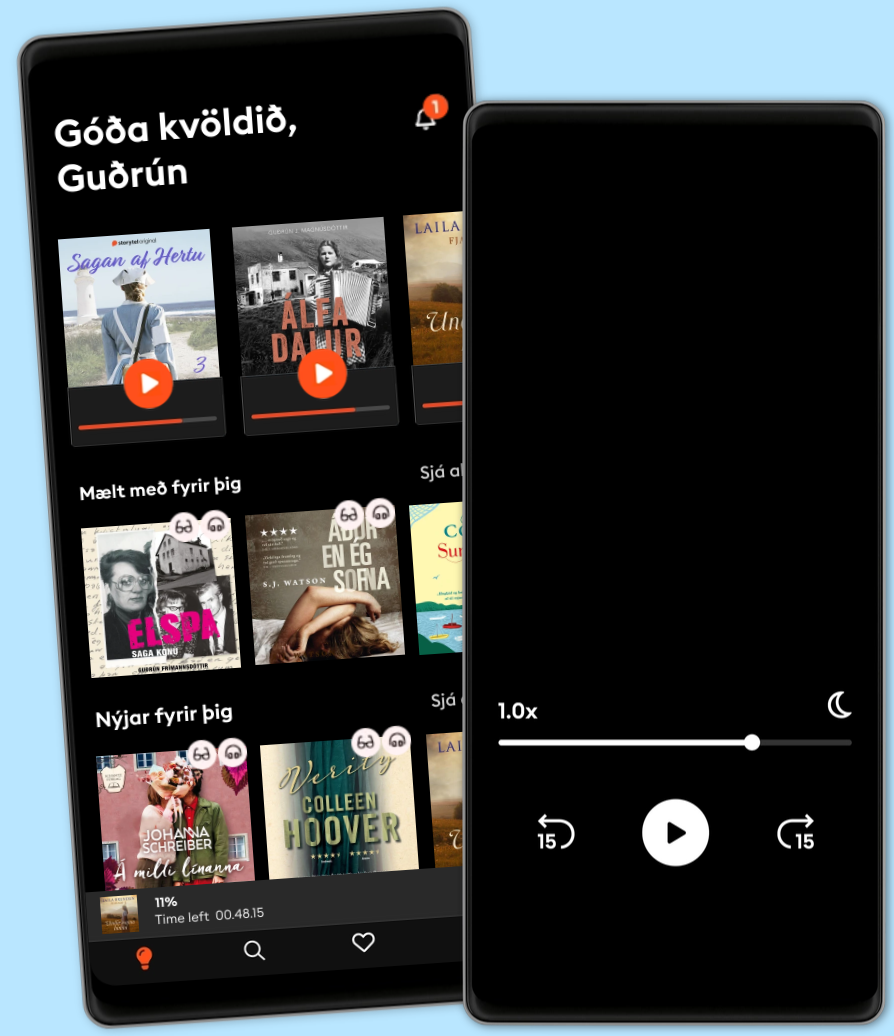

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Mining Tax Rules

- Höfundur

- Útgefandi

- Tungumál

- enska

- Format

- Flokkur

Viðskiptabækur

"Mining Tax Rules" offers a comprehensive exploration of the rapidly evolving world of cryptocurrency mining taxation, a critical area given crypto's increasing economic importance. The book addresses the challenges of applying traditional tax laws to this innovative technology, which often operates across borders. It highlights the lack of clear guidelines, creating uncertainty for miners, investors, and tax authorities.

Did you know that Bitcoin's emergence in 2009 sparked a decentralized digital economy where mining validates blockchain transactions, a process often misunderstood by existing tax frameworks? The book begins by explaining the fundamentals of crypto mining, including consensus mechanisms and hardware, before diving into specific tax laws across jurisdictions like the US, EU, and Singapore.

It analyzes income tax, VAT/GST, and property tax implications, addressing issues like determining the source of mining income and the deductibility of expenses. The book progresses to case studies and broader economic ramifications, arguing for a harmonized, global approach to crypto mining taxation to foster innovation and ensure fair tax collection.

This approach is vital as tax laws are often designed for traditional assets and struggle to classify and regulate crypto mining activities effectively.

© 2025 Publifye (Rafbók): 9788233998844

Þýðandi: AI

Útgáfudagur

Rafbók: 22 februari 2025

Merki

- 17 ástæður til að drepa Unnur Lilja Aradóttir

4

- Lykillinn Kathryn Hughes

4.4

- Jólabókarleitin Jenny Colgan

3.6

- Völundur Steindór Ívarsson

4.3

- Lára missir tönn Birgitta Haukdal

4.5

- Myrkraverk í miðbænum Birgitta H. Halldórsdóttir

3.8

- Dauðinn einn var vitni Stefán Máni

4.4

- Hundeltur Torill Thorup

4.3

- Næsta stúlkan Carla Kovach

4.1

- Opinberanir Torill Thorup

4.3

- Ég ætla að djamma þar til ég drepst Ívar Örn Katrínarson

4.4

- Utan frá sjó, þriðja bindi Guðrún frá Lundi

4.3

- Heim fyrir myrkur Eva Björg Ægisdóttir

4.2

- Lára lærir að lesa Birgitta Haukdal

4.2

- Atlas: Saga Pa Salt Lucinda Riley

4.7

Veldu áskrift

Hundruðir þúsunda raf- og hljóðbóka

Yfir 400 titlar frá Storytel Original

Barnvænt viðmót með Kids Mode

Vistaðu bækurnar fyrir ferðalögin

Unlimited

Besti valkosturinn fyrir einn notanda

1 aðgangur

Ótakmörkuð hlustun

Engin skuldbinding

Getur sagt upp hvenær sem er

Family

Fyrir þau sem vilja deila sögum með fjölskyldu og vinum.

2-6 aðgangar

100 klst/mán fyrir hvern aðgang

Engin skuldbinding

Getur sagt upp hvenær sem er

2 aðgangar

3990 kr /á mánuðiÍslenska

Ísland