments, Portfolio Management and Exits, 3rd Edition: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd Edition Mahendra Ramsinghani

- The Value Investors: Lessons from the World's Top Fund Managers, 2nd Edition Ronald Chan

- The Boston Consulting Group on Strategy: Classic Concepts and New Perspectives Michael S. Deimler

- In Pursuit of the Perfect Portfolio: The Stories, Voices, and Key Insights of the Pioneers Who Shaped the Way We Invest Andrew W. Lo

- DeFi and the Future of Finance Campbell R. Harvey

- Value: The Four Cornerstones of Corporate Finance Bill Dobbs

- The Anxious Investor: Mastering the Mental Game of Investing Scott Nations

- The New Tao of Warren Buffett Mary Buffett

- Beyond Diversification: What Every Investor Needs to Know About Asset Allocation Sebastien Page

- Where the Money Is: Value Investing in the Digital Age Adam Seessel

- The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions Eric Balchunas

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity Paul Pignataro

- Who Says Elephants Can't Dance? Louis V. Gerstner

- How to Make a Few Billion Dollars Brad Jacobs

- Inside Vanguard: Leadership Secrets From the Company That Continues to Rewrite the Rules of the Investing Business Charles D. Ellis

- The Truth About Crypto: A Practical, Easy-to-Understand Guide to Bitcoin, Blockchain, NFTs, and Other Digital Assets Ric Edelman

- Zero to Sold: How to Start, Run, and Sell a Bootstrapped Business Arvid Kahl

- The Trolls of Wall Street: How the Outcasts and Insurgents Are Hacking the Markets Nathaniel Popper

- Zero to IPO: Over $1 Trillion of Actionable Advice from the World's Most Successful Entrepreneurs Frederic Kerrest

- The Four Pillars of Investing, Second Edition: Lessons for Building a Winning Portfolio William J. Bernstein

- The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds Maneet Ahuja

- Competitive Advantage: Creating and Sustaining Superior Performance Michael E. Porter

- Security Analysis, Seventh Edition: Principles and Techniques Scott R. Pollak

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and Buyouts Claudia Zeisberger

- How to F*ck Up Your Startup: The Science Behind Why 90% of Companies Fail - and How You Can Avoid It Kim Hvidkjaer

- The Company I Keep: My Life in Beauty Leonard A. Lauder

- The Myth of Private Equity: An Inside Look at Wall Street’s Transformative Investments Jeffrey C. Hooke

- Winning the Loser's Game: Timeless Strategies for Successful Investing, Eighth Edition Charles D. Ellis

- The New Rules of Investing: Essential Wealth Strategies for Turbulent Times Richard C. Morais

- All-in On AI: How Smart Companies Win Big with Artificial Intelligence Tom Davenport

- Startup Communities: Building an Entrepreneurial Ecosystem in Your City, 2nd edition Brad Feld

- My Life as a Quant: Reflections on Physics and Finance Emanuel Derman

- The Devil's Financial Dictionary Jason Zweig

- Good Company Arthur M. Blank

- Big Mistakes: The Best Investors and Their Worst Investments Michael Batnick

- Regulating Wall Street: The Dodd-Frank Act and the New Architecture of Global Finance Viral V. Acharya

- The Innovator's Solution, with a New Foreword: Creating and Sustaining Successful Growth Clayton M. Christensen

- Buy Then Build: How Acquisition Entrepreneurs Outsmart the Startup Game Walker Deibel

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systems David Jenyns

- Becoming Trader Joe: How I Did Business My Way and Still Beat the Big Guys Joe Coulombe

- Security Analysis: Sixth Edition Benjamin Graham

- The Future of Competititve Strategy Mohan Subramaniam

- How to Invest David M. Rubenstein

- The Sweaty Startup: How to Get Rich Doing Boring Things Nick Huber

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really Mean Karen Berman

- Your Money and Your Brain: How the New Science of Neuroeconomics Can Help Make You Rich Jason Zweig

- The Little Book of Bull Moves in Bear Markets: How to Keep Your Portfolio Up When the Market is Down Peter D. Schiff

- Winning Now, Winning Later: How Companies Can Succeed in the Short Term While Investing for the Long Term David M. Cote

- The Alchemy of Finance George Soros

- Extended Reality in Practice: 100+ Amazing Ways Virtual, Augmented and Mixed Reality Are Changing Business and Society Bernard Marr

- The Elements of Investing: Easy Lessons for Every Investor: Easy Lessons for Every Investor, Updated Edition Charles D. Ellis

- Future Proofing You : Twelve Truths for Creating Opportunity, Maximizing Wealth and Controlling your Destiny in an Uncertain World: Twelve Truths for Creating Opportunity, Maximizing Wealth, and Controlling your Destiny in an Uncertain World Jay Samit

- A Random Walk Down Wall Street: The Best Investment Guide That Money Can Buy, Completely Revised and Updated Burton G. Malkiel

- Behind the Cloud : The Untold Story of How Salesforce.com Went from Idea to Billion-Dollar Company-and Revolutionized an Industry: The Untold Story of How Salesforce.com Went from Idea to Billion-Dollar Company-and Revolutionized an Industry Carlye Adler

- Consulting Essentials: The Art and Science of People, Facts, and Frameworks Jeff Kavanaugh

- The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing Michael J. Mauboussin

- The Dao of Capital: Austrian Investing in a Distorted World Ron Paul

- High Returns From Low Risk: A Remarkable Stock Market Paradox Jan De Koning

- Merger Masters: Tales of Arbitrage Mario Gabelli

- Debunkery Ken Fisher

- The Rise of the Rest: How Entrepreneurs in Surprising Places are Building the New American Dream Steve Case

- The Wyckoff Methodology in Depth: How to trade financial markets logically Ruben Villahermosa

- Angel Investing: Insider Secrets to Wealth Creation Adwait Karambelkar

- The Clash of the Cultures: Investment vs. Speculation John C. Bogle

- Why Moats Matter: The Morningstar Approach to Stock Investing Heather Brilliant

- Long-Term Secrets to Short-Term Trading Larry Williams

- Fundamentals of Corporate Finance, 4th Edition Thomas Bates

- Value Investing: From Graham to Buffett and Beyond, 2nd Edition Mark Cooper

- Straight Talk for Startups: 100 Insider Rules for Beating the Odds--From Mastering the Fundamentals to Selecting Investors, Fundraising, Managing Boards, and Achieving Liquidity Randy Komisar

- The Third Wave: An Entrepreneur's Vision of the Future Steve Case

- From Startup to Exit: An Insider's Guide to Launching and Scaling Your Tech Business Shirish Nadkarni

- Running Lean: Iterate from Plan A to a Plan That Works, 3rd Edition Ash Maurya

- Understanding Michael Porter: The Essential Guide to Competition and Strategy Joan Magretta

- The Innovator's DNA, Updated, with a New Preface: Mastering the Five Skills of Disruptive Innovators Clayton M. Christensen

- The Metail Economy: Strategies for Transforming Your Business in the Me-Centric Consumer Revolution Joel Bines

- The Most Important Thing: Uncommon Sense for The Thoughtful Investor Howard Marks

- The Clayton M. Christensen Reader Clayton M. Christensen

- Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tilt the Odds in Your Favor Spencer Jakab

- Rethinking Investing: A Very Short Guide to Very Long-Term Investing Charles D. Ellis

- Knowing Enough: A Conversation About Money and Life and Figuring Out What to Do with Yours William Bernstein

- The Art of Business Wars: Battle-Tested Lessons for Leaders and Entrepreneurs from History's Greatest Rivalries David Brown

- Family Wealth : Keeping It in the Family--How Family Members and Their Advisers Preserve Human, Intellectual and Financial Assets for Generations: Keeping It in the Family--How Family Members and Their Advisers Preserve Human, Intellectual, and Financial Assets for Generations James E. Hughes

- Why Does the Stock Market Go Up?: Everything You Should Have Been Taught About Investing in School, But Weren’t Brian Feroldi

- The Alliance: Managing Talent in the Networked Age Chris Yeh

- Founder vs Investor: The Honest Truth About Venture Capital from Startup to IPO Elizabeth Joy Zalman

- The Digital Transformer's Dilemma: How to Energize Your Core Business While Building Disruptive Products and Services Markus Schmidt

- The Little Book of Investing Like the Pros: Five Steps for Picking Stocks Josh Pearl

- 50 business models of the new economy. Lessons from unicorn companies Mikhail Ivanov

- Positioning: The Battle For Your Mind Jack Trout

- Money in One Lesson: How it Works and Why Gavin Jackson

- What It Takes: Seven Secrets of Success from the World's Greatest Professional Firms Charles D. Ellis

- Gonzo Capitalism: How to Make Money in an Economy that Hates You Chris Guillebeau

- The End of Competitive Advantage: How to Keep Your Strategy Moving as Fast as Your Business Rita Gunther McGrath

- Investment Banking: Valuation, LBOs, M&A, and IPOs, 3rd Edition Joshua Rosenbaum

- The Consulting Bible: How to Launch and Grow a Seven-Figure Consulting Business, 2nd Edition Alan Weiss

- Cahillik Hakkı Volkan Sönmez

4.5

- Bir Delinin Hatıra Defteri Nikolay Gogol

4.3

- Engereğin Gözü Zülfü Livaneli

4.5

- Yırtıcı Kuşlar Zamanı Ahmet Ümit

4.7

- Rezonans Kanunu Pierre Franckh

4.3

- Beş Ses Bir Sır Aslı Aktümen

4.4

- Mahalleden Arkadaşlar Selçuk Aydemir

4.7

- Ayrılış Çağan Irmak

4.7

- Salkım Sokak No.3 İclal Aydın

4.8

- Harry Potter ve Felsefe Taşı J.K. Rowling

4.3

- Hayat İmkânsız Matt Haig

4.3

- Gece Yarısı Kütüphanesi Matt Haig

4.6

- Düşüncenin Gücü James Allen

4.1

- İnce Memed 1 Yaşar Kemal

4.9

- Cumhuriyet'in İlk Sabahı İlber Ortaylı

4.9

Storytel dünyasını keşfet:

Kids mode

Çevrimdışı modu

İstediğin zaman iptal et

Her yerde erişim

Sınırsız

Sınırsızca dinlemek ve okumak isteyenler için.

1 hesap

Sınırsız erişim

İstediğin zaman iptal et

Sınırsız Yıllık

Sınırsızca dinlemek ve okumak isteyenler için.

1 hesap

Sınırsız erişim

İstediğin zaman iptal et

Aile (2 hesap)

Hikayeleri sevdikleri ile paylaşmak isteyenler için.

2 hesap

Sınırsız erişim

İstediğin zaman iptal et

Aile (3 hesap)

Hikayeleri sevdikleri ile paylaşmak isteyenler için.

3 hesap

Sınırsız erişim

İstediğin zaman iptal et

Türkçe

Türkiye